How $100K Weekly Bitcoin Inflows Are Preparing BTC for Bull Run

Weekly Bitcoin Inflows Are Preparing: Due to significant inflows into spot Bitcoin exchange-traded funds (ETFs) recently, the price of Bitcoin rose beyond $65,000 earlier this week. We have also witnessed massive purchases made by institutional players and Bitcoin whales during the correction that occurred at the beginning of July.

$100K Weekly Bitcoin Inflows

Ki Young Ju, the CEO of CryptoQuant, has said there has been a dramatic shift in the dynamics of Bitcoin trading. He stated that the over-the-counter (OTC) markets have surpassed the centralized exchange markets.

According to Ju, the whale holdings, which include custodial wallets and spot Bitcoin exchange-traded funds (ETFs), have collected a huge 1.45 million BTC so far this year. This brings the total holdings to more than 1.8 million BTC, including more than 1,000 BTC.

During the bull run in 2021, Ju stated that 70,000 Bitcoins were brought in during the year. The weekly inflows of $100,000 going on so far in 2024 could be the catalyst for the next bull run.

Further clarification is provided by Ju, who adds that this is not an internal shuffle from the custodial wallets that are currently in place. “The balance of old whale wallets, which have been in existence for more than 155 days, has not decreased, whereas the balance of new whale wallets, which have been in existence for less than 155 days,” Ju added.

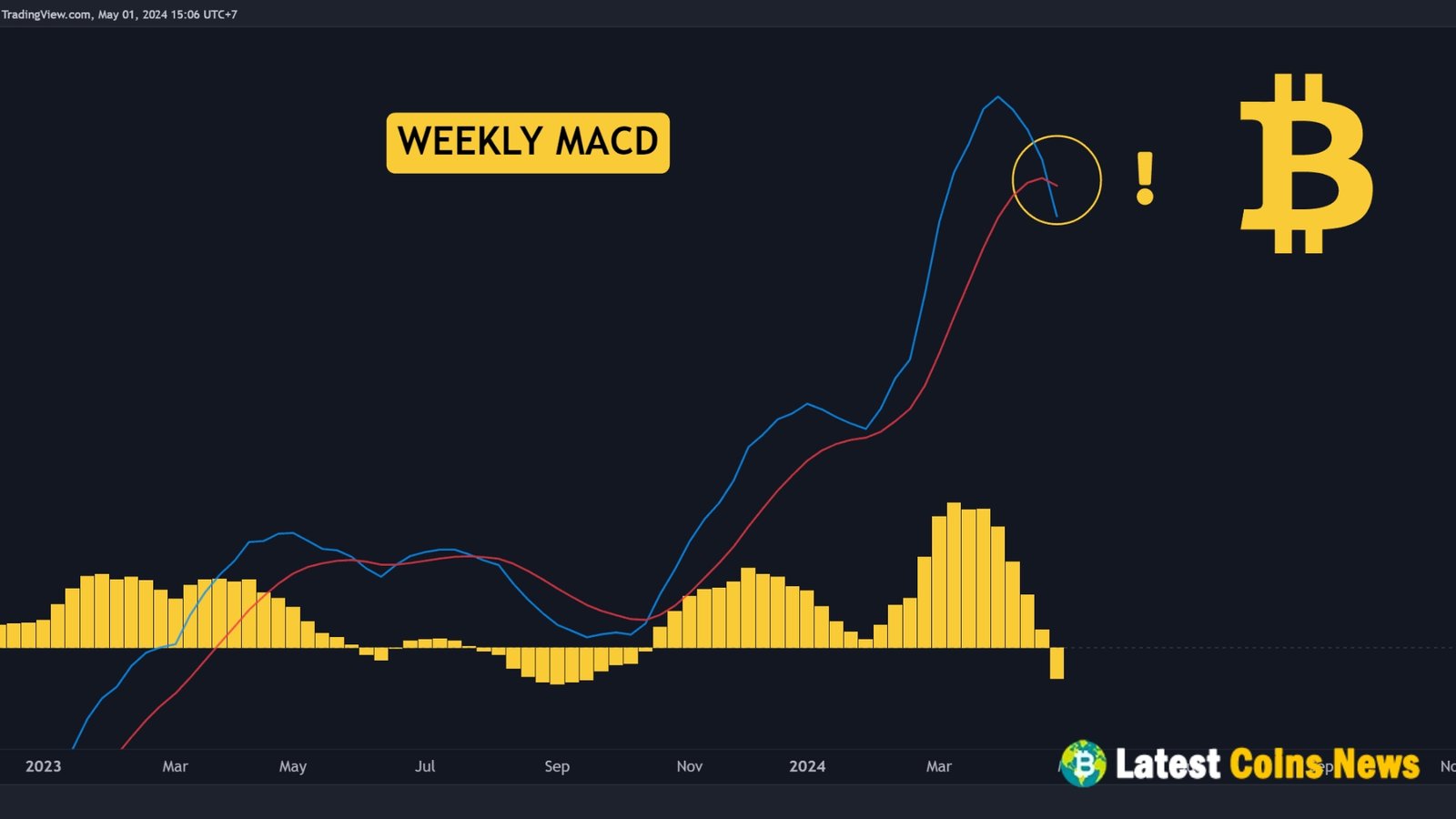

BTC Price Action Going Ahead

Since dropping below $53,500 two weeks ago, the price of Bitcoin has seen robust improvements, increasing by over 20%. However, Bitcoin is experiencing a slight correction following its relentless run-up above $65,500 this week. With a market valuation of $1.274 trillion, the price of Bitcoin is now trading at $64,581, down 1.5% around the time of press.

According to well-known cryptocurrency analyst Peter Brandt, the Bitcoin chart will likely keep showing lower and lower highs. “Although I am positively surprised by the recent upswing in Bitcoin Price Surge, it is important to acknowledge that declining prices persist regardless of the halving, the ETf, or the hype,” he stated. Moreover, the recent fluctuation in the price of Bitcoin is also attributable to the Mt. Gox redistribution.

According to On-chain College, Bitcoin is still putting on a show, and the recent plunge below the BTC Momentum signal was an attempt to rouse doubters, reset the market attitude, and prepare for the imminent rally.

Preparing for a Bull Run

These regular inflows are likely to be the driving force behind a potential bull run in Bitcoin, which is currently taking place. Those characteristics outlined before have the potential to fuel a bull run, which is defined by prolonged and considerable price increases. Based on the current environment, Bitcoin is currently being prepared for such a transition in the following manner.

Stronger Market Foundation

Consistent inflows are establishing a more solid market foundation for Bitcoin. Because more capital is consistently coming into the cryptocurrency, the price of Bitcoin is less likely to see unexpected declines brought on by huge sell-offs. This more robust foundation makes the beginning of a bull run possible, giving Bitcoin a more sturdy platform.

Increased Institutional Participation

There is a high probability that institutional participation will continue to increase. As many financial institutions see Bitcoin’s potential, capital inflows will continue and may even expand. As these institutions allocate more capital to Bitcoin. This will further drive up the price of Bitcoin and contribute to the momentum for a bull run.

Growing Retail Interest

There has been a rise in retail investors exhibiting interest in Bitcoin. Retail investors are entering the market in greater numbers due to the proliferation of easy-to-use trading platforms. The growing knowledge of cryptocurrencies among the general public. Due to the combination of this growing retail interest and institutional inflows, a significant force has been created. That has the potential to drive the price of Bitcoin higher.

Summary

The $100,000 weekly inflows into Bitcoin Price Surge are a solid sign of increasing investor confidence and market maturity. Institutional acceptance, clear regulations, and good macroeconomic conditions attract these inflows, which could lead to a bull run. Although there are still obstacles, Bitcoin’s current climate is quite conducive to future growth. These inflows may herald the start of a substantial price increase for Bitcoin. So, market watchers and investors should be on the lookout.

Also Read: BTC Almost $60K After $545M US Bitcoin ETF Outflow?