Ethereum’s Next Rally Why ETH Will Dominate Crypto’s Future

Ethereum trails Bitcoin by 42% but is poised to lead the next crypto cycle. ETH Will Dominate Crypto's Future...

The cryptocurrency market has witnessed an extraordinary transformation over the past year, with Bitcoin continuing its relentless march toward new all-time highs. However, one observation has left many investors puzzled: Ethereum, the world’s second-largest cryptocurrency by market capitalization, has been lagging approximately 42% behind Bitcoin’s impressive rally. While some market participants interpret this as a sign of weakness, seasoned analysts and blockchain enthusiasts recognize this divergence as a potential setup for Ethereum’s most significant breakout yet.

The current market dynamics present a fascinating paradox. Bitcoin’s dominance has reached levels not seen in years, capturing institutional attention and mainstream headlines. Meanwhile, Ethereum’s price action has been comparatively subdued, trading in a range that has tested the patience of long-term holders. Yet beneath the surface of these price movements lies a compelling narrative—one that suggests Ethereum is not falling behind but rather positioning itself to become the dominant force in the next crypto market cycle. This article explores the fundamental, technical, ETH Will Dominate Crypto’s Future: and ecosystem developments that support this thesis and explains why discerning investors are viewing Ethereum’s current underperformance as a generational accumulation opportunity.

The Bitcoin-Ethereum Performance Gap: Understanding the Divergence

The relationship between Bitcoin and Ethereum has always been complex, with each digital asset serving distinct purposes within the broader cryptocurrency ecosystem. Over recent months, Bitcoin has captured the lion’s share of capital inflows, driven primarily by institutional adoption, the approval of spot Bitcoin ETFs, and its established narrative as “digital gold.” This institutional preference has created a performance gap that currently stands at approximately 42%, marking one of the most significant divergences in the history of these two leading cryptocurrencies.

Several factors explain this temporary divergence. Bitcoin’s simpler value proposition as a store of value and inflation hedge resonates more easily with traditional finance institutions making their first foray into digital assets. The regulatory clarity surrounding Bitcoin, particularly in the United States, has made it the preferred entry point for conservative institutional capital. Additionally, Bitcoin’s fixed supply of 21 million coins and its halving mechanism create a straightforward scarcity narrative that appeals to investors familiar with commodities like gold.

Ethereum, by contrast, operates in a more complex technological landscape. As a smart contract platform that powers decentralized applications, DeFi protocols, and NFT marketplaces, Ethereum’s value proposition requires a deeper understanding of blockchain technology and its potential applications. This complexity has historically meant that Ethereum rallies tend to lag Bitcoin’s initial surges, only to outperform dramatically once market participants fully grasp the platform’s utility and network effects. This pattern has repeated itself across multiple bull market cycles, and current indicators suggest we may be witnessing the early stages of this phenomenon once again.

Ethereum’s Technological Evolution: The Foundation for Future Dominance

The most compelling reason for Ethereum’s inevitable dominance in the next market cycle lies in its unprecedented technological transformation. The successful transition to proof-of-stake through the Merge in September 2022 represented one of the most significant technological achievements in blockchain history. This upgrade didn’t just change Ethereum’s consensus mechanism; it fundamentally altered the economic structure of the network in ways that create powerful tailwinds for long-term price appreciation.

Following the Merge, Ethereum’s energy consumption decreased by over 99%, effectively neutralizing one of the primary criticisms leveled against blockchain technology by environmentally conscious investors and institutions. This transformation has opened doors to ESG-focused investment mandates that previously excluded cryptocurrencies due to environmental concerns. Major institutional investors who couldn’t justify Bitcoin exposure due to its energy-intensive proof-of-work mining can now consider Ethereum investments without compromising their sustainability commitments.

Beyond environmental benefits, the proof-of-stake mechanism introduced deflationary tokenomics that create a structural supply shock. The combination of transaction fee burning (implemented through EIP-1559) and reduced issuance through staking has resulted in periods where Ethereum’s supply actually contracts. This “ultrasound money” narrative presents a compelling economic case that rivals and potentially surpasses Bitcoin’s fixed supply model. When network activity increases during bull markets, Ethereum’s supply decreases, creating a reflexive dynamic that could propel prices far beyond previous cycles’ peaks.

The DeFi and Institutional Infrastructure Advantage

Ethereum’s dominance in decentralized finance represents another critical advantage that Bitcoin simply cannot replicate. The DeFi ecosystem, which enables financial services without traditional intermediaries, has grown into a multi-hundred-billion-dollar industry—and Ethereum remains its undisputed foundation. Despite competition from alternative Layer-1 blockchains, Ethereum continues to host the majority of DeFi’s total value locked, demonstrating the stickiness of its developer ecosystem and the trust users place in its security and decentralization.

The maturation of DeFi infrastructure has caught the attention of traditional financial institutions, many of which are now actively exploring how to integrate blockchain-based financial services into their operations. Major banks, asset managers, and payment processors are building on Ethereum or Ethereum-compatible networks, recognizing the platform’s first-mover advantage and robust security guarantees. This institutional infrastructure development creates network effects that compound over time—each new application built on Ethereum increases the platform’s utility, which attracts more users and developers, which in turn attracts more institutional involvement.

Furthermore, the anticipated approval of spot Ethereum ETFs represents a watershed moment that could unlock hundreds of billions in institutional capital. While Bitcoin ETFs have already launched successfully, Ethereum ETFs would offer investors exposure to a fundamentally different asset class—one with utility beyond store of value. The staking yield available through Ethereum’s proof-of-stake mechanism provides an additional return stream that Bitcoin cannot offer, making Ethereum ETFs potentially more attractive to yield-focused institutional investors. When these products gain regulatory approval, the resulting capital inflows could rapidly close the current performance gap with Bitcoin.

Layer-2 Scaling Solutions: Expanding Ethereum’s Reach

One of the most overlooked drivers of Ethereum’s future dominance is the explosive growth of Layer-2 scaling solutions. Networks like Arbitrum, Optimism, Base, and Polygon are processing millions of transactions daily at a fraction of the cost of Ethereum’s mainnet. These Layer-2 solutions maintain Ethereum’s security guarantees while dramatically increasing throughput and reducing costs, effectively solving the blockchain trilemma that has constrained previous generations of blockchain technology.

The brilliance of Ethereum’s Layer-2 strategy lies in its preservation of the base layer’s decentralization and security while enabling experimentation and scaling at higher layers. This modular approach allows Ethereum to serve as the settlement layer for countless applications and networks, similar to how the internet’s TCP/IP protocol serves as the foundation for countless higher-layer applications. As more activity migrates to Layer-2 solutions, the demand for Ethereum as a settlement and data availability layer increases, driving long-term value accrual to the base asset.

Recent data shows that Layer-2 networks are attracting significant developer attention and user adoption, with transaction volumes on some L2s exceeding Ethereum mainnet activity. This growth doesn’t cannibalize Ethereum’s value; instead, it enhances the entire ecosystem’s value proposition by making Ethereum-based applications accessible to mainstream users who cannot afford mainnet gas fees. As these Layer-2 networks continue to proliferate and mature, they create a powerful network effect that solidifies Ethereum’s position as the settlement layer for Web3, positioning ETH as the fundamental unit of account across a vast economic ecosystem.

Real-World Asset Tokenization: The Trillion-Dollar Opportunity

Perhaps the most significant catalyst for Ethereum’s next major rally is the accelerating trend toward real-world asset tokenization. Financial giants including BlackRock, Franklin Templeton, and JPMorgan are actively tokenizing traditional assets—from Treasury bonds to real estate—primarily on Ethereum and Ethereum-compatible networks. This represents a potential market measured in trillions of dollars, dwarfing the current cryptocurrency market capitalization by orders of magnitude.

Larry Fink, CEO of BlackRock, has publicly stated that tokenization represents the “next generation for markets,” emphasizing that blockchain technology will fundamentally transform how securities are issued, traded, and settled. BlackRock’s BUIDL fund, a tokenized money market fund launched on Ethereum, demonstrates that the world’s largest asset manager is betting on Ethereum infrastructure for institutional-grade financial products. When trillions of dollars in traditional assets migrate onto blockchain rails, the networks that capture this flow will see unprecedented value creation—and Ethereum is currently best positioned to capture the majority of this opportunity.

The tokenization narrative extends beyond financial assets to include intellectual property, carbon credits, supply chain tracking, and identity verification. ETH Will Dominate Crypto’s Future: Each of these use cases requires the security, decentralization, and programmability that Ethereum provides. As enterprises and governments increasingly recognize blockchain’s potential for transforming existing systems, Ethereum’s smart contract capabilities position it as the infrastructure layer for this transformation. This enterprise adoption could drive sustained demand for ETH that persists across market cycles, fundamentally changing the asset’s value proposition from speculative to utilitarian.

Network Activity and Developer Momentum: ETH Will Dominate Crypto’s Future

While price performance may lag temporarily, on-chain metrics paint a picture of an ecosystem experiencing robust growth. Ethereum network activity continues to reach new milestones, with active addresses, daily transactions, and smart contract interactions all trending upward over longer timeframes. The number of developers building on ETH Will Dominate Crypto’s Future: Ethereum remains higher than any competing blockchain, demonstrating that the platform continues to attract top technical talent who see long-term potential in the ecosystem.

Developer activity serves as a leading indicator of future network value. The applications being built today will drive user adoption and transaction volume in the coming months and years, creating the fundamental demand that ultimately drives price appreciation. Ethereum’s developer ecosystem benefits from years of accumulated knowledge, extensive documentation, ETH Will Dominate Crypto’s Future: mature development tools, and a large community of experts. This creates significant barriers to entry for competing platforms and ensures that Ethereum will remain at the forefront of blockchain innovation.

The diversity of applications being built on Ethereum—from gaming and social networks to prediction markets and decentralized autonomous organizations—demonstrates the platform’s versatility. ETH Will Dominate Crypto’s Future: Unlike Bitcoin, which primarily serves a single use case, Ethereum’s programmability enables it to capture value from countless applications across multiple sectors. ETH Will Dominate Crypto’s Future: As blockchain technology transitions from niche adoption to mainstream integration, platforms with the broadest utility will capture disproportionate value, positioning Ethereum for exponential growth that could dramatically outpace Bitcoin’s more limited scope.

Historical Patterns and Market Cycle Dynamics

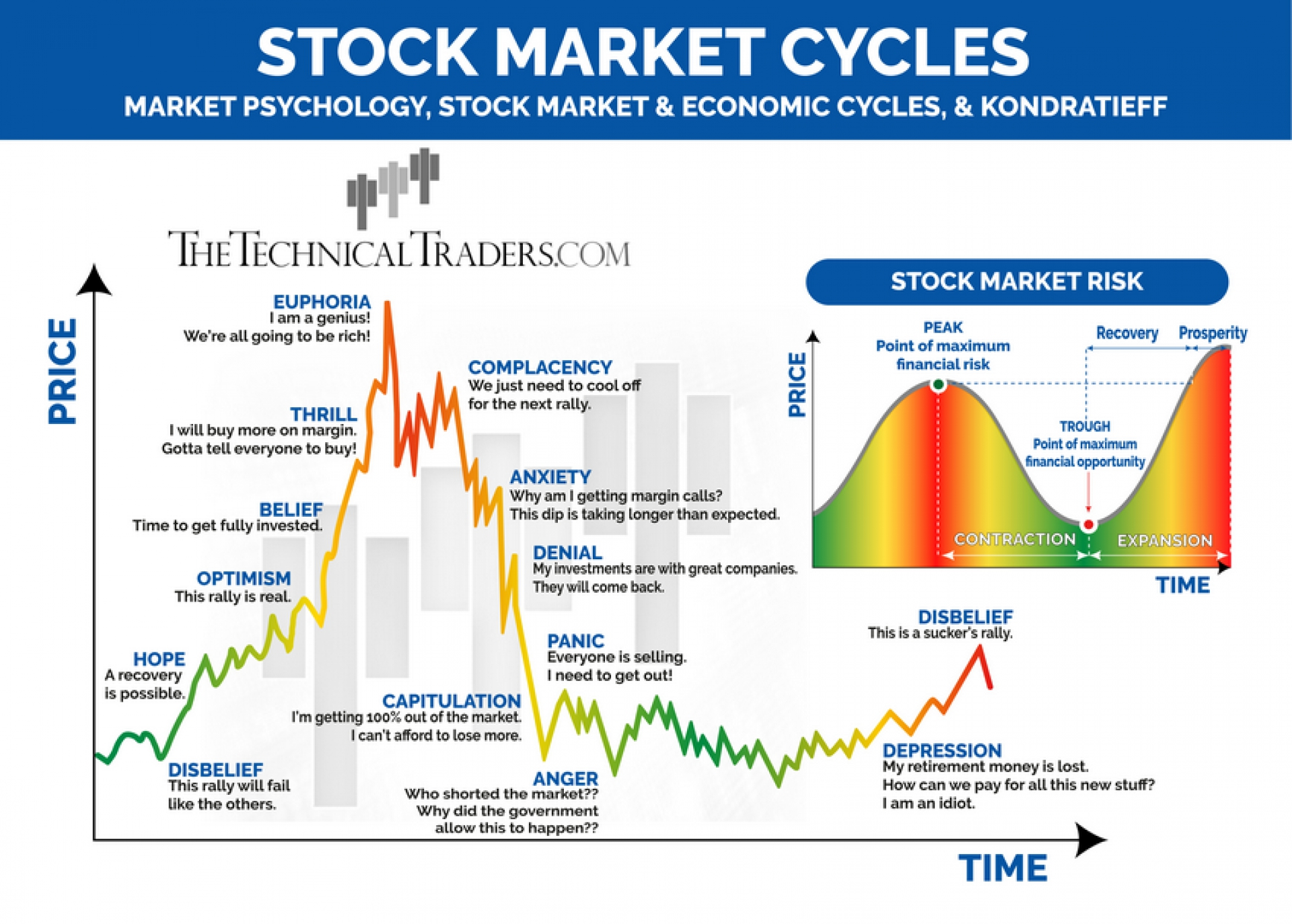

Cryptocurrency market history provides instructive precedents for understanding current price dynamics. In previous bull markets, Bitcoin typically leads initial rallies as institutional and retail capital enters the space through the most recognized cryptocurrency. Once Bitcoin approaches significant resistance levels or shows signs of exhaustion, capital rotation into alternative cryptocurrencies—led by Ethereum—has historically produced even more dramatic returns for altcoin investors.

This pattern played out spectacularly during the 2017 bull market, when Ethereum surged from approximately $8 in January to over $1,400 by January 2018—a gain exceeding 17,000%. Similar dynamics occurred during the 2020-2021 cycle, when Ethereum initially lagged Bitcoin’s rally before exploding from under $200 to nearly $4,900. In both cases, patient investors who recognized Ethereum’s fundamental strengths during periods of relative underperformance were rewarded with life-changing returns. Current market structure suggests we may be in the early stages of another such rotation.

The crypto market cycle typically follows a recognizable sequence: Bitcoin rallies first, attracting attention and capital to the broader cryptocurrency space. Once Bitcoin’s momentum slows, investors seek higher returns in large-cap altcoins with strong fundamentals—primarily Ethereum. Finally, capital flows into smaller altcoins before the cycle peaks and corrects. Understanding this pattern helps explain why Ethereum’s current underperformance relative to Bitcoin isn’t concerning but rather expected and potentially bullish for those positioning ahead of the next phase. The 42% lag isn’t a weakness; it’s an opportunity for strategic accumulation before the rotation begins.

The Institutional Adoption Inflection Point

We are approaching an inflection point in institutional cryptocurrency adoption that will disproportionately benefit Ethereum. While Bitcoin has achieved recognition as digital gold and a macro hedge, ETH Will Dominate Crypto’s Future: institutions increasingly recognize they need exposure to blockchain technology’s utility layer—not just its store of value layer. This recognition is driving institutional interest in Ethereum investments at an accelerating pace.

Major financial institutions are integrating Ethereum into their operations in ways that create long-term structural demand. JPMorgan operates its ETH Will Dominate Crypto’s Future: Onyx blockchain using Ethereum technology for institutional payments and settlements. Microsoft, Google, and Amazon offer Ethereum-based blockchain services through their cloud platforms. Even central banks exploring digital currencies frequently reference Ethereum’s technology in their research and pilot programs. ETH Will Dominate Crypto’s Future: This institutional infrastructure development creates gravitational force that attracts more participants, deepening network effects with each passing quarter.

The regulatory environment, while still evolving, is also trending favorably for Ethereum. ETH Will Dominate Crypto’s Future: The successful launch of Bitcoin ETFs has established precedent for cryptocurrency investment products, paving the way for Ethereum ETF approval. Regulatory clarity, when it arrives, will unlock capital from investors who have remained on the sidelines due to compliance concerns. Given Ethereum’s evolution toward proof-of-stake and its role in enabling compliant tokenized assets, it’s increasingly viewed as infrastructure rather than a speculative asset—a distinction that matters enormously to institutional risk committees evaluating cryptocurrency exposure.

Conclusion

Despite currently lagging 42% behind Bitcoin’s impressive rally, Ethereum stands poised to dominate the next cryptocurrency market cycle through a combination of technological superiority, ecosystem dominance, and accelerating real-world adoption. ETH Will Dominate Crypto’s Future: The platform’s successful transition to proof-of-stake, its deflationary tokenomics, and its position as the foundation for DeFi, NFTs, and real-world asset tokenization create multiple powerful tailwinds that Bitcoin cannot replicate. ETH Will Dominate Crypto’s Future: Layer-2 scaling solutions are expanding Ethereum’s reach while maintaining security, ETH Will Dominate Crypto’s Future: and institutional adoption is accelerating as major financial players recognize blockchain’s transformative potential.

Historical market patterns suggest that Ethereum’s current underperformance represents not weakness but opportunity—a chance for informed investors to position themselves ahead of the capital rotation that has characterized previous cycles. ETH Will Dominate Crypto’s Future: The convergence of technological maturity, regulatory clarity, institutional infrastructure, and unprecedented real-world use cases creates a setup for Ethereum that may be unparalleled in its history. ETH Will Dominate Crypto’s Future: While past performance doesn’t guarantee future results, the fundamental case for Ethereum’s dominance in the next market cycle has never been stronger.

For investors seeking exposure to the future of blockchain technology beyond digital gold, Ethereum offers a compelling value proposition that combines utility, ETH Will Dominate Crypto’s Future: scarcity, and network effects. ETH Will Dominate Crypto’s Future: The current performance gap with Bitcoin may soon be remembered not as a sign of weakness but as the calm before Ethereum’s most significant rally yet.

FAQs

Q: Why is Ethereum lagging behind Bitcoin if it has stronger fundamentals?

Ethereum’s current underperformance relative to Bitcoin is actually a normal pattern in cryptocurrency market cycles. ETH Will Dominate Crypto’s Future: Bitcoin typically attracts capital first due to its simpler value proposition and established reputation as digital gold. ETH Will Dominate Crypto’s Future: Institutional investors often enter the crypto market through Bitcoin before exploring other assets.

Q: How does Ethereum’s proof-of-stake system give it an advantage over Bitcoin?

Ethereum’s proof-of-stake mechanism provides several crucial advantages that position it favorably for the next market cycle. First, ETH Will Dominate Crypto’s Future: it reduced the network’s energy consumption by over 99%, making it attractive to ESG-focused institutional investors who couldn’t consider proof-of-work cryptocurrencies. ETH Will Dominate Crypto’s Future: Second, staking creates a yield-bearing component that Bitcoin lacks, making Ethereum more attractive to income-focused investors.

Q: What role will Layer-2 solutions play in Ethereum’s next rally?

Layer-2 scaling solutions are critical to Ethereum’s ability to support mainstream adoption without sacrificing decentralization or security. ETH Will Dominate Crypto’s Future: These networks process millions of transactions at minimal cost while settling to Ethereum’s base layer, ETH Will Dominate Crypto’s Future: effectively solving the scalability challenges that previously limited blockchain adoption.

Q: When might we see Ethereum outperform Bitcoin in this market cycle?

While precise timing is impossible to predict, several catalysts could trigger Ethereum’s outperformance. ETH Will Dominate Crypto’s Future: The approval and launch of spot Ethereum ETFs would likely spark significant capital inflows, similar to what Bitcoin experienced. ETH Will Dominate Crypto’s Future: Major enterprise announcements regarding tokenization projects could highlight Ethereum’s real-world utility.

Q: Is Ethereum a better long-term investment than Bitcoin?

The answer depends on individual investment goals and risk tolerance, as both assets serve different purposes within a portfolio. Bitcoin offers the simplest narrative as digital gold and a store of value, ETH Will Dominate Crypto’s Future: with regulatory clarity and institutional acceptance. ETH Will Dominate Crypto’s Future: Ethereum provides exposure to blockchain utility through its smart contract capabilities, DeFi ecosystem, and role in real-world asset tokenization.