Bitcoin Cash Price Forecast: Downside Risk Analysis & Predictions

The Bitcoin Cash price forecast has become increasingly concerning for investors as multiple bearish indicators converge to signal potential downside momentum. With declining open interest and reduced whale accumulation patterns, the cryptocurrency market is witnessing a shift in sentiment that could significantly impact BCH’s trajectory in the coming months. Understanding these market dynamics is crucial for traders and investors seeking to navigate the volatile landscape of digital assets.

Recent market data reveals troubling trends that suggest Bitcoin Cash price forecast models may need recalibration toward more conservative projections. The combination of diminishing institutional interest, reduced trading volumes, and shifting whale behaviour patterns creates a perfect storm for potential price corrections. This comprehensive analysis examines the key factors driving these concerns and provides actionable insights for cryptocurrency market participants.

Market Fundamentals Driving Bitcoin Cash Price Movements

Current BCH Price Action and Technical Analysis

The Bitcoin Cash price forecast relies heavily on technical indicators that have been painting an increasingly bearish picture. Over the past quarter, BCH has struggled to maintain key support levels, with price action characterised by lower highs and diminishing buying pressure during recovery attempts.

Chart patterns reveal a concerning trend where each rally faces stronger resistance, while sell-offs encounter less support. This technical deterioration aligns with fundamental weaknesses in market structure, particularly the declining open interest, which has become a significant concern for the accuracy of Bitcoin Cash price forecasts.

Volume profile analysis shows reduced participation at higher price levels, suggesting that institutional and retail appetite for BCH has waned considerably. The cryptocurrency’s relative performance against Bitcoin has also deteriorated, indicating sector rotation away from alternative cryptocurrencies toward more established digital assets.

Open Interest Decline: A Critical Warning Signal

One of the most significant factors affecting the Bitcoin Cash price forecast is the substantial decline in open interest across major derivatives exchanges. Open interest, which represents the total number of outstanding derivative contracts, serves as a crucial indicator of market engagement and future price volatility.

The reduction in open interest suggests several concerning developments. First, it indicates reduced speculative activity from both institutional and retail traders, which traditionally drives price momentum in cryptocurrency markets. Second, the decline often precedes major price movements, as it reflects changing market sentiment and positioning.

Data from leading cryptocurrency exchanges shows that BCH open interest has decreased by over 30% in recent months, coinciding with similar declines in other fundamental metrics. This trend suggests that the Bitcoin Cash price forecast may face additional headwinds as market participants reduce their exposure to the asset.

Whale Activity Analysis and Market Impact

Declining Whale Holdings: A Bearish Indicator

Large-scale investors, commonly referred to as “whales,” play a pivotal role in cryptocurrency markets, and their behaviour significantly influences any Bitcoin Cash price forecast. Recent on-chain analysis reveals a troubling pattern of whale divestment, with large holders reducing their BCH positions across multiple timeframes.

Whale watching services report that addresses holding more than 1,000 BCH have decreased their aggregate holdings by approximately 15% over the past six months. This systematic reduction in large-holder positions suggests institutional confidence in the asset may be waning, creating additional pressure on price support levels.

The impact of declining whale holdings extends beyond immediate selling pressure. These large investors often serve as market makers, providing liquidity during volatile periods. Their reduced presence could amplify future price movements, making the Bitcoin Cash price forecast more susceptible to extreme volatility.

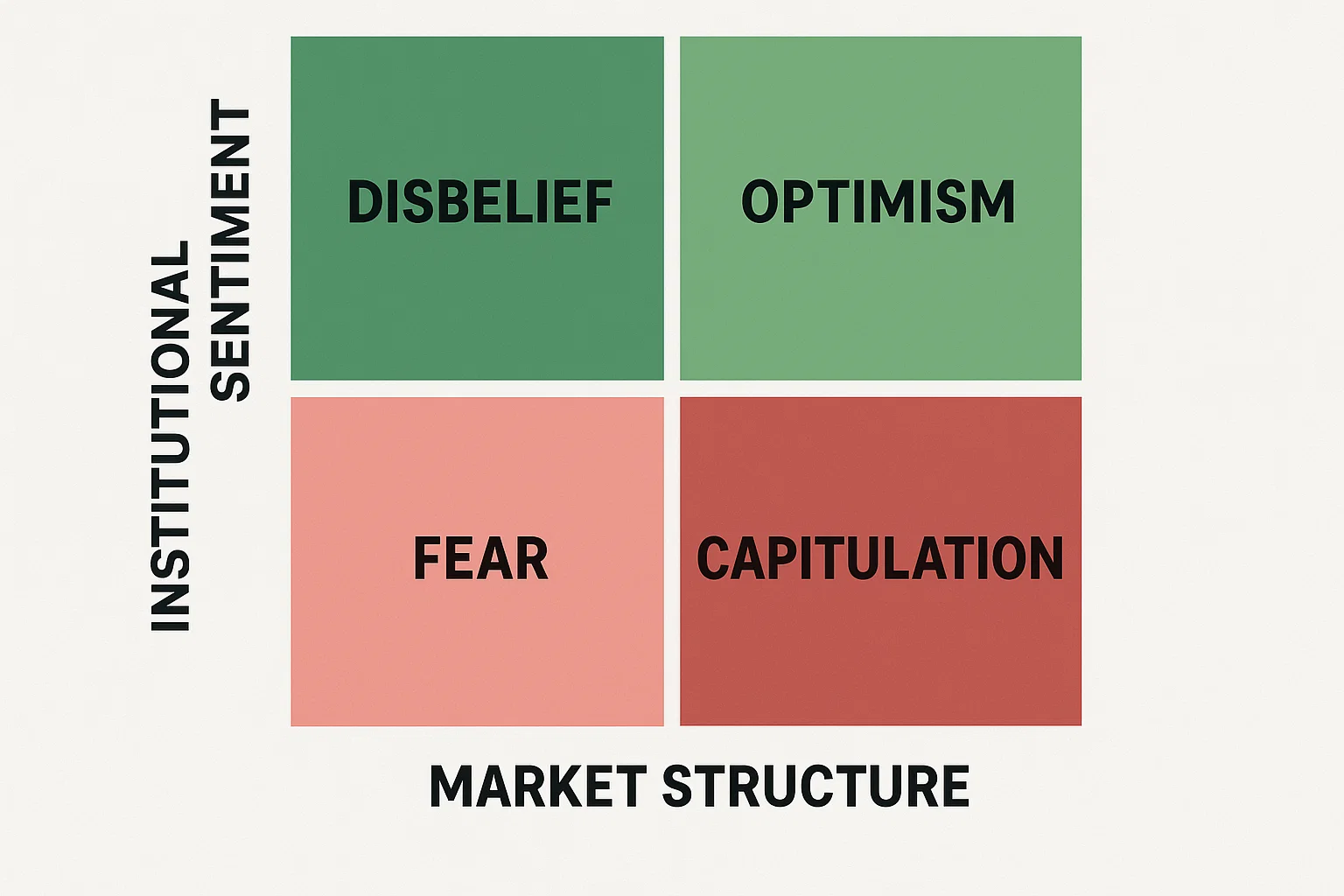

Institutional Sentiment and Market Structure

Professional trading firms and institutional investors have shown reduced interest in Bitcoin Cash, as evidenced by declining trading volumes and reduced participation in derivative markets. This institutional retreat has significant implications for any Bitcoin Cash price forecast, as these participants typically provide market stability and price discovery efficiency.

The changing institutional landscape reflects broader concerns about Bitcoin Cash’s competitive position within the cryptocurrency ecosystem. As more established cryptocurrencies gain institutional adoption, alternative coins like BCH face increased pressure to demonstrate unique value propositions.

Technical Analysis and Price Projections

Short-term Bitcoin Cash Price Forecast

The immediate Bitcoin Cash price forecast indicates continued pressure on key support levels, with technical indicators suggesting potential further declines. The Relative Strength Index (RSI) has remained in oversold territory for extended periods, while moving averages continue to trend downward.

Support levels identified through volume profile analysis show limited buying interest at current price ranges, suggesting that any significant selling pressure could result in rapid price declines. The lack of strong support zones makes the Bitcoin Cash price forecast particularly vulnerable to market shocks or adverse news events.

Fibonacci retracement levels indicate potential targets for further declines, with key psychological levels serving as potential areas of interest for value-seeking investors. However, the overall technical picture remains bearish, with few catalysts visible that could reverse the current trend.

Medium-term Market Outlook

The six-month Bitcoin Cash price forecast incorporates broader market trends and fundamental developments that could impact BCH’s trajectory. Regulatory developments, technological upgrades, and competitive pressures from other cryptocurrencies all factor into medium-term projections.

Economic conditions and changes in monetary policy could significantly impact the Bitcoin Cash price forecast, as cryptocurrency markets remain sensitive to macroeconomic factors. Rising interest rates and tightening liquidity conditions have historically created headwinds for risk assets, including digital currencies.

The evolution of market structure, including the development of new trading products and increased institutional participation in the broader cryptocurrency market, may also impact BCH’s relative performance and future price potential.

Fundamental Analysis and Network Health

Network Activity and Adoption Metrics

The Bitcoin Cash price forecast must consider fundamental network health indicators, including transaction volumes, active addresses, and developer activity. Recent data show mixed signals, with some metrics indicating stability while others suggest declining engagement.

Transaction volumes have remained relatively stable, indicating that BCH retains its utility for its intended use cases. However, the number of active addresses has shown some decline, indicating potentially reduced user adoption or engagement with the network.

Developer activity, as measured by code commits and protocol improvements, remains active but has not accelerated significantly. The pace of innovation and network upgrades plays a crucial role in long-term price sustainability, affecting the Bitcoin Cash price forecast accordingly.

Competitive Landscape Assessment

Bitcoin Cash faces intense competition from other cryptocurrencies targeting similar use cases, including faster payment solutions and innovative contract platforms. This competitive pressure significantly impacts any Bitcoin Cash price forecast, as market share and mindshare directly influence investor interest.

The emergence of central bank digital currencies (CBDCs) and the improvement of traditional payment systems also pose challenges to Bitcoin Cash’s value proposition. These developments must be factored into long-term Bitcoin Cash price forecast models to provide realistic expectations for investors.

Risk Assessment and Market Scenarios

Downside Risk Factors

Several key risk factors support the bearish Bitcoin Cash price forecast currently dominating market analysis. Regulatory uncertainty continues to create headwinds for cryptocurrency adoption, while technological challenges and scalability concerns persist across the industry.

Market concentration risks, where a small number of exchanges or wallets control significant portions of the BCH supply, could amplify volatility and create systemic risks. These factors contribute to the negative sentiment reflected in current Bitcoin Cash price forecast models.

Macroeconomic conditions, including concerns about inflation and changes in monetary policy, could further pressure cryptocurrency markets and validate bearish Bitcoin Cash price forecast scenarios.

Potential Upside Catalysts

Despite the predominantly bearish Bitcoin Cash price forecast, several potential catalysts could reverse current trends. Major technological upgrades, increased merchant adoption, or significant partnerships could provide positive momentum for BCH prices.

Regulatory clarity and favourable policy developments could also support more optimistic Bitcoin Cash price forecast scenarios. The cryptocurrency industry’s evolution toward mainstream acceptance could benefit established coins like BCH if they can maintain relevance and utility.

Market Psychology and Sentiment Analysis

Investor Sentiment Indicators

Current market sentiment surrounding Bitcoin Cash reflects the challenges highlighted in bearish Bitcoin Cash price forecast analyses. Social media sentiment, search volume trends, and survey data all indicate a decline in enthusiasm for the cryptocurrency.

Fear and greed indices specific to cryptocurrency markets have shown elevated fear levels, which historically coincide with extended periods of price weakness. This psychological backdrop supports conservative Bitcoin Cash price forecast projections, suggesting that any recovery may face significant resistance.

The prevalence of negative news coverage and analyst commentary creates a self-reinforcing cycle that can perpetuate bearish trends, making it more difficult for optimistic Bitcoin Cash price forecast scenarios to materialise.

Market Cycle Analysis

Bitcoin Cash’s position within the broader cryptocurrency market cycles provides context for current Bitcoin Cash price forecast models. Historical analysis suggests that alternative cryptocurrencies often experience extended periods of underperformance relative to Bitcoin during market downturns.

The current market phase appears to be characterised by a flight-to-quality behaviour, where investors consolidate their positions in more established cryptocurrencies. This trend supports bearish Bitcoin Cash price forecast projections until broader market conditions improve.

Trading Strategies and Risk Management

Strategic Positioning for Current Market Conditions

Given the bearish Bitcoin Cash price forecast, traders and investors must adapt their strategies to current market realities. Risk management becomes paramount when technical and fundamental indicators align to suggest continued downside pressure.

Dollar-cost averaging strategies may appeal to long-term investors who believe current Bitcoin Cash price forecast models are overly pessimistic. However, these approaches require careful consideration of position sizing and timeline expectations.

Short-term trading strategies should account for the increased volatility and reduced liquidity highlighted in current Bitcoin Cash price forecast analyses. Stop-loss orders and position management become crucial tools for navigating uncertain market conditions.

Portfolio Diversification Considerations

The challenges reflected in the current Bitcoin Cash price forecast underscore the importance of diversification within cryptocurrency portfolios. Concentration risk in any single digital asset can lead to significant losses during extended bear markets.

Institutional investors and financial advisors increasingly recommend limited exposure to any individual cryptocurrency, including BCH, regardless of Bitcoin Cash price forecast projections. This approach helps manage downside risk while maintaining upside potential.

Future Outlook and Long-term Prospects

Technology Roadmap and Development Progress

Technological advancements and protocol enhancements significantly influence the long-term Bitcoin Cash price forecast. The BCH development community continues to work on scalability solutions and feature enhancements that could impact future price performance.

Network upgrade schedules and implementation timelines provide important milestones for evaluating the accuracy of Bitcoin Cash price forecasts. Successful deployments of new features could catalyse positive sentiment shifts and support more optimistic price projections.

Interoperability developments and cross-chain functionality could also influence long-term Bitcoin Cash price forecast models by expanding the cryptocurrency’s utility and addressable market.

Market Maturation and Institutional Adoption

The evolution of cryptocurrency markets toward greater institutional participation could benefit or challenge Bitcoin Cash, depending on its ability to meet the requirements of professional investors. Current Bitcoin Cash price forecast models must take into account these changing market dynamics.

Regulatory developments and compliance frameworks will significantly impact the institutional adoption potential and, consequently, the long-term accuracy of Bitcoin Cash’s price forecast. Clear regulatory pathways could support more optimistic scenarios, while restrictive policies could validate bearish projections.

Conclusion

The comprehensive analysis of market conditions, technical indicators, and fundamental factors supports a cautious Bitcoin Cash price forecast in the near to medium term. The convergence of declining open interest, reduced whale holdings, and challenging market conditions creates a compelling case for continued downside pressure on BCH prices.

Investors considering Bitcoin Cash positions should carefully evaluate their risk tolerance and investment timeline in light of current Bitcoin Cash price forecast projections. While long-term believers may view current conditions as opportunities for accumulation, the technical and fundamental evidence suggests that patience and careful risk management will be essential.

Read more: When Will Altcoin Season Start After Bitcoin’s $111,000 ATH