Bitcoin Drops Below $102K Crypto Market Faces

Bitcoin Drops Below $102K Crypto while Ethereum, XRP, and Dogecoin plunge over 2%. Discover what's driving the crypto market downturn.

Bitcoin tumbled below the crucial $102,000 threshold, marking a notable shift in market sentiment. This decline didn’t occur in isolation, as major altcoins, including Ethereum, XRP, and Dogecoin, each recorded losses exceeding 2%, painting a broader picture of market-wide volatility. For investors and traders who have been riding the wave of recent bullish momentum, Bitcoin Drops Below $102K Crypto: this sudden reversal serves as a stark reminder of the inherent unpredictability that defines the digital asset landscape.

The cryptocurrency sector has once again demonstrated why risk management remains paramount for anyone holding digital assets. As Bitcoin’s price action influences the broader market, understanding the factors behind this decline becomes essential for making informed investment decisions. Bitcoin Drops Below $102K Crypto: This comprehensive analysis explores the catalysts driving the current downturn, examines how major cryptocurrencies are responding, Bitcoin Drops Below $102K Crypto: and provides insights into what investors should watch for in the coming days.

Bitcoin’s Price Movement Below $102,000

Bitcoin’s descent below the $102,000 mark represents more than just a numerical milestone—it signals a potential shift in market dynamics that traders have been monitoring closely. The leading cryptocurrency had been consolidating above this level for several trading sessions, Bitcoin Drops Below $102K Crypto: building what many analysts believed was support for another leg higher. However, selling pressure intensified, pushing the price through this psychological barrier and triggering additional liquidations in the derivatives market.

The Bitcoin market operates 24/7, making it susceptible to news events, regulatory announcements, and macroeconomic factors at any hour. This particular decline appears to stem from a confluence of factors rather than a single catalyst. Market participants have pointed to profit-taking after recent gains, concerns about regulatory scrutiny in key markets, and broader macroeconomic uncertainty as potential contributors to the bearish sentiment.

Technical analysts have noted that Bitcoin’s price structure showed signs of exhaustion near the $104,000 level, with declining trading volumes suggesting waning buying interest. When support at $102,000 failed to hold, algorithmic trading systems likely amplified the downward movement, creating a cascading effect that pushed prices lower in a relatively short timeframe. This pattern is not uncommon in cryptocurrency markets, where leverage and automated trading can exacerbate price movements in both directions.

Ethereum’s Struggle Amid Market Turbulence

Ethereum, the second-largest cryptocurrency by market capitalisation, found itself caught in Bitcoin’s downdraft, experiencing its own challenging trading session. The Ethereum network, despite its fundamental strengths and ongoing development activity, couldn’t escape the broader market sentiment that dragged prices lower. ETH’s decline of over 2% reflects the high correlation that typically exists between Bitcoin and major altcoins during periods of significant volatility.

The Ethereum ecosystem continues to evolve with ongoing upgrades and increasing adoption of layer-two scaling solutions, yet short-term price action remains heavily influenced by Bitcoin’s directional moves. Traders who focus on Ethereum’s fundamentals often find themselves frustrated during these correlation-driven selloffs, as positive developments within the ecosystem get overshadowed by macro market forces.

What makes Ethereum’s position particularly interesting during this downturn is the continued growth in decentralised finance applications and non-fungible token platforms built on its blockchain. Transaction activity and network utilisation metrics suggest healthy underlying demand for Ethereum’s blockchain capabilities, even as speculative trading drives short-term price volatility. This divergence between fundamental growth and price action creates potential opportunities for long-term investors who can weather near-term uncertainty.

XRP’s Performance During: Bitcoin Drops Below $102K Crypto

XRP has carved out a unique position in the cryptocurrency market, particularly following recent legal clarity regarding its regulatory status. However, even positive regulatory developments couldn’t shield XRP from the broader market downturn, with the token dropping more than 2% alongside its peers. The XRP community, which has been energised by favourable legal outcomes, now faces the reality that market-wide sentiment can override individual token narratives.

The digital asset has seen increased attention from institutional investors exploring cross-border payment solutions, and Ripple’s ongoing partnerships with financial institutions continue to provide fundamental support for the token’s long-term value proposition. Nevertheless, XRP’s price remains subject to the same technical and sentiment-driven forces that affect the broader cryptocurrency market.

Trading volumes for XRP suggest that while some investors used the dip as a buying opportunity, the overall market momentum remained tilted toward the downside. This behaviour is typical during correction phases when risk-off sentiment dominates trading decisions. For XRP holders who believe in the token’s utility for international remittances and payment settlements, these price dips may represent accumulation opportunities rather than cause for concern.

Dogecoin Joins the Downturn

Dogecoin, the popular meme-inspired cryptocurrency, experienced similar downward pressure, declining over 2% in sympathy with larger digital assets. What began as an internet joke has evolved into a widely recognised cryptocurrency with a dedicated community and increasing merchant adoption. However, Dogecoin’s price remains particularly sensitive to social media sentiment and broader market trends, making it vulnerable during risk-off periods.

The Dogecoin community has historically demonstrated remarkable resilience during market downturns, often viewing price declines as opportunities to accumulate more tokens at lower prices. This grassroots support provides a unique dynamic that differentiates Dogecoin from many other cryptocurrencies, though it doesn’t insulate the token from correlation-driven selloffs when Bitcoin leads the market lower.

Recent developments around Dogecoin payment integrations and potential use cases for everyday transactions have given the token more utility than its meme origins might suggest. Nevertheless, the speculative nature of Dogecoin trading means that its price often exhibits higher volatility compared to more established cryptocurrencies, particularly during periods of market-wide uncertainty.

Market Sentiment and Investor Behaviour

The current cryptocurrency market environment reflects a complex interplay of factors influencing investor behaviour. Market sentiment indicators have shifted from extreme greed to more neutral territory, suggesting that traders are reassessing their positions and risk exposure. This recalibration often leads to increased volatility as positions get adjusted and stop-loss orders trigger across various price levels.

Social media analysis and sentiment tracking tools show a marked decrease in bullish rhetoric compared to just days ago, when optimism about continued price appreciation dominated discussions. This shift in sentiment can become self-reinforcing, as negative price action breeds additional pessimism, which in turn drives further selling pressure. Understanding these psychological dynamics is crucial for investors trying to navigate volatile market conditions effectively.

Long-term holders, often referred to as “diamond hands” within the cryptocurrency community, typically view these pullbacks as temporary setbacks rather than fundamental threats to their investment thesis. Historical data shows that Bitcoin and other major cryptocurrencies have experienced numerous corrections of similar or greater magnitude during previous bull markets, only to eventually resume their upward trajectories. This historical context provides perspective for investors evaluating their response to current market conditions.

Technical Analysis and Key Support Levels

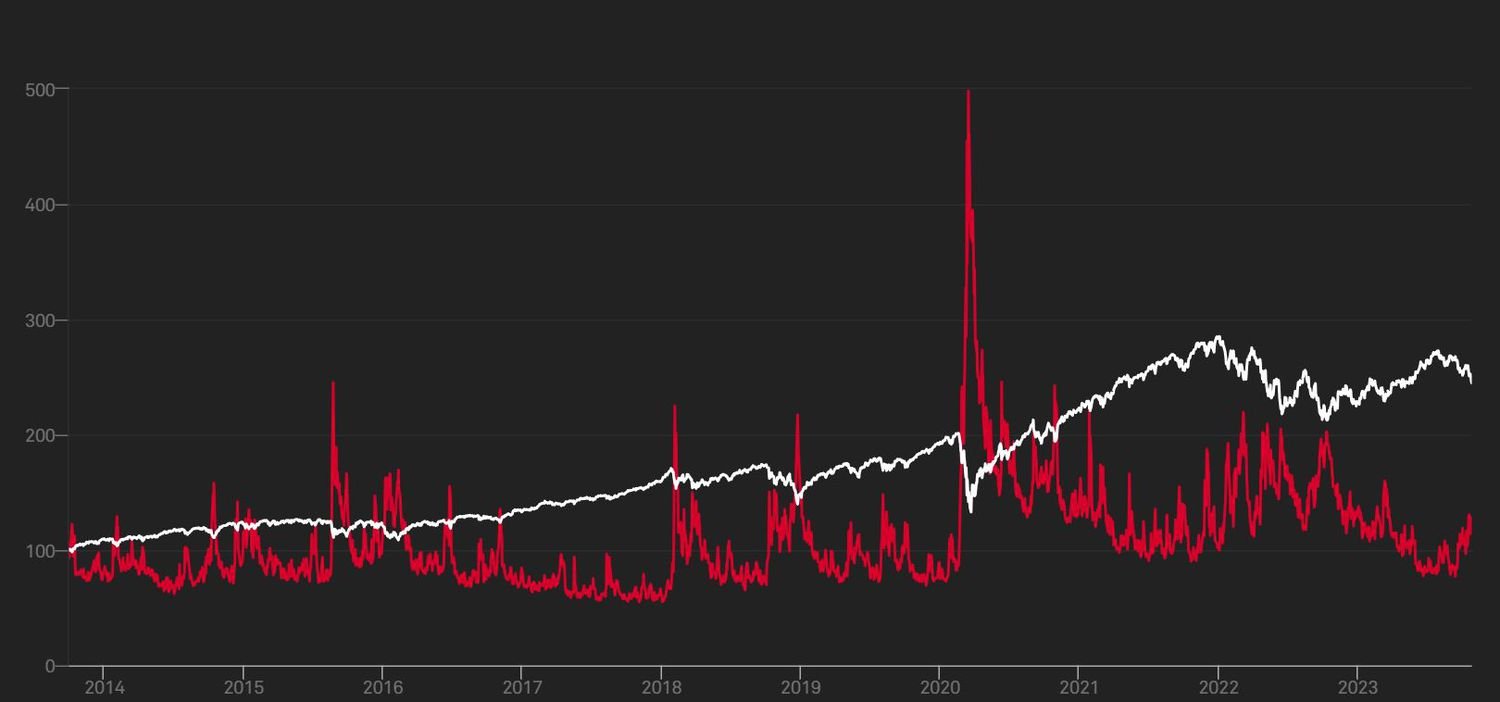

From a technical perspective, Bitcoin’s movement below $102,000 has traders focusing on the next significant support zones that might stem the decline. Chart patterns and indicator readings suggest that the market is testing important technical levels that have historically provided buying interest. The Relative Strength Index (RSI) for Bitcoin has moved from overbought territory into more neutral ranges, potentially indicating that the selloff may be approaching exhaustion.

Moving averages, which many traders use as dynamic support and resistance levels, are being closely monitored to gauge the health of the broader uptrend. Should Bitcoin find support at these moving averages, it could signal that the current decline represents a healthy correction within an ongoing bull market rather than the beginning of a more significant reversal. Conversely, a break below key moving averages might suggest that more downside lies ahead.

Volume analysis during this decline provides additional context about the strength of the selling pressure. Higher-than-average volume during the breakdown below $102,000 indicates genuine conviction among sellers, while declining volume on subsequent price drops might suggest that selling pressure is diminishing. These volume patterns help traders distinguish between temporary shakeouts and more serious trend reversals.

Regulatory Environment and Market Impact

The regulatory landscape for cryptocurrencies continues to evolve globally, with different jurisdictions taking varied approaches to digital asset oversight. Recent discussions about stricter compliance requirements and enhanced reporting obligations have created uncertainty among market participants, potentially contributing to the cautious sentiment reflected in current price action. Investors remain attentive to regulatory developments, knowing that policy changes can significantly impact market dynamics.

The United States, European Union, and Asian markets each maintain distinct regulatory frameworks for cryptocurrency trading and custody, creating a complex global environment for digital asset firms to navigate. When regulatory concerns surface in major markets, the resulting uncertainty often manifests as increased volatility and risk-averse behaviour among traders. This regulatory overhang can temporarily suppress prices even when fundamental adoption metrics remain strong.

However, the maturation of regulatory frameworks can also provide long-term benefits by bringing clarity and legitimacy to the cryptocurrency sector. Institutional investors, who control vast amounts of capital, often cite regulatory uncertainty as a barrier to larger allocations toward digital assets. As regulations become more defined, these concerns may diminish, potentially paving the way for increased institutional participation that could support higher valuations over time.

Institutional Investment Trends

Institutional adoption of cryptocurrencies has been a major theme in recent years, with hedge funds, family offices, and publicly traded companies adding Bitcoin and other digital assets to their portfolios. The current market pullback provides a test of institutional conviction, revealing whether these sophisticated investors view price declines as buying opportunities or reasons to reduce exposure. Early indications suggest a mixed response, with some institutions adding to positions while others remain on the sidelines.

The Bitcoin exchange-traded funds (ETFs) that have launched in various markets have provided traditional investors with regulated access to cryptocurrency exposure without directly holding the underlying assets. Flows into and out of these investment vehicles offer valuable insights into institutional sentiment. Monitoring these flows during the current downturn can help gauge whether institutional money is being deployed or withdrawn from the cryptocurrency sector.

Corporate treasury allocations to Bitcoin, pioneered by companies seeking to preserve purchasing power or diversify reserves, face scrutiny during market volatility. These corporate holders typically maintain long-term investment horizons and are less likely to be swayed by short-term price fluctuations. Their continued commitment to holding Bitcoin through volatility provides a stabilising influence and demonstrates confidence in the long-term value proposition of digital assets.

The Broader Economic Context

Macroeconomic factors play an increasingly important role in cryptocurrency price movements as digital assets become more integrated into the global financial system. Interest rate policies, inflation expectations, and overall risk appetite in traditional markets all influence how investors approach cryptocurrency allocations. The current environment, characterised by ongoing debates about monetary policy direction, creates uncertainty that can trigger volatility across all risk assets, including cryptocurrencies.

The relationship between Bitcoin and traditional safe-haven assets like gold has been a topic of ongoing debate. During some market stress periods, Bitcoin has behaved more like a risk asset, declining alongside equities. In other instances, it has shown resilience or even inverse correlation to traditional markets. This evolving relationship makes it challenging to predict how Bitcoin will respond to various macroeconomic scenarios, adding another layer of complexity for investors.

Currency fluctuations and concerns about fiat currency devaluation continue to drive interest in cryptocurrencies as alternative stores of value. In regions experiencing currency instability or capital controls, Bitcoin and other cryptocurrencies serve practical purposes beyond speculation. This utility-driven demand provides fundamental support that exists independently of short-term price volatility in developed markets.

Recovery Prospects and Future Outlook

Looking ahead, market participants are divided on whether the current decline represents a temporary pullback or the beginning of a more sustained correction. Bulls point to strong fundamentals, including growing adoption, improving infrastructure, and increasing recognition of cryptocurrencies as legitimate asset classes. These factors suggest that any significant price decline may attract buyers looking to enter or expand positions at more attractive valuations.

Bears caution that the cryptocurrency market may need additional time to consolidate recent gains before resuming upward momentum. Historical patterns show that after rapid price appreciation, periods of consolidation or correction are common and healthy for long-term market stability. These corrective phases allow new support levels to form and excessive leverage to be flushed from the system, creating a more sustainable foundation for future growth.

The development of cryptocurrency infrastructure, including improved custody solutions, enhanced trading platforms, and expanded merchant acceptance, continues regardless of short-term price movements. This ongoing buildout of the ecosystem creates long-term value that may not be immediately reflected in daily price action but becomes increasingly apparent over extended timeframes. Investors with multi-year horizons often focus on these fundamental developments rather than near-term volatility.

Conclusion

The recent decline that pushed Bitcoin below $102,000 while dragging Ethereum, XRP, and Dogecoin down more than 2% serves as a reminder of the cryptocurrency market’s inherent volatility. While short-term price movements can be unsettling for investors, they represent normal market behaviour within an asset class still establishing itself within the global financial system. The factors driving this pullback—including profit-taking, regulatory uncertainty, and broader risk-off sentiment—are not unprecedented and have been navigated successfully during previous market cycles.

For investors evaluating their positions, the current environment emphasises the importance of maintaining a long-term perspective, using appropriate position sizing, and avoiding excessive leverage that can amplify losses during volatile periods. The fundamental developments supporting cryptocurrency adoption continue to progress, suggesting that temporary price setbacks may represent opportunities for patient investors rather than signals to abandon digital assets entirely. As always, conducting thorough research and maintaining realistic expectations about volatility remain essential practices for anyone participating in the cryptocurrency market.

FAQs

Q: Why did Bitcoin fall below $102,000?

Bitcoin’s decline below $102,000 resulted from multiple factors, including profit-taking after recent gains, regulatory concerns in major markets, and broader risk-off sentiment affecting all cryptocurrencies. Technical factors such as breaking key support levels and liquidations in the derivatives market amplified the downward movement.

Q: Should I buy cryptocurrencies during this market dip?

Investment decisions should be based on your individual financial situation, risk tolerance, and investment timeline. Market dips have historically provided attractive entry points for long-term investors, but there’s no guarantee that prices won’t decline further in the short term.

Q: How are Ethereum, XRP, and Dogecoin correlated with Bitcoin?

Major altcoins like Ethereum, XRP, and Dogecoin typically exhibit high correlation with Bitcoin, especially during significant price movements. When Bitcoin declines sharply, selling pressure usually spreads across the broader cryptocurrency market regardless of individual token fundamentals.

Q: What support levels should investors watch for Bitcoin?

Technical analysts are monitoring several key support levels below $102,000, including major moving averages and previous consolidation zones. The specific levels vary depending on the timeframe and methodology used, but areas where Bitcoin previously found buying interest often serve as potential support during declines.

Q: Could this decline mark the beginning of a crypto bear market?

While any decline raises concerns about broader trend reversals, single-day or short-term drops don’t necessarily signal the start of a bear market. Bear markets typically develop over extended periods with sustained selling pressure, deteriorating fundamentals, and shifts in long-term sentiment.