Monero Price Prediction Next 5 Years Complete Analysis & Expert Forecasts (2025-2030)

The cryptocurrency market continues to evolve rapidly, with privacy-focused coins gaining significant attention from investors worldwide. Among these digital assets, Monero (XMR) stands out as a leading privacy cryptocurrency, prompting many investors to seek accurate Monero price prediction next 5 years. Understanding XMR’s potential trajectory requires analyzing multiple factors, including market trends, regulatory developments, technological advancements, and adoption rates.

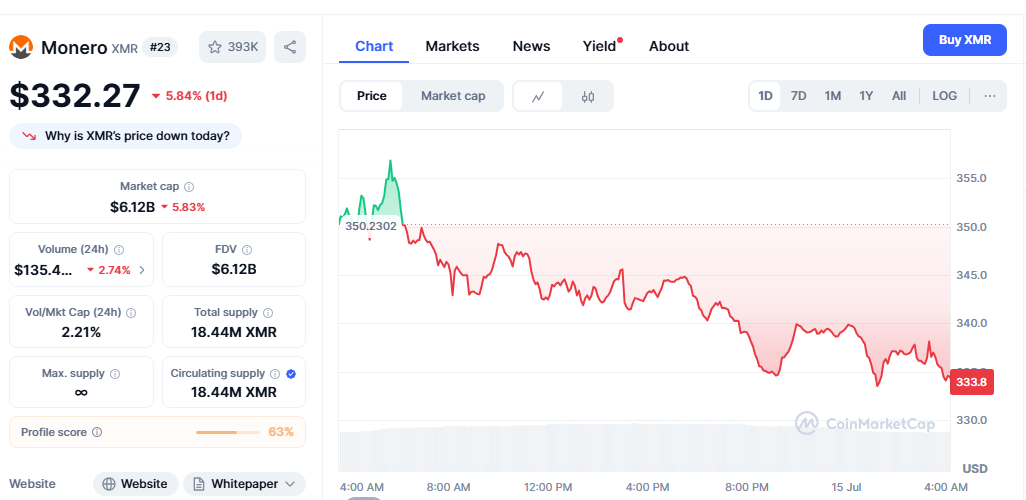

Current market data shows Monero trading around $340, but what does the future hold for this privacy-centric cryptocurrency? This comprehensive analysis examines expert predictions, technical indicators, and fundamental factors that could shape Monero’s price performance over the next five years. Whether you’re a seasoned cryptocurrency investor or exploring privacy coins for the first time, this detailed forecast provides valuable insights into XMR’s potential growth trajectory and investment opportunities.

Understanding Monero’s Current Market Position

Monero has established itself as the premier privacy cryptocurrency, offering untraceable transactions and enhanced anonymity features that set it apart from Bitcoin and other transparent blockchain networks. The cryptocurrency’s unique ring signature technology, stealth addresses, and RingCT implementation create a robust privacy framework that appeals to users seeking financial confidentiality.

The current market landscape shows Monero maintaining steady performance despite broader cryptocurrency volatility. With a circulating supply mechanism that includes tail emissions, XMR offers long-term sustainability that differs from Bitcoin’s fixed supply model. This monetary policy creates ongoing miner incentives while maintaining scarcity through controlled inflation rates.

Market capitalization rankings consistently place Monero among the top privacy cryptocurrencies, with institutional interest growing as privacy concerns become more prominent in the digital asset space. Regulatory challenges in certain jurisdictions have created short-term price pressures, but these same concerns drive adoption among privacy-conscious users and investors.

Expert Analysis

Expert Analysis

2025 Price Forecasts

Multiple cryptocurrency analysis platforms provide optimistic forecasts for Monero’s near-term performance. According to recent expert analysis, XMR could experience significant growth throughout 2025, with price targets varying based on market conditions and adoption rates.

Technical analysis suggests Monero’s price could reach between $250 and $548 by the end of 2025, depending on market sentiment and regulatory developments. Conservative estimates from reputable platforms indicate minimum price levels around $257, while bullish scenarios project potential highs exceeding $600.

The wide range in predictions reflects the inherent volatility in cryptocurrency markets and the specific challenges facing privacy coins. Regulatory clarity, exchange listings, and mainstream adoption will significantly influence which end of the price spectrum materializes for XMR holders.

Long-term Growth Projections Through 2030

Looking beyond 2025, long-term Monero price predictions become increasingly speculative but offer insights into potential growth trajectories. Industry experts analyzing historical data and market trends suggest XMR could experience substantial appreciation over the five-year period.

By 2030, some analysts project Monero reaching between $1,236 and $5,828, representing significant multiples of current trading prices. These projections assume continued adoption of privacy-focused cryptocurrencies and successful navigation of regulatory challenges across major markets.

Conservative forecasts suggest more modest growth, with prices potentially ranging from $395 to $593 by 2030. These estimates factor in market maturation, increased competition from other privacy coins, and potential regulatory restrictions that could limit growth potential.

Technical Analysis and Market Indicators

Support and Resistance Levels

Current technical analysis reveals Monero trading within established support and resistance zones that provide insights into short-term price movements. Key support levels around $295-$314 have held during recent market corrections, while resistance levels near $421 present immediate upside targets.

Moving averages indicate neutral to slightly bullish sentiment, with price action suggesting consolidation before potential breakout scenarios. Volume analysis supports these technical indicators, showing steady trading activity that suggests institutional accumulation rather than retail speculation.

The Fear and Greed Index currently shows greed levels at 71, indicating optimistic market sentiment that could support near-term price appreciation. However, this elevated sentiment also suggests potential for corrections if market conditions deteriorate.

Fundamental Analysis Factors

Monero’s technological advantages continue driving adoption among users prioritizing transaction privacy. The cryptocurrency’s fungibility features make it attractive for legitimate commerce where financial privacy is valued, creating sustained demand independent of speculative trading.

Network metrics show consistent usage patterns with transaction volumes maintaining steady growth despite market volatility. Hash rate stability indicates miner confidence in long-term viability, while development activity remains robust with regular protocol improvements and security enhancements.

Regulatory developments present both opportunities and challenges for XMR’s future performance. While some jurisdictions have implemented restrictions on privacy coins, others are exploring frameworks that could legitimize their use, creating potential catalysts for price appreciation.

Factors Influencing Monero’s Price Performance

Regulatory Environment Impact

The regulatory landscape significantly impacts privacy cryptocurrency valuations, with government policies directly affecting exchange listings and institutional adoption. Recent developments in major markets show mixed signals, with some jurisdictions embracing privacy rights while others implement restrictions.

European Union discussions regarding cryptocurrency regulation include provisions that could affect privacy coin operations. The outcome of these deliberations will likely influence XMR’s price trajectory, particularly regarding exchange accessibility and institutional investment opportunities.

United States regulatory clarity remains uncertain, with various agencies providing conflicting guidance on privacy and cryptocurrency classifications. Resolution of these regulatory ambiguities could unlock significant price appreciation if favorable frameworks emerge.

Technological Development and Adoption

Monero’s development roadmap includes several enhancements that could drive price appreciation through improved functionality and user experience. Planned upgrades to transaction efficiency, mobile wallet integration, and cross-chain compatibility represent potential catalysts for increased adoption.

Privacy-focused applications built on Monero’s infrastructure could expand use cases beyond simple transactions, creating additional demand for XMR tokens. Decentralized finance (DeFi) protocols incorporating privacy features might drive institutional interest and trading volume.

Merchant adoption continues growing as businesses recognize the value of private transactions for legitimate commerce. Payment processors integrating Monero support could significantly expand the cryptocurrency’s utility and demand base.

Market Sentiment and Institutional Interest

Institutional cryptocurrency adoption has accelerated across the broader market, with privacy coins attracting attention from funds seeking portfolio diversification. While institutional XMR adoption remains limited compared to Bitcoin, growing privacy concerns could drive future investment.

Correlation analysis shows Monero maintaining some independence from broader cryptocurrency market movements, suggesting potential as a portfolio diversifier. This characteristic becomes increasingly valuable as traditional cryptocurrency correlations with equity markets strengthen.

Public awareness of financial privacy issues continues growing, driven by concerns about surveillance and data security. This trend could benefit privacy cryptocurrencies like Monero, particularly among users prioritizing financial confidentiality.

Dollar-Cost Averaging Approach

Given Monero’s price volatility, dollar-cost averaging represents a prudent investment strategy for long-term holders. This approach reduces timing risk while allowing investors to benefit from XMR’s potential appreciation over the five-year forecast period.

Regular purchase intervals help smooth out price fluctuations while building positions during market downturns. Historical analysis suggests this strategy has been effective for privacy cryptocurrencies, given their tendency toward long-term appreciation despite short-term volatility.

Portfolio allocation strategies should consider Monero’s unique characteristics compared to other cryptocurrencies. Privacy coins typically exhibit different risk-return profiles that warrant specific position sizing within broader cryptocurrency portfolios.

Also Read: Altcoin Price Navigating Alternative Cryptocurrencies 2024

Investing in privacy cryptocurrencies requires careful risk assessment, particularly regarding regulatory developments and exchange accessibility. Diversification across multiple privacy coins and traditional assets helps mitigate concentration risk while maintaining exposure to XMR’s growth potential.

Storage security becomes critically important for privacy coin holders, with hardware wallets offering superior protection compared to exchange custody. Proper security practices protect against both technical vulnerabilities and potential regulatory seizures.

Market timing strategies should account for Monero’s unique market dynamics, including lower liquidity compared to major cryptocurrencies and sensitivity to privacy-related news events. These factors can create both opportunities and risks for active traders.

Monero Mining and Network Security

Mining Profitability Analysis

Monero’s RandomX algorithm ensures CPU-friendly mining that maintains network decentralization while providing sustainable mining rewards. Current mining profitability depends on electricity costs, hardware efficiency, and XMR price performance.

Tail emission mechanics provide ongoing miner incentives beyond the traditional halving cycles seen in Bitcoin. This design maintains network security while creating predictable inflation rates that could support long-term price stability.

Mining pool distribution shows healthy decentralization with no single entity controlling the majority hash rate. This network security characteristic enhances Monero’s value proposition and reduces risks associated with centralized mining operations.

Network Health Metrics

Transaction volume analysis reveals consistent network usage with organic growth patterns, suggesting real utility rather than speculative trading. Daily transaction counts and average transaction values indicate healthy network adoption across various use cases.

Network difficulty adjustments maintain block time consistency while adapting to changing hash rate conditions. This stability supports user confidence and merchant adoption by ensuring predictable transaction processing times.

Development activity metrics show active protocol improvement with regular updates addressing security, efficiency, and user experience enhancements. This ongoing development supports long-term network viability and potential price appreciation.

Privacy Coin Comparison

Monero faces competition from other privacy-focused cryptocurrencies, each offering unique approaches to transaction confidentiality. Zcash provides selective transparency options, while Dash emphasizes instant transactions with optional privacy features.

Market share analysis shows Monero maintaining leadership in the privacy cryptocurrency sector, with superior adoption rates and merchant acceptance compared to alternatives. This competitive advantage could support sustained price premiums over competing privacy coins.

Technological differentiation through ring signatures, stealth addresses, and mandatory privacy features creates barriers to entry for new privacy cryptocurrencies. These advantages could help Monero maintain market leadership throughout the forecast period.

Mainstream Cryptocurrency Competition

Bitcoin’s transparency features limit its appeal for privacy-conscious users, creating opportunities for Monero adoption among users requiring transaction confidentiality. However, Bitcoin’s established infrastructure and institutional adoption present challenges for XMR market share growth.

Ethereum’s smart contract capabilities offer privacy solutions through layer-2 implementations, potentially competing with Monero’s privacy features. However, these solutions often compromise decentralization and security compared to Monero’s native privacy implementation.

Central bank digital currencies (CBDCs) represent potential long-term competition for privacy cryptocurrencies, though their surveillance capabilities could drive increased demand for decentralized privacy solutions like Monero.

Conclusion

The comprehensive analysis of Monero price prediction next 5 years reveals significant growth potential for this leading privacy cryptocurrency. Expert forecasts suggest XMR could experience substantial appreciation, with conservative estimates indicating 2-3x growth and optimistic projections suggesting 5-10x returns by 2030.

However, investors must carefully consider regulatory risks, technological challenges, and market competition when evaluating Monero’s investment potential. The cryptocurrency’s unique privacy features provide compelling value propositions that could drive long-term adoption and price appreciation.

FAQs

What is the most realistic Monero price prediction for 2030?

Based on current analysis and expert forecasts, realistic Monero price predictions for 2030 range from $400 to $1,200, with most conservative estimates suggesting prices between $500-$800. These projections assume continued adoption of privacy cryptocurrencies and successful navigation of regulatory challenges.

How does Monero’s privacy technology affect its price potential?

Monero’s superior privacy features create unique value propositions that could drive price appreciation as privacy concerns grow. The cryptocurrency’s fungibility and untraceability make it attractive for legitimate commerce, potentially supporting higher valuations than transparent cryptocurrencies.

What are the main risks to Monero’s price growth over the next 5 years?

Primary risks include regulatory restrictions in major markets, exchange delistings, and competition from other privacy solutions. Technical vulnerabilities or successful attacks on Monero’s privacy features could also negatively impact price performance.

Can Monero reach $1000 by 2030?

Several expert analyses suggest Monero could reach $1000 by 2030, with some projections indicating even higher potential prices. However, achieving these targets depends on sustained adoption growth, regulatory clarity, and successful technological development.

How does Monero compare to Bitcoin as a long-term investment?

Monero offers different risk-return characteristics compared to Bitcoin, with privacy features providing unique value propositions. While Bitcoin benefits from institutional adoption and infrastructure development, Monero’s privacy advantages could drive significant appreciation as surveillance concerns grow.