Ethereum Price Rally a Trap? One More Drop Predicted

Ethereum Price Rally a Trap misleading investors? A prominent trader warns of another drop ahead ETH volatility and what comes next.

Ethereum’s price, leaving investors and traders questioning whether this rally represents a genuine recovery or merely a temporary spike before another significant downturn. A prominent cryptocurrency trader has recently sounded the alarm, suggesting that despite the current upward momentum, Ethereum may experience one more substantial drop before establishing a solid foundation for sustained growth.

This prediction has sent ripples through the crypto community, with investors frantically reassessing their positions and strategies. Understanding the technical indicators, Ethereum Price Rally a Trap: market sentiment, and fundamental factors influencing Ethereum’s price trajectory has never been more critical. As the second-largest cryptocurrency by market capitalization continues to demonstrate volatile price action, distinguishing between a legitimate rally and a bull trap becomes essential for protecting capital and making informed investment decisions.

In this comprehensive analysis, we’ll explore the trader’s prediction in detail, examine the technical patterns suggesting another decline, investigate the broader market conditions affecting ETH price movements, and provide actionable insights for navigating these uncertain waters. Whether you’re a seasoned cryptocurrency investor or someone monitoring Ethereum’s performance, Ethereum Price Rally a Trap: understanding these dynamics will help you make more informed decisions in the coming weeks.

The Current Ethereum Price Rally: Ethereum Price Rally a Trap

The recent Ethereum price rally has captured significant attention across financial markets, with ETH climbing impressively from recent lows. This upward movement initially appeared promising, with many retail investors interpreting it as the beginning of a sustained bull run. However, experienced traders recognize that not all price increases signal genuine market strength, and the concept of a “bull trap” remains ever-present in cryptocurrency trading.

A bull trap occurs when prices rise temporarily, luring investors into buying positions, only to reverse sharply afterward, leaving those who bought near the peak with substantial losses. The cryptocurrency market’s notorious volatility makes it particularly susceptible to such patterns, and Ethereum has experienced multiple instances of deceptive rallies throughout its history. The current price action exhibits several characteristics that align with historical bull trap patterns, raising legitimate concerns among technical analysts.

Market psychology plays a crucial role in these scenarios. After extended periods of declining prices, investors become increasingly eager for any sign of recovery. This psychological state creates fertile ground for bull traps, as fear of missing out (FOMO) drives purchases even when underlying market conditions haven’t fundamentally improved. The trader’s warning serves as a reminder that emotional decision-making often leads to poor outcomes in cryptocurrency markets, and maintaining discipline through rigorous technical analysis remains paramount.

The Trader’s Prediction: Technical Analysis Behind the Warning

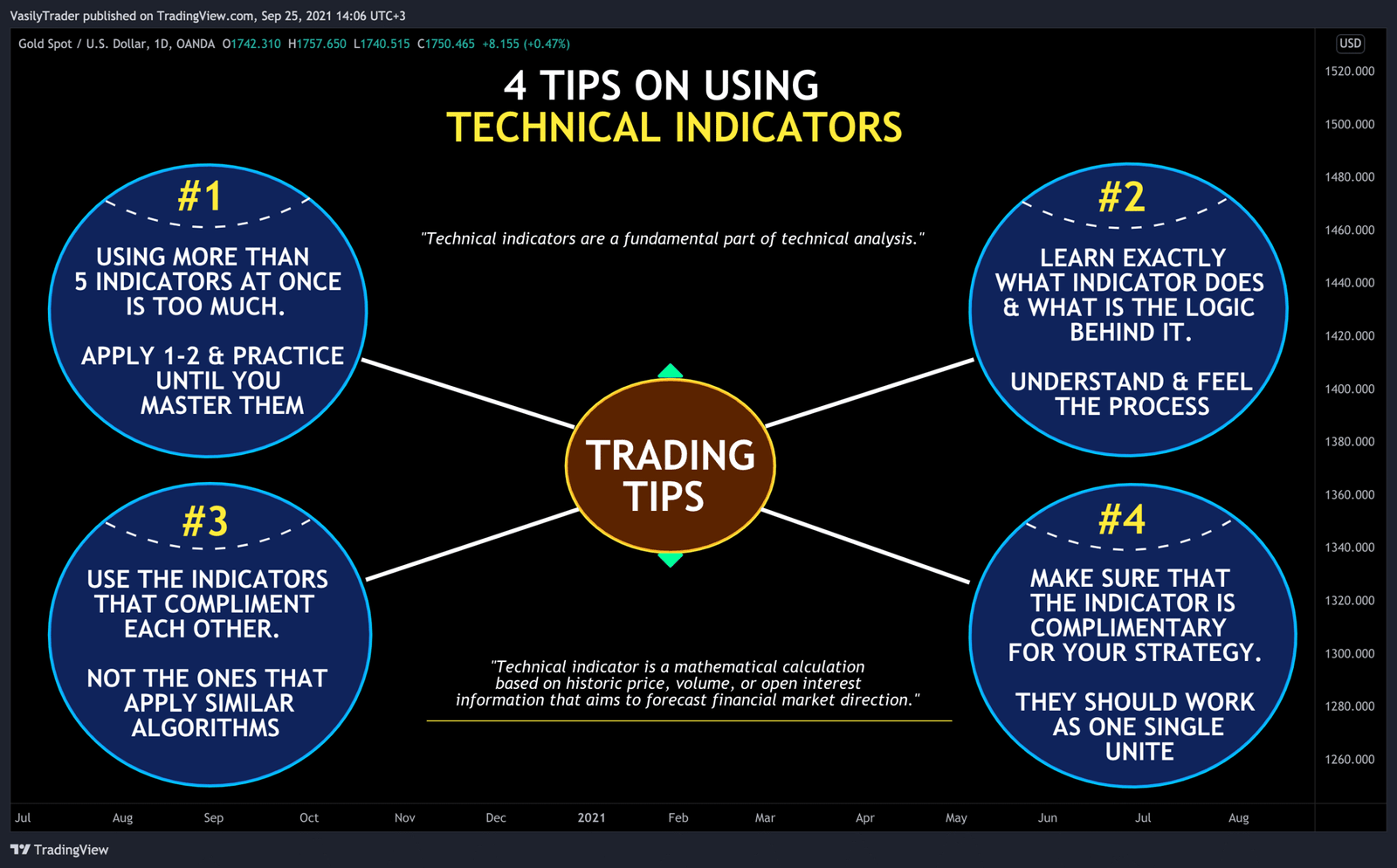

The prominent trader issuing this warning bases their prediction on comprehensive technical analysis that incorporates multiple timeframes and indicators. According to their assessment, Ethereum’s recent rally lacks the volume and momentum characteristics typically associated with sustainable uptrends. Instead, the price action resembles corrective movements within a larger bearish structure, suggesting that one more significant decline could materialize before Ethereum establishes a legitimate bottom.

Elliott Wave Theory features prominently in this analysis, with the trader identifying the current rally as potentially being the final corrective wave before another impulse wave downward. This classical technical framework suggests that market movements occur in predictable patterns, with impulsive waves in the direction of the main trend alternating with corrective waves against it. If this interpretation proves accurate, Ethereum could revisit or even break below previous support levels in the coming weeks.

Additionally, resistance levels identified through historical price data align closely with current price zones, suggesting that Ethereum faces significant selling pressure at these heights. The convergence of multiple technical resistance points, including Fibonacci retracement levels and previous consolidation areas, creates a formidable barrier to further upside. Combined with weakening momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), the technical picture supports the possibility of another decline.

The trader also highlights declining trading volumes during this rally, a classic warning sign that the upward movement lacks conviction from serious market participants. In healthy rallies, trading volume typically increases alongside price, confirming genuine buying interest. The absence of this confirmation suggests that the current price increase may represent short covering or retail FOMO rather than institutional accumulation.

Market Conditions Supporting Another Ethereum Drop

Beyond pure technical analysis, several macroeconomic factors and broader market conditions support the possibility of another Ethereum decline. The cryptocurrency market doesn’t operate in isolation, and understanding the external forces influencing digital asset prices provides crucial context for evaluating this prediction.

Regulatory uncertainty continues casting a shadow over cryptocurrency markets globally. Various jurisdictions are implementing or considering new regulations that could significantly impact how cryptocurrencies operate and are traded. This regulatory overhang creates hesitation among institutional investors, potentially limiting capital inflows that might otherwise support higher Ethereum prices. The Securities and Exchange Commission’s ongoing examination of cryptocurrency classification and the implementation of stricter compliance requirements have contributed to persistent market uncertainty.

Traditional financial markets also exert considerable influence on cryptocurrency valuations. Recent volatility in equity markets, particularly in technology stocks, tends to correlate with cryptocurrency price movements. When risk appetite diminishes across broader financial markets, cryptocurrencies typically experience selling pressure as investors retreat to safer assets. The current economic environment, characterized by concerns about inflation, interest rates, and potential recession, creates headwinds for risk assets, including Ethereum.

The DeFi ecosystem built primarily on Ethereum has experienced its own challenges, with declining total value locked (TVL) and reduced activity on decentralized applications. This diminished on-chain activity suggests weakening fundamental demand for Ethereum beyond speculative trading. When fewer users actively utilize the Ethereum network for real-world applications, the fundamental case for higher prices weakens correspondingly.

Competition from alternative blockchain platforms also factors into Ethereum’s price outlook. While Ethereum maintains its position as the leading smart contract platform, emerging competitors continue capturing market share by offering faster transactions and lower fees. This competitive pressure may limit Ethereum’s upside potential until the network fully realizes the benefits of its ongoing upgrades and improvements.

Ethereum’s Technical Support Levels and Potential Drop Targets

Identifying key support levels becomes critical when anticipating potential price declines. Technical analysts have pinpointed several important zones where Ethereum might find buying interest if another drop materializes. Understanding these levels helps investors prepare appropriate risk management strategies and potential entry points.

The first significant support level resides approximately 15-20% below current prices, representing a consolidation area from previous trading periods. This zone has historically attracted buyers and could serve as the initial target for any downward movement. However, if selling pressure intensifies and this support fails to hold, Ethereum could experience an accelerated decline toward deeper support levels.

More substantial support exists at levels representing 30-40% declines from recent peaks, coinciding with previous market bottoms and major technical indicators. These deeper support zones would likely require significant negative catalysts to reach, such as major regulatory announcements or broader market crashes. Nevertheless, the trader’s warning suggests that such scenarios remain within the realm of possibility given current market dynamics.

Fibonacci extension levels provide additional price targets that traders monitor closely. These mathematical relationships derived from the Fibonacci sequence have proven surprisingly reliable in cryptocurrency markets for identifying potential reversal points. Multiple Fibonacci levels converge at specific price zones below current levels, increasing the probability that these areas could serve as accumulation zones for patient investors.

Volume profile analysis reveals additional insights into where significant trading activity has occurred historically. Areas with high historical trading volumes tend to act as magnets for price, as many market participants have established positions at those levels. Ethereum Price Rally a Trap: This volume analysis suggests several specific price points where Ethereum might stabilize if another decline occurs, providing reference points for traders planning their strategies.

How Investors Should Prepare for Potential Ethereum Volatility

Given the prediction of another potential drop, prudent investors should implement specific strategies to protect their capital while maintaining exposure to Ethereum’s long-term potential. Risk management becomes paramount during periods of heightened uncertainty, and several approaches can help navigate these challenging conditions.

Position sizing represents the first line of defense against unexpected market movements. Rather than committing significant capital at current levels, investors might consider maintaining smaller positions or dollar-cost averaging into Ethereum over time. This approach reduces the impact of any single poor entry point while ensuring participation if prices unexpectedly continue rising. Setting clear stop-loss orders at predetermined levels helps limit potential losses if the predicted decline materializes.

Diversification across multiple cryptocurrencies and asset classes provides additional protection against Ethereum-specific risks. While Ethereum remains a core holding for many cryptocurrency portfolios, maintaining exposure to Bitcoin, Ethereum Price Rally a Trap: stablecoins, and potentially traditional assets creates a more resilient overall portfolio. This diversification strategy ensures that one’s entire investment thesis doesn’t depend solely on Ethereum’s near-term price performance.

For traders with higher risk tolerance, Ethereum Price Rally a Trap: the predicted volatility could present opportunities for strategic positioning. Some might consider establishing short positions or purchasing put options to profit from potential declines, though these strategies carry substantial risks and require careful execution. Alternatively, maintaining cash reserves to deploy at lower price levels could prove advantageous if the predicted drop occurs, allowing strategic accumulation at more favorable prices.

Monitoring on-chain metrics provides valuable real-time insights into Ethereum’s network health and investor behavior. Ethereum Price Rally a Trap: Metrics such as exchange inflows and outflows, Ethereum Price Rally a Trap: whale wallet movements, and transaction volumes offer clues about institutional positioning and potential price direction. Ethereum Price Rally a Trap: Combining these fundamental indicators with technical analysis creates a more comprehensive view of market conditions.

Long-Term Ethereum Outlook Despite Short-Term Concerns

While near-term predictions suggest caution, Ethereum Price Rally a Trap: Ethereum’s long-term fundamentals remain compelling for many investors. Understanding the distinction between short-term trading volatility and long-term investment thesis helps maintain perspective during uncertain periods.

The ongoing Ethereum network upgrades continue progressing, with improvements in scalability, security, and energy efficiency strengthening the platform’s competitive position. The successful transition to proof-of-stake demonstrated Ethereum’s capability to execute complex technical upgrades, and future enhancements promise to address current limitations. These technological advancements support the long-term value proposition even if short-term price volatility persists.

Institutional adoption of Ethereum continues expanding, with major financial institutions exploring Ethereum-based solutions for various applications. The development of Ethereum exchange-traded funds (ETFs) in multiple jurisdictions provides traditional investors with regulated exposure to ETH, potentially driving significant capital inflows over time. This institutional interest suggests that despite near-term volatility, Ethereum’s role in the evolving financial landscape continues to strengthen.

The DeFi and NFT ecosystems built on Ethereum, despite recent challenges, represent genuine innovation with real-world applications. As these technologies mature and regulatory clarity improves, the fundamental demand for Ethereum to power these applications could increase substantially. This utility, beyond mere speculation, provides a foundation for long-term value that transcends short-term price fluctuations.

Global macroeconomic conditions will inevitably improve at some point, potentially triggering renewed interest in risk assets, including cryptocurrencies. Ethereum Price Rally a Trap: When that inflection point arrives, Ethereum’s established position, technological capabilities, and ecosystem development could position it to benefit substantially from renewed capital inflows.

Conclusion

The warning from a prominent trader that Ethereum’s recent price rally might be a trap deserving of another decline serves as an important reminder of cryptocurrency market volatility. Ethereum Price Rally a Trap: While the current Ethereum price increase has generated optimism among some investors, technical analysis, market conditions, and historical patterns suggest caution is warranted. The possibility of one more significant drop before establishing a genuine bottom cannot be dismissed, particularly given weakening momentum indicators, declining volumes, and challenging macroeconomic conditions.

However, short-term predictions, regardless of their technical foundation, carry inherent uncertainty. Markets frequently defy expectations, and the Ethereum Price Rally a Trap: Ethereum could just as easily surprise to the upside if circumstances change rapidly. The key for investors lies in preparing for multiple scenarios through prudent risk management, appropriate position sizing, Ethereum Price Rally a Trap: and maintaining focus on long-term fundamentals rather than becoming overly fixated on near-term price movements.

Whether Ethereum experiences another decline as predicted or continues defying bearish expectations, the cryptocurrency’s long-term potential remains tied to technological development, adoption rates, Ethereum Price Rally a Trap: and its role in the evolving digital economy. Navigating the current uncertainty requires discipline, patience, and a commitment to informed decision-making rather than emotional reactions to short-term volatility.

FAQs

Q: What is a bull trap in cryptocurrency trading?

A bull trap occurs when cryptocurrency prices rise temporarily, creating the illusion of a sustained uptrend that attracts buyers, only to reverse sharply downward afterward. Ethereum Price Rally a Trap: This leaves investors who bought during the rally holding positions at losses. Bull traps are particularly common in volatile markets like cryptocurrencies.

Q: How can investors protect themselves from potential Ethereum price drops?

Investors can protect themselves through several strategies, including proper position sizing, setting stop-loss orders at predetermined levels, Ethereum Price Rally a Trap: diversifying across multiple assets, and avoiding overleveraged positions. Maintaining cash reserves for potential accumulation at lower prices and using dollar-cost averaging.

Q: What technical indicators suggest Ethereum might decline further?

Several technical indicators support the possibility of further Ethereum declines, including weakening momentum oscillators like RSI and MACD, Ethereum Price Rally a Trap: declining trading volumes during the recent rally, resistance at key Fibonacci retracement levels, and Elliott Wave patterns suggesting incomplete corrective structures.

Q: Does a short-term price drop mean Ethereum is a bad long-term investment?

Not necessarily. Short-term price volatility doesn’t invalidate long-term investment theses based on fundamental technological development, adoption trends, and utility. Ethereum Price Rally a Trap: Many successful long-term cryptocurrency investments have experienced significant drawdowns before ultimately appreciating substantially.

Q: What factors could invalidate the prediction of another Ethereum drop?

Several factors could invalidate bearish predictions, including unexpected positive regulatory developments, major institutional adoption announcements, successful technical upgrades that exceed expectations, or sudden improvements in broader macroeconomic conditions.