Bitcoin & Ethereum Drive $2B ETP Exodus AuM Falls to $191B

Bitcoin & Ethereum Drive $2B ETP as total assets under management plummet to $191B. Discover what's driving this exodus.

Bitcoin and Ethereum exchange-traded products experienced unprecedented capital flight, with investors withdrawing approximately $2 billion from these vehicles. This massive exodus has resulted in total assets under management declining sharply to $191 billion, marking one of the most significant withdrawal periods in the digital asset investment space. Bitcoin & Ethereum Drive $2B ETP: The development raises critical questions about investor sentiment, market dynamics, and the future trajectory of institutional cryptocurrency adoption.

This substantial outflow represents more than just numbers on a balance sheet. It signals a potential inflection point in how institutional and retail investors are approaching cryptocurrency exposure through regulated financial products. Bitcoin & Ethereum Drive $2B ETP As digital assets continue to mature as an investment class, understanding the drivers behind such significant capital movements becomes essential for anyone participating in or observing the crypto markets.

The Scale of the ETP Exodus: Bitcoin & Ethereum Drive $2B ETP

The $2 billion withdrawal from cryptocurrency exchange-traded products represents a watershed moment for the digital asset investment industry. To put this figure into perspective, this outflow occurred over a relatively compressed timeframe, suggesting coordinated or sentiment-driven selling rather than gradual portfolio rebalancing. The decline in assets under management to $191 billion marks a substantial retreat from previous highs, indicating that investor confidence may be wavering amid various market pressures.

Exchange-traded products have long been positioned as the bridge between traditional finance and the cryptocurrency ecosystem. They offer investors regulated, accessible exposure to digital currencies without the complexities of managing private keys, dealing with cryptocurrency exchanges, or navigating the technical challenges of blockchain technology. The fact that such products are experiencing significant outflows suggests deeper concerns about either the underlying assets themselves or broader macroeconomic conditions affecting risk appetite.

The composition of these outflows is particularly telling. While Bitcoin and Ethereum have historically been the cornerstone holdings for most crypto investment products, their simultaneous experience of capital flight indicates systematic rather than asset-specific concerns. This synchronised withdrawal pattern often emerges during periods of heightened uncertainty or when investors are rotating out of risk assets across multiple categories.

Bitcoin’s Dominance in Outflow Patterns

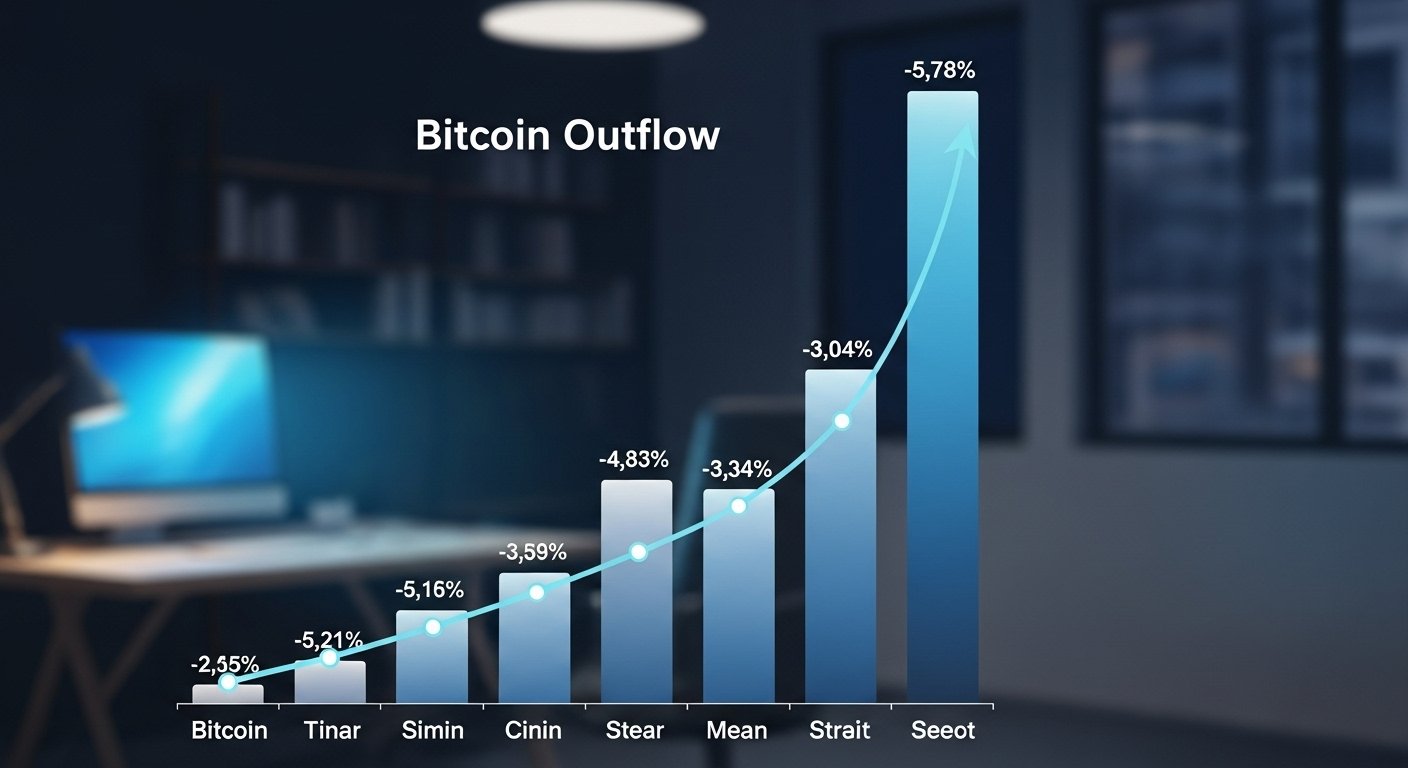

Bitcoin exchange-traded products have borne the brunt of the recent exodus, with the flagship cryptocurrency seeing substantial redemptions across multiple fund families. As the original and largest cryptocurrency by market capitalisation, Bitcoin has traditionally served as the entry point for institutional investors seeking blockchain asset exposure. The current withdrawal trend, therefore, carries significant implications for the broader digital asset ecosystem.

Several factors may be contributing to reduced Bitcoin ETP holdings. Market volatility has remained elevated, with price fluctuations creating uncertainty among investors who prefer more stable return profiles. Additionally, macroeconomic headwinds, including central bank policy decisions and inflation concerns, have prompted many institutional investors to reassess their allocation to alternative assets. Bitcoin, despite its growing acceptance, still occupies the high-risk portion of most institutional portfolios, making it vulnerable during risk-off market environments.

The cryptocurrency market dynamics surrounding Bitcoin have also evolved considerably. With increased correlation to traditional equity markets, particularly technology stocks, Bitcoin has lost some of its appeal as a portfolio diversification tool. Investors who initially allocated to Bitcoin, expecting an uncorrelated return, have found themselves holding an asset that increasingly moves in tandem with broader market trends, diminishing its strategic value within diversified portfolios.

Furthermore, regulatory developments continue to create uncertainty around Bitcoin investment products. While some jurisdictions have embraced cryptocurrency ETPs, others maintain restrictive stances that limit product availability and create compliance challenges for fund managers. This regulatory fragmentation contributes to investor hesitancy and may be driving some participants to exit positions until greater clarity emerges.

Ethereum’s Parallel Challenges

Ethereum investment vehicles have experienced similar outflow pressures, though the dynamics affecting the second-largest cryptocurrency differ in important ways from Bitcoin. Ethereum’s value proposition extends beyond being a store of value or medium of exchange; it serves as the foundational infrastructure for decentralized applications, smart contracts, and an entire ecosystem of blockchain-based innovations.

Despite this broader utility, Ethereum ETPs have not been immune to the current wave of redemptions. The network’s ongoing evolution, including its transition to proof-of-stake consensus and various scaling solutions, has created both opportunities and uncertainties. While these technological improvements promise enhanced efficiency and reduced environmental impact, they also introduce transition risks that conservative institutional investors may view unfavorably.

The decentralised finance sector, which predominantly operates on Ethereum, has experienced its own challenges that may be influencing ETP flows. High-profile protocol failures, security breaches, and regulatory scrutiny of DeFi platforms have raised concerns about the sustainability and safety of the broader Ethereum ecosystem. Even though ETP investors don’t directly participate in DeFi protocols, negative sentiment around the ecosystem can influence perceptions of the underlying asset’s value and stability.

Competition from alternative blockchain platforms has also intensified. Newer networks offering faster transaction speeds, lower fees, and innovative features have captured market share and developer attention, potentially diminishing Ethereum’s perceived dominance. This competitive pressure may be prompting some investors to question Ethereum’s long-term market position, contributing to reduced confidence in Ethereum-based investment products.

Macroeconomic Pressures Reshaping Crypto Investments

The substantial outflows from digital asset investment funds cannot be understood in isolation from the broader macroeconomic environment. Global financial markets have been navigating a complex landscape characterised by elevated interest rates, persistent inflation concerns, and geopolitical tensions that create volatility across all asset classes.

Rising interest rates have fundamentally altered the opportunity cost of holding non-yielding assets like cryptocurrencies. When safe government bonds offer attractive real yields, the relative appeal of speculative investments diminishes significantly. Institutional investors conducting portfolio optimisation exercises increasingly find that traditional fixed-income securities offer better risk-adjusted returns than they have in over a decade, prompting reallocation away from alternative assets.

Cryptocurrency market sentiment has also been shaped by liquidity conditions in broader financial markets. As central banks have withdrawn stimulus measures and reduced balance sheets, the abundant liquidity that fueled risk asset appreciation has receded. Cryptocurrencies, which benefited enormously from the low-rate, high-liquidity environment of recent years, now face headwinds as these conditions reverse.

Corporate earnings pressures and economic growth concerns have further contributed to risk aversion. When investors worry about a recession or significant economic slowdown, they typically reduce exposure to volatile, speculative assets in favour of defensive positions. This flight to safety naturally impacts cryptocurrency holdings, as they occupy the highest-risk tier in most institutional portfolios.

Institutional Investor Behaviour and Portfolio Rebalancing

The composition of investors withdrawing from cryptocurrency ETPs provides valuable insights into current market psychology. Institutional investors, who have been instrumental in legitimizing cryptocurrency investments through their participation, appear to be reassessing allocation strategies. This reassessment reflects not necessarily a rejection of digital assets as an investment category, but rather a tactical response to changing market conditions.

Many institutions operate under strict risk management frameworks that require regular portfolio rebalancing. When cryptocurrency prices decline relative to other holdings, positions may fall below minimum thresholds or target allocations, triggering mechanical selling that contributes to outflows. Similarly, when volatility exceeds predetermined tolerance levels, risk management systems may automatically reduce exposure to bring portfolios back into compliance.

Digital currency investment trends also reflect evolving perspectives on cryptocurrency’s role within portfolios. Early institutional adopters often positioned Bitcoin and Ethereum as inflation hedges or stores of value comparable to gold. However, the actual performance correlation of cryptocurrencies during inflationary periods has challenged this thesis, prompting reconsideration of how these assets fit within overall investment strategies.

The sophistication of institutional investors means their positioning decisions are rarely impulsive or emotionally driven. Instead, they reflect ongoing analytical work, changing assumptions about market structure, and responses to new information about regulatory developments, technological risks, and competitive dynamics within the cryptocurrency space.

Regulatory Developments Influencing Investment Flows

Cryptocurrency regulation remains a pivotal factor shaping institutional investment decisions and ETP flows. The regulatory landscape has evolved considerably, with different jurisdictions adopting varying approaches that create both opportunities and challenges for investment product providers and their clients.

In some regions, regulatory clarity has improved significantly, with frameworks emerging that provide greater certainty around tax treatment, custody requirements, and investor protections. These developments have generally supported cryptocurrency ETP growth by reducing uncertainty and enabling broader participation. However, in other jurisdictions, regulatory crackdowns, enforcement actions against major crypto platforms, and proposed restrictions have created headwinds that undermine investor confidence.

The ongoing debate around the classification of various digital assets—whether as securities, commodities, or entirely new asset categories—continues to create uncertainty. This ambiguity affects not only the regulatory treatment of the underlying cryptocurrencies but also the legal status and operational requirements of the ETPs themselves. Fund managers must navigate this complex environment while attempting to serve investors who demand both competitive returns and regulatory compliance.

Recent enforcement actions by financial regulators against cryptocurrency exchanges and service providers have heightened concerns about counterparty risk and systemic stability within the digital asset ecosystem. Even though regulated investment products offer structural protections that direct cryptocurrency holdings lack, negative regulatory developments still influence overall market sentiment and can trigger protective selling by risk-averse institutional investors.

Market Outlook and Future Implications

The current $2 billion exodus from Bitcoin and Ethereum investment products should be contextualised within the longer-term trajectory of cryptocurrency adoption. While significant, these outflows represent a correction or consolidation phase rather than necessarily indicating the end of institutional interest in digital assets. Historical precedent suggests that cryptocurrency markets move in cycles, with periods of euphoria and accumulation alternating with phases of scepticism and distribution.

Several factors will likely determine whether current outflows represent a temporary setback or the beginning of a more prolonged downturn. Macroeconomic conditions, particularly the trajectory of interest rates and inflation, will significantly influence risk appetite and asset allocation decisions across all investor categories. Should economic conditions stabilise and central banks signal policy easing, risk assets, including cryptocurrencies, could experience renewed interest.

Technological developments within the blockchain ecosystem will also play crucial roles. Successful implementation of scaling solutions, improved user experience, and the emergence of compelling use cases that demonstrate real-world utility could reignite institutional enthusiasm. Conversely, security failures, technological setbacks, or failure to achieve promised improvements could extend the current period of caution.

The digital asset investment landscape continues to mature, with new products, improved infrastructure, and enhanced regulatory frameworks emerging despite current challenges. This ongoing development suggests that even as some investors exit positions, the foundation is being laid for the next phase of cryptocurrency adoption. The current consolidation may ultimately prove healthy, eliminating weak hands and creating a more stable base for future growth.

Conclusion

The $2 billion outflow from Bitcoin and Ethereum exchange-traded products, resulting in assets under management declining to $191 billion, represents a significant moment in cryptocurrency investment history. This exodus reflects a confluence of factors, including macroeconomic pressures, regulatory uncertainties, market volatility, and evolving institutional investment strategies. While the magnitude of withdrawals raises concerns about near-term sentiment, it does not necessarily signal the end of cryptocurrency’s evolution as a legitimate investment asset class.

Understanding these dynamics requires looking beyond headline numbers to examine the underlying drivers of investor behaviour. The current environment challenges the assumptions and investment theses that drove earlier cryptocurrency adoption, forcing both institutional and retail investors to reassess their positions. As the digital asset market continues maturing, such periods of consolidation and reassessment may prove essential to building more sustainable foundations for long-term growth.

The coming months will reveal whether this exodus represents a temporary setback during a broader adoption journey or marks a more fundamental shift in how investors view cryptocurrency exposure. Regardless of the outcome, the cryptocurrency investment landscape that emerges from this period will likely be more sophisticated, better regulated, and more clearly integrated into the broader financial ecosystem.

FAQs

Q: What caused the $2 billion outflow from Bitcoin and Ethereum ETPs?

The outflows resulted from multiple factors, including macroeconomic pressures like rising interest rates, increased market volatility, regulatory uncertainties, and portfolio rebalancing by institutional investors. Many investors reduced risk exposure amid concerns about global economic conditions.

Q: Does this exodus mean cryptocurrencies are no longer viable investments?

Not necessarily. Market cycles are normal in cryptocurrency investing, and periods of outflows often precede consolidation phases that establish foundations for future growth. The exodus reflects current market sentiment and conditions rather than fundamentally undermining cryptocurrency’s long-term investment case.

Q: How do exchange-traded products differ from direct cryptocurrency ownership?

ETPs provide regulated exposure to cryptocurrencies without requiring investors to manage private keys, navigate cryptocurrency exchanges, or handle technical custody issues. They offer convenience, regulatory oversight.

Q: Will the assets under management continue declining from $191 billion?

Future trends depend on various factors, including macroeconomic conditions, regulatory developments, cryptocurrency market performance, and overall risk appetite among investors. While current momentum suggests continued caution, positive catalysts could reverse the trend.

Q: Should retail investors be concerned about these institutional outflows?

Retail investors should view institutional outflows as one data point among many when making investment decisions. While institutional behaviour can influence market dynamics and price movements, individual investors have different time horizons, risk tolerances, and investment objectives.