Chainlink Price Targets $30 With Institutional Interest Rising

Chainlink price targets gain momentum toward the $30 threshold, fueled by unprecedented institutional adoption. Simultaneously, the emerging Layer Brett project is making headlines by approaching the remarkable $4 million milestone in presale funding, demonstrating the evolving landscape of blockchain investments.

As institutional investors increasingly recognize the value proposition of decentralized oracle networks, Chainlink’s price target $30 has become a focal point for market analysts and crypto enthusiasts alike. This bullish sentiment, combined with Layer Brett’s impressive fundraising achievements, reflects the broader market’s confidence in blockchain infrastructure and meme coin innovations.

The convergence of established projects, such as Chainlink, with emerging ventures, like Layer Brett, illustrates the diverse opportunities available in today’s cryptocurrency ecosystem. With institutional backing driving traditional projects and retail enthusiasm propelling innovative presales, the market presents multiple avenues for potential growth and investment returns.

Chainlink’s Path Toward $30: Institutional Adoption Drives Momentum

The Chainlink price targets trajectory has gained substantial credibility as institutional investors continue to recognize the critical role of oracle networks in the decentralized finance ecosystem. Chainlink is forecasted to move between $17 and $44 in 2025, with analysts suggesting new all-time highs in the period from 2026 to 2028.

Institutional interest in Chainlink stems from its fundamental utility in connecting blockchain networks with real-world data sources. Major financial institutions are increasingly incorporating blockchain technology into their operations, creating unprecedented demand for reliable oracle services. This institutional adoption has become a primary catalyst for the Chainlink price target $30.

The project’s partnerships with traditional financial institutions, technology companies, and government entities have solidified its position as the leading oracle network. These strategic alliances not only validate Chainlink’s technology but also create sustainable revenue streams that support long-term price appreciation.

Market analysts cite Chainlink’s expanding ecosystem as evidence supporting a $30 price target. The network’s integration with various blockchain platforms, including Ethereum, Polygon, and Solana, demonstrates its versatility and potential for widespread adoption. This multi-chain approach positions Chainlink to benefit from the growth of the entire blockchain industry.

Market Analysis: Why Institutional Investors Choose Chainlink

Technical Fundamentals Supporting Price Growth

The technical analysis supporting Chainlink price targets reveals several bullish indicators that align with institutional investment strategies. According to market predictions, if the network updates in cryptography and initiates new partnerships, the LINK price might reach a maximum of $47, significantly exceeding the current $30 target.

Chainlink’s tokenomics present an attractive proposition for institutional investors seeking exposure to the oracle market. The token’s utility extends beyond mere speculation, as LINK tokens are essential for network security and data validation processes. This fundamental utility generates organic demand, supporting sustainable price growth.

The network’s proof-of-stake security model appeals to environmentally conscious institutional investors who prioritize sustainability in their investment decisions. Unlike energy-intensive mining operations, Chainlink’s approach aligns with ESG investment criteria increasingly adopted by major financial institutions.

Institutional Use Cases Driving Adoption

Major corporations across various industries are implementing Chainlink’s oracle solutions for mission-critical applications. Insurance companies utilize Chainlink for automated claim processing, while supply chain organizations leverage the network for transparent tracking and verification systems.

The decentralized finance sector’s explosive growth has created substantial demand for reliable oracle services, positioning Chainlink as an essential infrastructure component. As DeFi protocols mature and attract institutional participation, the demand for Chainlink’s services continues to expand exponentially.

Intelligent contract automation represents another significant growth driver for Chainlink adoption. Enterprises implementing blockchain solutions require seamless integration with existing systems, a capability that Chainlink’s oracle network uniquely provides through its extensive API connectivity.

Layer Brett’s Impressive Presale Performance: Approaching $4 Million

Meme Coin Evolution: From Speculation to Utility

Layer Brett has raised $3.9 million in its presale, with this fundraising achievement signaling strong belief in its vision. The project represents a new generation of meme coins that combine cultural appeal with tangible utility through Layer 2 technology.

Layer Brett is an Ethereum Layer 2 blockchain project that evolved from the original Brett meme coin, designed for scalability, staking, and user rewards. This technical foundation differentiates it from traditional meme coins that lack substantial utility propositions.

The project’s approach of combining meme culture with Layer 2 infrastructure addresses two significant market demands: community-driven engagement and blockchain scalability solutions. This dual appeal has resonated strongly with both retail investors and technical enthusiasts.

Presale Structure and Investor Appeal

Layer Brett raises $3.7M with tokens priced at $0.0058, offering a 706% APY staking rate and Ethereum layer two speed. The project’s staking mechanism provides immediate utility and rewards for early participants, creating sustainable tokenomics that extend beyond typical meme coin speculation.

Layer Brett offers Layer-2 speed, low fees, and a capped supply of 10 billion tokens. The fixed supply mechanism addresses inflationary concerns that plague many meme coins, providing investors with deflationary tokenomics that support long-term value appreciation.

The presale’s structured pricing model creates clear incentives for early participation while maintaining transparency throughout the fundraising process. This professional approach has attracted investors seeking legitimate projects within the meme coin sector.

Comparative Market Analysis: Established vs. Emerging Projects

Risk-Reward Profiles in Current Market Conditions

The contrast between Chainlink price targets and Layer Brett’s presale performance illustrates the diverse risk-reward profiles available in today’s cryptocurrency market. Chainlink represents a mature, institutionally-backed investment opportunity with relatively predictable growth patterns, while Layer Brett offers high-risk, high-reward potential typical of early-stage projects.

Institutional investors are drawn to Chainlink due to its established track record, regulatory clarity, and fundamental utility within the blockchain ecosystem. The project’s gradual price appreciation aligns with institutional investment timelines and risk management strategies.

Conversely, Layer Brett appeals to investors seeking exponential returns through early participation in innovative projects. The presale model allows investors to acquire tokens at potentially significant discounts compared to future market prices, though with correspondingly higher risks.

Portfolio Diversification Strategies

Sophisticated investors often combine exposure to both established projects, such as Chainlink, and emerging opportunities, like Layer Brett, to optimize their cryptocurrency portfolio performance. This diversification strategy strikes a balance between stability and growth potential, spreading risk across various project stages and market segments.

The complementary nature of oracle networks and Layer 2 solutions suggests potential synergies between projects like Chainlink and Layer Brett. As the blockchain ecosystem evolves, interoperability between different protocols creates additional value propositions for investors holding diverse portfolios.

Technical Analysis: Price Predictions and Market Trends

Chainlink Price Movement Patterns

Starting in 2024 at $15, LINK briefly spiked to $18 in February before falling to $12 by April, with the coin’s price fluctuating throughout the year. These price movements reflect the broader cryptocurrency market volatility while maintaining an overall upward trajectory supported by fundamental developments.

Technical indicators suggest that Chainlink’s price target $30 represents achievable goals based on historical performance patterns and current market conditions. The token’s resilience during market downturns demonstrates its defensive characteristics, making it an attractive option for risk-averse institutional investors.

Support and resistance levels indicate that Chainlink has established a solid foundation for sustained growth. The accumulation phase observed in recent months suggests that institutional investors are building positions in anticipation of significant price appreciation.

Layer Brett Growth Projections

Layer Brett’s presale performance provides limited historical data for technical analysis, but the project’s rapid fundraising success indicates strong market demand. Layer Brett’s presale momentum, which is currently at $4M, represents clever money positioning for the inevitable infrastructure upgrade.

The project’s tokenomics and utility features suggest potential for substantial returns once trading commences on major exchanges. However, investors should consider the inherent risks associated with early-stage projects and the volatility of meme coins.

Regulatory Environment and Compliance Considerations

Institutional Investment Compliance Requirements

The regulatory landscape has a significant influence on institutional investment decisions in cryptocurrency projects. Chainlink’s established regulatory relationships and compliance record make it more accessible to institutional investors, who are subject to strict regulatory oversight.

Layer Brett’s presale structure must navigate evolving securities regulations while maintaining accessibility for retail investors. The project’s approach to compliance will significantly impact its ability to attract institutional participation in future funding rounds.

Regulatory clarity in major markets continues to evolve, with recent developments suggesting more favorable treatment for utility tokens and infrastructure projects. This regulatory progress benefits both established projects, such as Chainlink, and emerging ventures, like Layer Brett.

Future Regulatory Impact on Price Targets

Anticipated regulatory developments could significantly impact Chainlink price targets as institutional adoption accelerates. Clear regulatory frameworks reduce compliance costs and risks, making cryptocurrency investments more attractive to traditional financial institutions.

The classification of utility tokens versus securities will continue to influence market dynamics and investment flows. Projects with clear utility propositions, like Chainlink’s oracle services, may benefit from more favorable regulatory treatment.

Investment Strategies and Risk Management

Institutional Investment Approaches

Institutional investors typically employ systematic approaches to cryptocurrency investments, focusing on projects with strong fundamentals, straightforward utility, and regulatory compliance. Chainlink price targets align with these institutional criteria, making it a preferred choice for conservative cryptocurrency allocations.

Dollar-cost averaging strategies work particularly well for established projects, such as Chainlink, allowing institutional investors to build positions gradually while minimizing timing risks. This approach has proven effective for managing volatility while maintaining exposure to long-term growth potential.

Risk management protocols require institutional investors to maintain diversified portfolios across different cryptocurrency sectors. The combination of infrastructure projects, such as Chainlink, with emerging opportunities, like Layer Brett, provides balanced exposure to various market segments.

Retail Investor Considerations

Retail investors have greater flexibility in allocation strategies, allowing for higher-risk investments in projects like Layer Brett while maintaining core positions in established cryptocurrencies. The presale opportunity represents a unique entry point that may not be available to institutional investors.

Education and due diligence remain crucial for retail investors participating in presales and evaluating price targets. Understanding project fundamentals, tokenomics, and market conditions enables investors to make informed decisions that align with their risk tolerance and investment objectives.

Market Outlook and Future Developments

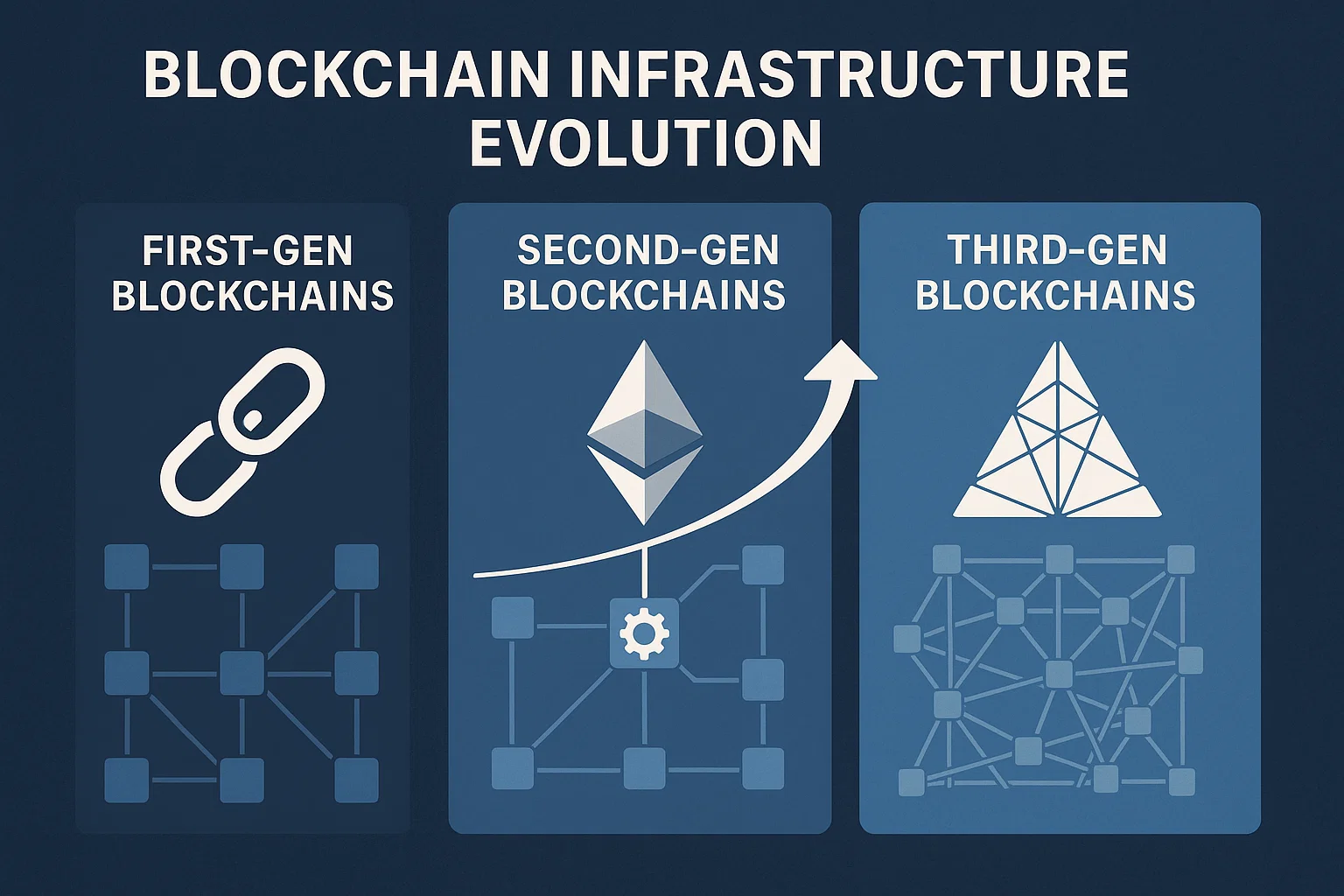

Blockchain Infrastructure Evolution

The cryptocurrency market’s maturation continues to create opportunities for both established projects and innovative newcomers. Chainlink price targets $30 to reflect the growing recognition of blockchain infrastructure’s importance in the digital economy transformation.

Layer 2 solutions, such as Layer Brett, address scalability challenges that have limited blockchain adoption in mainstream applications. The success of such projects depends on their ability to provide tangible utility while maintaining community engagement that drives meme coin culture.

Interoperability between different blockchain networks will become increasingly important as the ecosystem evolves. Projects that successfully navigate this transition while maintaining their core value propositions are likely to experience sustained growth and investor interest.

Technology Integration and Adoption

The integration of blockchain technology into traditional business operations creates sustained demand for infrastructure projects like Chainlink. Oracle networks become essential components of the digital transformation process, supporting the Chainlink price targets through fundamental utility growth.

Emerging projects like Layer Brett benefit from improved blockchain infrastructure and reduced transaction costs. The combination of meme coin culture with practical utility creates new investment categories that appeal to a diverse range of investor segments.

Conclusion

The cryptocurrency market’s current dynamics, exemplified by Chainlink’s price target $30 and Layer Brett’s impressive presale performance, demonstrate the diverse opportunities available to investors across different risk profiles and investment strategies. Chainlink’s institutional adoption and technical fundamentals support its bullish price predictions, while Layer Brett’s innovative approach to meme coin utility creates potential for substantial returns.

Investors considering exposure to these opportunities should carefully evaluate their risk tolerance, investment objectives, and portfolio diversification needs. The combination of established projects with proven track records and emerging ventures with innovative approaches offers multiple avenues for participation in the cryptocurrency market.

Read more: Chainlink Price Chart Analysis: Key Support & Resistance Levels for 2025