Bitcoin price under pressure amid $92K breakdown

Bitcoin price under pressure after losing $92K. Is the 4-year cycle “self-fulfilling prophecy” driving this drop? Learn what’s next for BTC.

The Bitcoin price under pressure once again has traders on edge as it slips below the psychologically important $92,000 level. For many investors, this is more than just another pullback in a volatile market. The move ties directly into a growing narrative: that Bitcoin’s historic 4-year cycle has become a “self-fulfilling prophecy” driven by crowd behavior, halving events, and market sentiment.

Every four years, Bitcoin goes through a mining reward halving, cutting the supply of new coins entering circulation. Historically, these events have lined up with major bull runs followed by deep corrections. As more traders study these patterns, some analysts argue that the market is now reacting to the cycle rather than simply reflecting it. That feedback loop could be amplifying both rallies and crashes.

In this article, we’ll explore why the Bitcoin price is under pressure, what the drop below $92,000 tells us, and how the 4-year cycle and self-fulfilling prophecy narrative may shape the next phase of the market. We’ll also look at the role of macro conditions, institutional flows, market liquidity, and on-chain metrics in this correction—so you can better understand what’s happening and what it might mean for your strategy.

Bitcoin price under pressure: what the drop below $92,000 means

The phrase “Bitcoin price under pressure” isn’t new, but the current move below $92,000 carries extra weight. This level has been widely discussed in trading communities and technical analysis, making it a sort of informal line in the sand. When such a widely watched level breaks, it tends to trigger: The key question is not just that the Bitcoin price is under pressure, but why this pressure is mounting now, and how it connects to the deeper structure of Bitcoin’s 4-year cycle.

The phrase “Bitcoin price under pressure” isn’t new, but the current move below $92,000 carries extra weight. This level has been widely discussed in trading communities and technical analysis, making it a sort of informal line in the sand. When such a widely watched level breaks, it tends to trigger: The key question is not just that the Bitcoin price is under pressure, but why this pressure is mounting now, and how it connects to the deeper structure of Bitcoin’s 4-year cycle.

How the 4-year Bitcoin cycle became a “self-fulfilling prophecy”

The origins of the 4-year cycle

Bitcoin’s 4-year cycle is rooted in its monetary design. Approximately every four years, a halving event reduces the block reward given to miners. This slows down the rate of new BTC issuance, tightening supply. Historically, halvings have been followed by: These repeating phases led analysts to map Bitcoin’s behavior into a four-year rhythm. Over time, this simple model became popular among traders, crypto influencers, and even some institutional desk notes.

From pattern to self-fulfilling prophecy

The problem—and the opportunity—is that once everyone studies the same pattern, they start trading based on it. When enough market participants anticipate a certain outcome, their actions can create the very outcome they expect. This is where the notion of a “self-fulfilling prophecy” comes in.

As the Bitcoin price under pressure narrative grows, many traders assume that a post-peak correction must occur “because that’s what the 4-year cycle says.” They mayction into a more dramatic drop. In this way, the 4-year cycle is no longer just a historical observation; it becomes an active force in shaping Bitcoin price action.

Why Bitcoin price is under pressure now

1. Profit-taking after aggressive upside

After any powerful rally, Bitcoin price tends to face a wave of profit-taking. Traders who entered at lower levels see an attractive opportunity to lock in gains, especially if price stalls near previous cycle projections or popular resistance zones.

2. Macro headwinds and risk sentiment

Even though Bitcoin is often marketed as “digital gold” and a hedge against inflation, it still behaves like a risk asset in many macro environments. When global markets worry about interest rates, liquidity conditions, or slowing growth, investors often reduce exposure to volatile assets first—and that includes Bitcoin.

When macro headlines turn sour, Bitcoin price can be hit from two sides at once: crypto-native selling and traditional market de-risking. This convergence can make drops below key psychological levels, such as $92,000, feel sharper and more emotional than the charts alone would suggest.

3. Liquidity pockets and leverage wipe-outs

Modern crypto trading is deeply intertwined with leveraged derivatives: futures, perpetual swaps, and options. When the market clusters around specific levels—like $92,000—many of these positions use similar stop losses or liquidation thresholds.

The role of long-term holders and “diamond hands”

Strong hands vs. weak hands

During corrections, the market tends to distinguish between short-term traders and long-term holders. The former are more likely to sell under stress, while the latter often remain calm or even increase their exposure.

Exchange balances and self-custody trends

Another important aspect is where coins are stored. When investors move Bitcoin from exchanges into personal wallets, it generally indicates a long-term conviction mindset. When they move BTC onto exchanges, it often signals a readiness to sell or trade actively.

The balance between these behaviors can influence how deep or shallow a correction becomes. Over time, if supply continues to tighten while demand slowly rebuilds, it sets the stage for the next leg of the cycle.

The broader crypto market: altcoins, sentiment, and spillover effects

Altcoins tend to amplify Bitcoin’s moves

When Bitcoin price breaks down from key levels, the rest of the crypto market rarely escapes unscathed. Many altcoins follow Bitcoin’s trend with higher volatility. That means: As Bitcoin price is under pressure, capital often rotates out of smaller, riskier coins and seeks relative safety in stablecoins or BTC itself. This dynamic can cause dramatic percentage moves in altcoin portfolios during corrections.

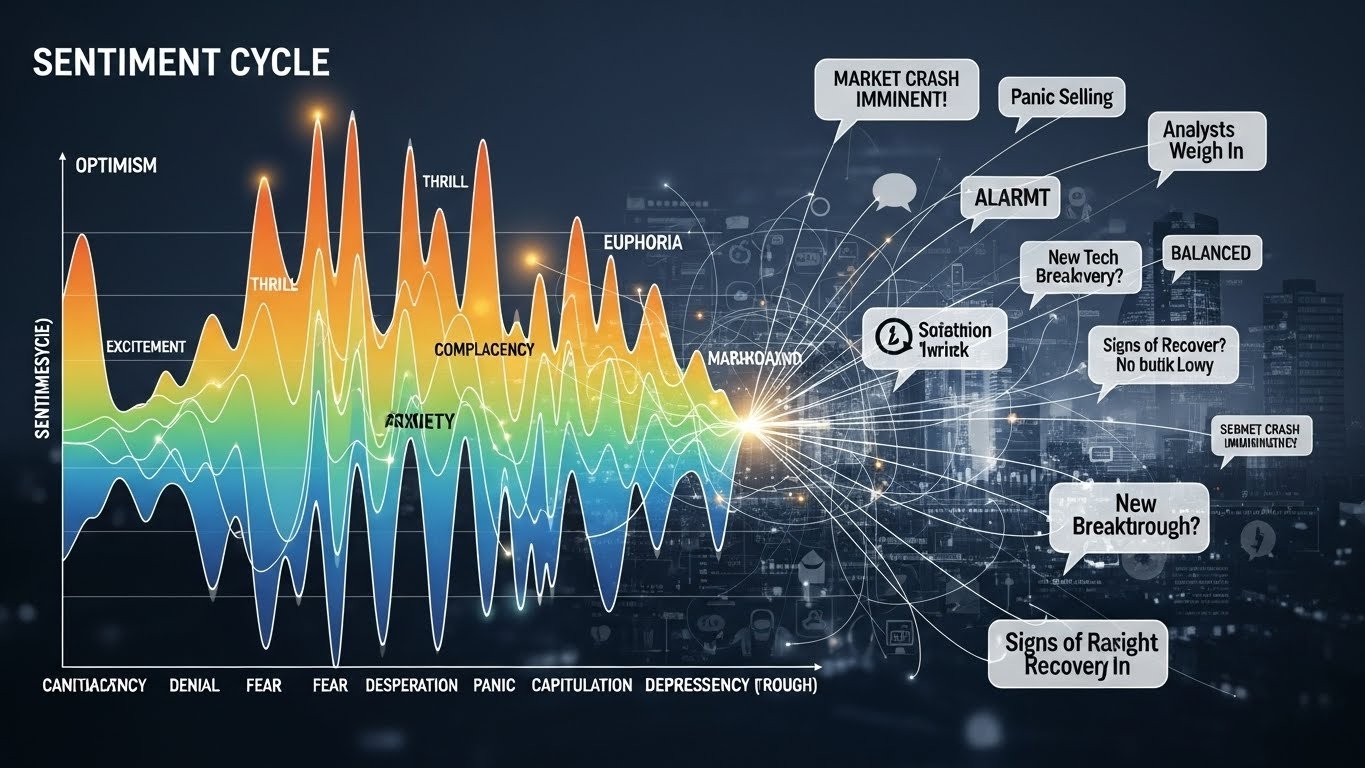

Sentiment cycles and media narratives

Crypto sentiment can shift quickly from “we’re going to the moon” to “the bubble has burst.” Mainstream media headlines tend to follow price action, not lead it. When Bitcoin falls below a highlighted level like $92,000, negative coverage can intensify, which in turn influences retail sentiment.

Crypto sentiment can shift quickly from “we’re going to the moon” to “the bubble has burst.” Mainstream media headlines tend to follow price action, not lead it. When Bitcoin falls below a highlighted level like $92,000, negative coverage can intensify, which in turn influences retail sentiment.

This feedback loop can make corrections feel worse than they are in the bigger picture. For investors, separating short-term noise from long-term structure is essential.

Conclusion

The Bitcoin price under pressure after breaking below $92,000 is more than a simple red candle on the chart. It reflects: At the same time, long-term holders continue to view Bitcoin as scarce digital asset, and many see cyclical corrections as part of a broader, multi-decade adoption story. The 4-year cycle remains a useful framework, but it should be balanced with on-chain data, macro context, and clear risk management. Whether you are a trader trying to navigate short-term volatility or an investor building a long-term position, understanding why Bitcoin price is under pressure helps you move from emotional reactions to informed decisions. Cycles come and go, support breaks, and new highs are eventually made—but only disciplined participants are around to benefit when the next phase begins.

FAQs

Q. Why is the Bitcoin price under pressure after dropping below $92,000?

The Bitcoin price is under pressure below $92,000 due to a mix of profit-taking, macro uncertainty, and leveraged liquidations around key technical levels. As widely watched supports break, automatic selling and emotional reactions tend to amplify the move, pushing price lower than many traders expect.

Q. What is the 4-year Bitcoin cycle?

The 4-year Bitcoin cycle is a pattern built around Bitcoin’s halving events, which reduce the block reward for miners approximately every four years. Historically, halvings have been followed by major bull runs and deep corrections. Over time, this pattern has become popular among traders and is increasingly seen as a self-fulfilling prophecy, as market participants act in anticipation of it.

Q. How does the “self-fulfilling prophecy” affect Bitcoin’s price?

When many traders believe in the 4-year cycle, they adjust their behavior around expected tops and bottoms: taking profits, tightening stops, or reducing risk after strong rallies. This coordinated behavior can create or exaggerate the very corrections they expect, turning the cycle from a passive pattern into an active driver of Bitcoin price action.

Q. Is now a good time to buy Bitcoin after the drop below $92,000?

Whether it’s a good time to buy depends on your risk tolerance, time horizon, and strategy. For long-term investors who believe in Bitcoin’s fundamentals, periods when Bitcoin price is under pressure can be opportunities to accumulate via dollar-cost averaging. Short-term traders, however, need to be cautious, as volatility and further downside are always possible.

Q. What should I watch next after Bitcoin loses the $92,000 level?

These elements together will help indicate whether the current Bitcoin price under pressure is a short-lived shake-out or the beginning of a deeper, cycle-driven correction.

See more;Expert Identifies Three Signals for Bitcoin’s Price Bottom