ADA Momentum vs $0.035 Crypto Which Wins in 2025?

Cryptocurrency could outperform ADA Momentum vs $0.035 Crypto Explore price predictions, market analysis, and investment opportunities.

Cardano (ADA) is establishing itself as a prominent player in the blockchain ecosystem. However, savvy investors are increasingly turning their attention toward undervalued cryptocurrencies trading at fraction-of-a-dollar prices, seeking opportunities that could deliver exponential returns. While Cardano has demonstrated impressive momentum with its technological advancements and growing ecosystem, a particular cryptocurrency trading at just $0.035 is capturing significant attention from analysts and investors alike.

The cryptocurrency landscape is evolving rapidly, with institutional adoption accelerating and retail investors constantly searching for the next breakthrough digital asset. ADA Momentum vs $0.035 Crypto: Cardano has built a solid reputation through its peer-reviewed approach to blockchain development and commitment to sustainability. Despite these accomplishments, the mathematical reality of market capitalization creates natural limitations on potential percentage gains for established cryptocurrencies. This fundamental principle is driving sophisticated investors to explore low-cap cryptocurrencies with stronger upside potential, particularly those trading well under the one-dollar threshold.

In this comprehensive analysis, we’ll explore why this $0.035 cryptocurrency could potentially outperform Cardano’s momentum, examining market dynamics, technological innovations, adoption metrics, and risk-reward profiles. Whether you’re a seasoned crypto investor or just beginning your journey into digital assets, understanding these market opportunities could prove crucial for portfolio optimization in the current bull cycle.

Cardano’s Current Market Position

Cardano has established itself as a third-generation blockchain platform, distinguished by its scientific philosophy and research-driven approach to development. Founded by Ethereum co-founder Charles Hoskinson, the network has successfully implemented proof-of-stake consensus through its Ouroboros protocol, positioning itself as an environmentally sustainable alternative to energy-intensive blockchain networks.

The ADA token has experienced significant price appreciation since its inception, with market capitalization regularly placing it among the top ten cryptocurrencies globally. Cardano’s development roadmap includes ambitious phases named after notable historical figures—Byron, Shelley, Goguen, Basho, and Voltaire—each bringing crucial functionality to the ecosystem. The network has successfully deployed smart contract capabilities, enabling decentralized applications and DeFi protocols to flourish on its platform.

Recent momentum for Cardano stems from increasing network activity, strategic partnerships with governments and enterprises, and continuous protocol upgrades enhancing scalability and functionality. ADA Momentum vs $0.035 Crypto: The blockchain’s transaction throughput has improved substantially, and the ecosystem has witnessed growing adoption from developers building innovative applications. Additionally, Cardano’s commitment to financial inclusion through initiatives in developing nations has strengthened its brand recognition and community support.

However, despite these positive developments, Cardano’s market capitalization constrains its potential for dramatic percentage gains. ADA Momentum vs $0.035 Crypto: For ADA to double in price, ADA Momentum vs $0.035 Crypto: billions of dollars in new capital must flow into the asset. ADA Momentum vs $0.035 Crypto: This mathematical reality doesn’t diminish Cardano’s long-term viability but does highlight why investors seeking maximum returns are exploring smaller-cap alternatives with greater percentage growth potential.

The $0.035 Cryptocurrency Opportunity

While specific identification of the cryptocurrency would require current market data, the characteristics defining compelling sub-dollar investment opportunities remain consistent across market cycles. Cryptocurrencies trading at $0.035 price points typically represent early-stage projects, recently launched tokens, or undervalued assets that haven’t yet captured mainstream attention.

The mathematical advantage of low-priced cryptocurrencies is straightforward. A token priced at $0.035 requires significantly less capital inflow to achieve substantial percentage gains compared to established assets. A movement from $0.035 to $0.07 represents a 100% gain, whereas Cardano would need to move from its current price level to double, requiring exponentially more capital due to its larger market capitalization. This fundamental difference explains why penny cryptocurrencies attract speculative capital during bull markets.

Successful low-priced cryptocurrencies share several characteristics that distinguish them from purely speculative ventures. These include solving genuine problems within the blockchain ecosystem, demonstrating technological innovation, securing strategic partnerships, and building engaged communities. Projects with strong fundamentals trading at low prices often represent undervalued opportunities where market sentiment hasn’t yet caught up with technological progress.

The risk-reward profile for such investments differs significantly from established cryptocurrencies. While volatility increases substantially, the potential for life-changing returns attracts investors willing to accept higher risk. Historical precedent shows numerous examples of cryptocurrencies that traded for pennies before experiencing thousand-percent gains during favorable market conditions. Understanding which projects possess legitimate potential versus purely speculative appeal requires thorough due diligence and market analysis.

Technological Advantages and Innovation Factors

The cryptocurrency sector rewards innovation, and projects introducing novel technological solutions often capture disproportionate market attention. While Cardano excels in academic rigor and methodical development, emerging projects frequently leverage newer technological architectures that weren’t available during Cardano’s initial development phase.

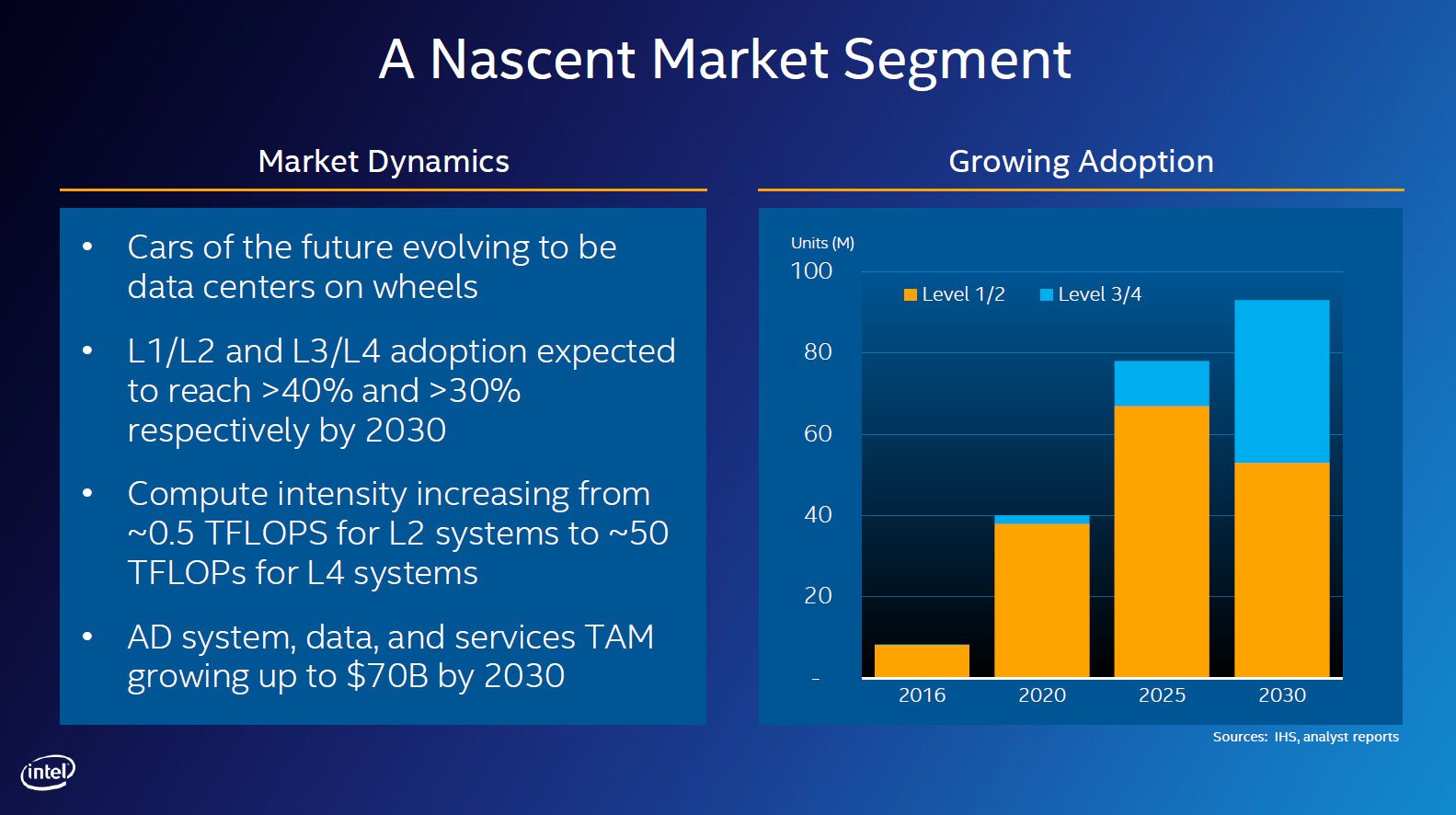

Layer-2 scaling solutions, cross-chain interoperability protocols, and novel consensus mechanisms represent areas where newer projects can demonstrate advantages over established blockchains. Some low-priced cryptocurrencies focus on specific use cases like decentralized identity, supply chain verification, or gaming economies, targeting niches where specialized optimization provides competitive advantages.

The modular blockchain thesis has gained significant traction, with projects separating execution, settlement, and data availability layers to optimize performance. Cryptocurrencies implementing these architectural innovations often trade at low prices initially, as markets take time to recognize their technical superiority. Early identification of such projects can provide substantial returns as adoption accelerates and market awareness increases.

Furthermore, the integration of artificial intelligence with blockchain technology represents an emerging frontier where innovative projects are establishing first-mover advantages. Cryptocurrencies facilitating AI model training, decentralized compute networks, or AI-enhanced DeFi protocols are capturing investor imagination. Many such projects remain priced accessibly, representing potential opportunities for investors seeking exposure to converging technological trends.

Market Dynamics and Growth Catalysts

Understanding market dynamics driving cryptocurrency valuations is essential for identifying opportunities. While Cardano benefits from established exchange listings, institutional recognition, and regulatory clarity in certain jurisdictions, smaller cryptocurrencies often experience explosive growth when similar milestones are achieved from lower baseline valuations.

Exchange listing announcements frequently trigger significant price appreciation for low-cap cryptocurrencies, as increased liquidity and accessibility attract new investors. ADA Momentum vs $0.035 Crypto: Major exchange listings can deliver 50-200% returns within days, particularly for projects with strong fundamentals previously constrained by limited trading venues. This catalyst remains less impactful for established cryptocurrencies like Cardano, which already enjoy universal exchange availability.

Partnership announcements with established companies, blockchain networks, or governmental organizations serve as powerful catalysts for smaller cryptocurrencies. ADA Momentum vs $0.035 Crypto: Such developments validate the project’s technological approach and expand its potential user base. The proportional impact on market capitalization is substantially greater for low-cap assets, creating opportunities for astute investors monitoring such announcements.

The broader cryptocurrency market cycle also influences relative performance between established and emerging assets. During bull markets, capital typically flows from Bitcoin to large-cap altcoins like Cardano, then subsequently into mid-cap and small-cap cryptocurrencies. ADA Momentum vs $0.035 Crypto: Understanding this rotation pattern helps investors position portfolios to capture momentum as market cycles progress through various phases.

Investment Risk Assessment and Portfolio Strategy

Investing in low-priced cryptocurrencies requires careful risk management and realistic expectations. While potential returns exceed those available from established assets, ADA Momentum vs $0.035 Crypto: the probability of total loss also increases substantially. ADA Momentum vs $0.035 Crypto: Projects can fail due to technological shortcomings, team issues, regulatory challenges, or simple market disinterest.

Portfolio allocation strategies for cryptocurrency investing typically recommend limiting exposure to highly speculative assets. Financial advisors often suggest allocating no more than 5-10% of a cryptocurrency portfolio to high-risk, high-reward opportunities. This approach allows investors to capture potential exponential gains while protecting the majority of capital through allocation to established cryptocurrencies and traditional assets.

Due diligence processes for evaluating low-priced cryptocurrencies should examine multiple factors, including team credentials, technological feasibility, tokenomics structure, competitive landscape, and community engagement. Projects with transparent development activity, regular communication, and demonstrable progress toward roadmap milestones present lower risk profiles than those lacking these characteristics.

Diversification within the small-cap segment provides additional risk mitigation. Rather than concentrating capital in a single $0.035 cryptocurrency, spreading investments across multiple promising projects increases the probability that at least one delivers exceptional returns. This strategy acknowledges the high failure rate in early-stage cryptocurrency projects while positioning portfolios to capture breakthrough successes.

Comparing Long-Term Value Propositions: ADA Momentum vs $0.035 Crypto

The debate between investing in established cryptocurrencies like Cardano versus emerging alternatives ultimately depends on individual investment objectives, risk tolerance, and time horizons. Cardano offers relative stability, established technology, growing ecosystem adoption, and reduced risk of complete failure. These characteristics appeal to investors prioritizing capital preservation with moderate growth potential.

Conversely, low-priced cryptocurrencies offer asymmetric risk-reward profiles where limited capital investment could generate substantial returns if the project achieves its objectives. The potential for 10x, 50x, or even 100x returns exists, though the probability of such outcomes remains uncertain. This investment thesis attracts those willing to accept higher risk for potentially transformative returns.

Long-term cryptocurrency investors often maintain hybrid portfolio strategies, allocating core positions to established assets while dedicating speculative capital to emerging opportunities. This balanced approach provides stability through blue-chip cryptocurrency holdings while maintaining exposure to potential breakout performers in the low-cap segment.

The cryptocurrency market’s maturation continues advancing, with institutional infrastructure, regulatory frameworks, and mainstream adoption increasing steadily. Both established cryptocurrencies and emerging projects will benefit from these tailwinds, though market dynamics will continue favoring different segments during various cycle phases. Successful investors remain flexible, adjusting allocations based on prevailing market conditions and emerging opportunities.

Conclusion

While Cardano (ADA) has demonstrated impressive momentum through technological development, ecosystem growth, and increasing adoption, the mathematical constraints of its market capitalization limit potential percentage gains compared to smaller alternatives. ADA Momentum vs $0.035 Crypto: The cryptocurrency trading at $0.035 represents the type of opportunity where early investment could potentially deliver exponential returns during favorable market conditions.

The decision between investing in established cryptocurrencies versus emerging alternatives should reflect individual financial circumstances, investment objectives, and risk tolerance. ADA Momentum vs $0.035 Crypto: Cardano offers proven technology, an established community, and relative stability, ADA Momentum vs $0.035 Crypto: making it appropriate for risk-averse investors seeking steady appreciation. ADA Momentum vs $0.035 Crypto: Meanwhile, low-priced cryptocurrencies provide speculative opportunities with potential for dramatic returns, suitable for investors comfortable with higher volatility and risk.

Successful cryptocurrency investing requires continuous education, disciplined risk management, and realistic expectations. The market will continue producing breakthrough projects alongside numerous failures, and distinguishing between these outcomes demands thorough research and analysis. Whether choosing Cardano, exploring $0.035 alternatives, ADA Momentum vs $0.035 Crypto, or maintaining diversified exposure across market cap segments, investors should align strategies with personal financial goals while remaining adaptable as the cryptocurrency landscape evolves.

FAQs

Q1: Is investing in cryptocurrencies priced under $0.10 riskier than established coins like Cardano?

Yes, low-priced cryptocurrencies generally carry substantially higher risk than established assets. Many penny cryptocurrencies lack proven technology, experienced teams, ADA Momentum vs $0.035 Crypto: or viable use cases. However, ADA Momentum vs $0.035 Crypto: this increased risk is balanced by the potential for exponential returns.

Q2: How can I identify legitimate low-priced cryptocurrencies versus scam projects?

Legitimate projects demonstrate several key characteristics, including transparent team credentials with verifiable backgrounds, open-source code repositories with active development, ADA Momentum vs $0.035 Crypto: clear roadmaps with achieved milestones, engaged communities on multiple platforms, and partnerships with established entities.

Q3: What percentage of my crypto portfolio should I allocate to speculative low-cap coins?

Financial advisors typically recommend limiting high-risk cryptocurrency investments to 5-10% of your total cryptocurrency portfolio, ADA Momentum vs $0.035 Crypto: which itself should represent only a portion of your overall investment portfolio. ADA Momentum vs $0.035 Crypto: This approach provides exposure to potential breakthrough returns while protecting the majority of capital through more stable investments.

Q4: Can Cardano still provide good returns despite its established market position?

Absolutely. Cardano remains capable of delivering solid returns through continued ecosystem development, increasing adoption, and favorable market conditions. ADA Momentum vs $0.035 Crypto: While percentage gains may not match those possible from smaller cryptocurrencies, Cardano’s reduced volatility and lower risk profile make it attractive for investors prioritizing capital preservation alongside growth.

Q5: How do I research and evaluate $0.035 cryptocurrencies before investing?

Begin by reviewing the project’s whitepaper to understand its technological approach and value proposition. Examine team credentials through LinkedIn and previous project involvement. Assess development activity through GitHub repositories and roadmap progress. ADA Momentum vs $0.035 Crypto: Analyze tokenomics, including supply distribution, vesting schedules, and utility mechanisms. Evaluate community engagement across social media platforms and forums. Review partnerships and exchange listings.