Crypto Forecast Is Risk Sentiment Deteriorating This Week?

Explore this week's Crypto Forecast. Key market drivers, risk sentiment shifts, and what traders need to watch closely.

The cryptocurrency market has always been characterized by its volatility and sensitivity to broader financial trends, but recent developments suggest that traders and investors may need to brace themselves for increased turbulence. As we navigate through another eventful week in digital asset markets, mounting concerns about deteriorating risk sentiment are casting shadows over bullish projections that dominated earlier market cycles. Understanding the fundamental drivers behind these shifts becomes crucial for anyone looking to position themselves strategically in the current environment.

The intersection of macroeconomic pressures, regulatory uncertainties, and technical market dynamics creates a complex tapestry that determines cryptocurrency price action. While Bitcoin and major altcoins have demonstrated remarkable resilience over the years, the current landscape presents unique challenges that warrant careful examination. This comprehensive analysis delves into the key factors shaping the weekly fundamental forecast for cryptocurrencies, Crypto Forecast: exploring whether the apparent shift in market sentiment represents a temporary correction or signals deeper structural concerns that could influence digital asset valuations for weeks or months to come.

Current Market Sentiment Dynamics: Crypto Forecast

Market sentiment serves as the psychological backbone of cryptocurrency trading, often driving price movements that defy traditional fundamental analysis. The concept of risk sentiment encompasses investor appetite for speculative assets, with cryptocurrencies typically falling into the high-risk category alongside growth stocks and emerging market investments. When risk sentiment deteriorates, capital tends to flow away from these volatile assets toward perceived safe havens like government bonds, gold, or established fiat currencies.

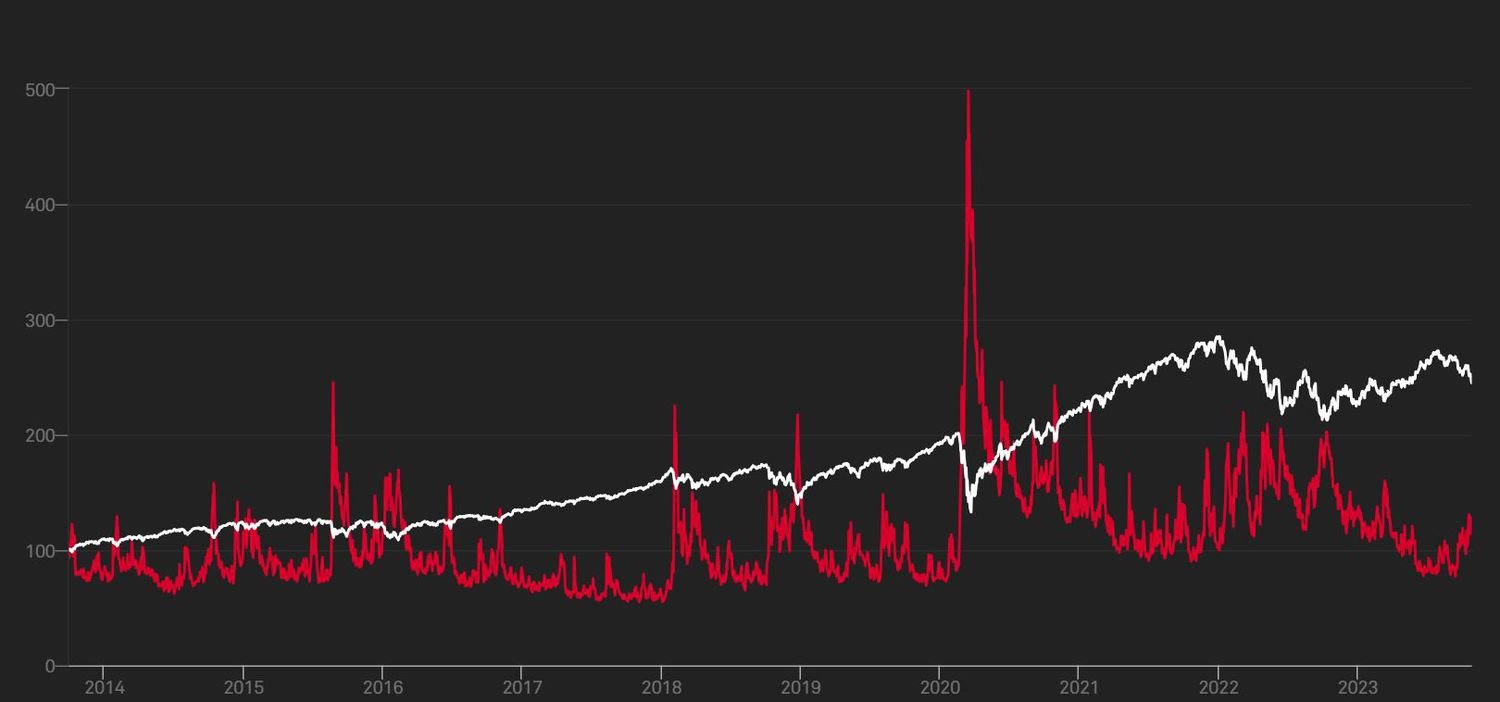

Recent trading sessions have revealed telling signs that risk appetite may indeed be waning. The correlation between cryptocurrency markets and traditional risk assets like the Nasdaq Composite has strengthened considerably, suggesting that digital assets are increasingly being treated as risk-on instruments rather than the alternative stores of value some proponents envision. This correlation becomes particularly problematic during periods of broader market stress, as it amplifies downside movements and reduces the diversification benefits that originally attracted many institutional investors to the space.

The fear and greed index for cryptocurrencies, a widely watched sentiment indicator, has oscillated between neutral and fear zones throughout recent weeks. This metric aggregates various data points, including volatility, trading volume, social media sentiment, and Bitcoin dominance, to provide a snapshot of market psychology. The persistent inability to establish sustained readings in the greed territory suggests underlying hesitation among market participants, even during brief price rallies that might otherwise inspire confidence.

Macroeconomic Headwinds Affecting Digital Assets

The broader macroeconomic environment exerts tremendous influence over cryptocurrency valuations, particularly as institutional participation has grown substantially. Central bank policies, inflation trajectories, and employment data all contribute to shaping the landscape within which digital assets operate. Currently, several macroeconomic factors are converging to create challenging conditions for risk assets across the board.

Interest rate policies from major central banks remain a primary concern for cryptocurrency traders. Higher interest rates increase the opportunity cost of holding non-yielding assets like Bitcoin, making traditional interest-bearing instruments relatively more attractive. The Federal Reserve’s continued commitment to maintaining elevated rates until inflation convincingly returns to target levels has created a sustained headwind for speculative investments. Each economic data release that suggests persistent inflationary pressures reinforces the likelihood of prolonged restrictive monetary policy, directly impacting cryptocurrency valuations.

Global economic growth concerns add another layer of complexity to the fundamental forecast. Weakening manufacturing data from major economies, particularly in Europe and parts of Asia, suggests that economic momentum may be slowing more significantly than previously anticipated. This deceleration typically translates to reduced risk appetite as investors prioritize capital preservation over growth-oriented speculation. For cryptocurrencies, which thrive during periods of abundant liquidity and optimistic growth expectations, this environment presents genuine challenges.

Currency market dynamics also deserve attention within any comprehensive cryptocurrency analysis. The strength of the US dollar, measured by indexes tracking its performance against major currency pairs, inversely correlates with cryptocurrency prices during most market cycles. A robust dollar makes dollar-denominated assets like Bitcoin more expensive for international buyers while simultaneously signaling global preference for safe-haven assets. Recent dollar strength, driven by relative economic resilience in the United States compared to other developed markets, has contributed to pressure on crypto market valuations.

Regulatory Developments Shaping Market Confidence

The regulatory landscape surrounding cryptocurrencies continues evolving rapidly, with government actions and policy proposals significantly impacting investor confidence and market sentiment. Unlike traditional financial markets with established regulatory frameworks, the cryptocurrency space operates within a patchwork of jurisdictions, each developing its own approaches to digital asset oversight. This regulatory uncertainty itself contributes to risk sentiment deterioration as market participants struggle to assess future operating conditions.

Recent enforcement actions by regulatory bodies have intensified scrutiny across the cryptocurrency ecosystem. Major exchanges face ongoing investigations regarding their operational practices, token listing procedures, and compliance with securities laws. These developments create tangible risks for market infrastructure while simultaneously generating negative headlines that influence broader investor perception. The potential for additional enforcement actions remains elevated, creating an overhang that weighs on market sentiment even during technically favorable trading conditions.

Legislative developments in key jurisdictions present both opportunities and challenges for the cryptocurrency industry. Comprehensive regulatory frameworks, when thoughtfully designed, can provide the clarity that institutional investors require before committing significant capital to digital assets. However, overly restrictive regulations risk stifling innovation while pushing activity toward less regulated jurisdictions. The ongoing debate about appropriate cryptocurrency regulation reflects fundamental tensions between consumer protection objectives, financial stability concerns, and innovation encouragement that remain unresolved across most major economies.

The treatment of cryptocurrency taxation represents another critical regulatory dimension affecting market fundamentals. Various jurisdictions continue refining their approaches to taxing digital asset transactions, staking rewards, and mining income. Increased tax enforcement and reporting requirements, while arguably necessary for market maturation, create additional compliance burdens and transaction friction that may discourage retail participation. These evolving tax frameworks contribute to uncertainty that manifests in more cautious positioning by market participants.

Technical Market Structure and Liquidity Concerns

Beyond macroeconomic and regulatory factors, the technical structure of cryptocurrency markets themselves provides important insights into potential sentiment deterioration. Market microstructure elements including liquidity depth, order book composition, and derivative positioning all contribute to understanding the resilience or fragility of current price levels.

Liquidity conditions across major cryptocurrency exchanges have shown signs of thinning during recent months. Reduced market depth means that large orders can move prices more significantly, increasing volatility and making markets more susceptible to manipulation or cascading liquidations. This liquidity deterioration partly reflects reduced market maker activity as firms reassess their risk exposure amid uncertain market conditions. When liquidity diminishes, even modest selling pressure can trigger disproportionate price declines, creating a fragile market environment where sentiment can shift rapidly.

The derivatives market for cryptocurrencies provides additional perspective on trader positioning and sentiment. Funding rates for perpetual futures contracts, which indicate whether long or short positions are paying premiums, have remained relatively subdued compared to previous bull market periods. This muted funding suggests a lack of aggressive bullish speculation despite recent price stability. Similarly, options market data showing elevated demand for downside protection relative to upside exposure indicates that sophisticated traders are positioning defensively, anticipating potential weakness rather than preparing for breakout moves.

The concentration of Bitcoin holdings among large wallet addresses, often referred to as “whales,” creates additional market structure concerns during periods of uncertain sentiment. When these large holders decide to reduce positions, their selling can overwhelm available bid liquidity and trigger significant price declines. Recent blockchain analytics suggest increased movement of coins from long-term holder wallets to exchanges, potentially signaling preparation for distribution. While not definitively bearish, these flows warrant monitoring as potential precursors to broader sentiment shifts.

Altcoin Performance and Market Leadership Patterns

The relationship between Bitcoin and alternative cryptocurrencies provides valuable insights into overall market health and risk appetite. During strong bull markets characterized by robust risk sentiment, altcoins typically outperform Bitcoin as traders seek higher-risk, higher-reward opportunities. Conversely, when risk sentiment deteriorates, capital tends to flow back toward Bitcoin as the relatively safer and more established digital asset, with altcoins experiencing disproportionate weakness.

Recent price action suggests a concerning pattern for altcoin investors. Many mid-cap and small-cap cryptocurrencies have failed to maintain gains relative to Bitcoin, with several prominent projects trading near multi-month lows when measured in BTC pairs. This underperformance indicates selective risk reduction where market participants are exiting more speculative positions in favor of Bitcoin or fiat currencies. The inability of altcoins to attract sustained buying interest despite various project developments and ecosystem improvements reflects underlying caution that extends beyond Bitcoin-specific concerns.

The performance of different cryptocurrency sectors provides additional nuance to market sentiment analysis. Decentralized finance tokens, non-fungible token platform coins, and layer-two scaling solutions have each experienced distinct trajectories reflecting sector-specific fundamentals alongside broader market trends. Currently, most sectors are exhibiting weakness relative to their previous cycle highs, suggesting that the sentiment deterioration is broad-based rather than concentrated in specific niche areas. This widespread weakness supports the thesis that macro factors, rather than cryptocurrency-specific developments, are driving current market dynamics.

Market dominance metrics, which measure Bitcoin’s percentage of total cryptocurrency market capitalization, have been gradually increasing during recent weeks. This rising dominance typically signals defensive positioning as traders consolidate holdings in the most liquid and established digital asset. While Bitcoin dominance increases can occur during both bull and bear markets, the current context of modest overall market capitalization declines suggests this particular dominance increase reflects risk-off behavior rather than Bitcoin-specific optimism.

Institutional Investment Trends and Their Implications

The maturation of cryptocurrency markets over recent years has brought substantial institutional participation, fundamentally altering market dynamics and sentiment drivers. Institutional investors, including hedge funds, asset managers, and corporate treasuries, approach cryptocurrency investment with different frameworks and risk tolerances than retail traders. Understanding institutional sentiment and positioning provides crucial context for assessing whether current market conditions represent temporary consolidation or more significant trend changes.

Recent data on institutional cryptocurrency holdings presents a mixed picture. While some prominent institutions continue accumulating Bitcoin through various investment vehicles, others have reduced exposure or maintained static positions. The launch and performance of cryptocurrency exchange-traded products in various jurisdictions was initially viewed as a catalyst for sustained institutional inflows, but actual adoption has proceeded more gradually than optimistic projections suggested. This tempered institutional enthusiasm contributes to the sense that risk sentiment may be deteriorating as professional investors reassess their digital asset allocations.

Corporate balance sheet adoption of Bitcoin, which generated substantial enthusiasm during previous market cycles, has essentially stalled. Few new major corporations have added Bitcoin to their treasuries recently, while some early adopters have reduced positions amid operational needs or changing strategic priorities. This pause in corporate adoption removes a significant source of structural demand that previously supported bullish narratives about cryptocurrency as a legitimate corporate reserve asset.

Institutional derivative positioning reveals defensive tendencies among sophisticated market participants. Large traders are maintaining relatively balanced long and short exposure compared to the aggressive directional positioning characteristic of high-conviction periods. This neutrality suggests institutions are content to trade around positions rather than making bold directional bets, indicating uncertainty about near-term cryptocurrency market direction. When the smart money remains cautious, retail investors should carefully consider whether contrarian bullish positioning represents an opportunity or simply fighting against better-informed participants.

Global Geopolitical Factors and Safe Haven Dynamics

Geopolitical developments increasingly influence cryptocurrency markets as digital assets become more integrated with traditional financial systems. Various international tensions, from trade disputes to military conflicts, create uncertainty that affects global capital flows and risk appetite. Understanding how geopolitical factors intersect with cryptocurrency fundamentals provides important context for weekly market forecasts.

Cryptocurrencies occupy an ambiguous position within the safe-haven asset spectrum. Early advocates promoted Bitcoin as “digital gold” that would appreciate during traditional financial system stress, providing portfolio diversification and capital preservation. However, actual price behavior during recent geopolitical crises has been inconsistent with this narrative. Instead of appreciating during risk-off episodes, cryptocurrencies have frequently declined alongside equities, suggesting markets treat them as speculative risk assets rather than defensive stores of value. This behavioral pattern becomes self-reinforcing as it shapes investor expectations and positioning strategies.

Regulatory responses to geopolitical tensions also impact cryptocurrency markets in complex ways. Various governments have explored using cryptocurrency regulations as tools for enforcing sanctions or preventing capital flight during periods of international tension. These regulatory actions, while often justified by legitimate policy objectives, create uncertainty about the long-term viability of cryptocurrency as a genuinely permissionless and censorship-resistant medium of exchange. When governments demonstrate willingness and capability to intervene in cryptocurrency markets, it undermines fundamental value propositions that attract many investors to digital assets.

The relationship between geopolitical risk and cryptocurrency adoption in emerging markets deserves consideration within any comprehensive fundamental analysis. Some regions experiencing currency instability or capital controls have seen increased cryptocurrency adoption as citizens seek to preserve wealth or access international markets. While these use cases demonstrate genuine utility, they represent relatively small segments of overall trading volume and don’t typically influence prices to the same degree as developed market investor sentiment and capital flows.

Conclusion

The question of whether risk sentiment is deteriorating within cryptocurrency markets cannot be answered with a simple affirmation or denial. Instead, the current environment reflects a complex interplay of factors that collectively suggest increased caution is warranted among market participants. Macroeconomic headwinds from persistent inflation and elevated interest rates, regulatory uncertainties across major jurisdictions, technical market structure concerns, including reduced liquidity, and defensive institutional positioning all point toward a challenging period for digital assets.

However, markets rarely move in straight lines, and periods of apparent sentiment deterioration often create opportunities for strategic positioning ahead of eventual recovery. The fundamental forecast for cryptocurrencies over the coming week depends not only on these existing concerns but also on potential catalysts that could shift momentum in either direction. Key economic data releases, regulatory announcements, or significant technical breakouts could rapidly alter the prevailing narrative.

Investors navigating current market conditions should prioritize risk management, maintain appropriate position sizing, and avoid overleveraging during this uncertain period. While deteriorating risk sentiment presents genuine challenges, the long-term structural trends supporting cryptocurrency adoption remain intact. Successful trading and investing during transitional periods requires balancing near-term caution with longer-term strategic conviction, adapting positions as fundamentals evolve while maintaining discipline around risk parameters.

FAQs

1. What are the main indicators suggesting risk sentiment is deteriorating in cryptocurrency markets?

Several key indicators point toward deteriorating risk sentiment, including declining altcoin performance relative to Bitcoin, reduced trading volumes across major exchanges, elevated volatility metrics, and defensive positioning in derivatives markets. Additionally, the strengthening correlation between cryptocurrencies and traditional risk assets like growth stocks suggests digital assets are increasingly being sold during broader risk-off periods.

Q: How do macroeconomic factors like interest rates affect cryptocurrency prices?

Higher interest rates impact cryptocurrencies through multiple channels. First, they increase the opportunity cost of holding non-yielding assets like Bitcoin since investors can earn attractive returns from safer alternatives like government bonds. Second, elevated rates typically strengthen the US dollar, making dollar-denominated cryptocurrencies more expensive for international buyers.

Q: Should investors avoid cryptocurrencies entirely when risk sentiment deteriorates?

Complete avoidance isn’t necessarily the optimal strategy for all investors. While deteriorating risk sentiment creates genuine challenges, it also potentially creates opportunities for strategic accumulation at more attractive valuations. The appropriate approach depends on individual risk tolerance, investment timeframe, and portfolio objectives.

Q: How do regulatory developments impact cryptocurrency market sentiment?

Regulatory developments affect cryptocurrency sentiment through both direct and indirect channels. Direct impacts include enforcement actions against exchanges or projects that create operational risks and potentially reduce market access. Indirect impacts work through changing investor perceptions about the long-term viability and mainstream acceptance of digital assets.

Q: What role do institutional investors play in cryptocurrency market sentiment?

Institutional investors increasingly influence cryptocurrency market sentiment through their capital allocation decisions and public positioning. When prominent institutions add or maintain cryptocurrency exposure, it validates the asset class and encourages additional participation.