Chainlink Price Eyes $15 Retest Before 200% Rally to $46

Chainlink (LINK) has recently captured significant attention from technical analysts and market observers. According to recent analysis from prominent cryptocurrency experts, the digital asset could experience a temporary pullback to the $15 support level before embarking on an impressive 200% rally that would propel prices toward the ambitious $46 target. This projection has sparked considerable discussion within the crypto community, prompting both seasoned traders and newcomers to reassess their positions in this decentralized oracle network token.

Chainlink has established itself as a fundamental infrastructure component within the blockchain ecosystem, providing critical data feeds and connectivity solutions that enable smart contracts to interact with real-world information. As the cryptocurrency landscape matures and decentralized finance applications continue to expand their reach, the utility and demand for reliable oracle services have positioned LINK as a potential beneficiary of broader market adoption. Chainlink Price Eyes $15: Understanding the technical patterns, market dynamics, and fundamental catalysts driving this bullish forecast requires a comprehensive examination of multiple factors influencing Chainlink’s price trajectory in the current market environment.

Chainlink’s Current Market Position

Chainlink’s position within the cryptocurrency hierarchy extends far beyond simple price speculation. The protocol serves as the backbone for countless decentralized applications, providing secure and tamper-proof inputs and outputs for complex smart contracts across multiple blockchain networks. This fundamental utility has helped LINK maintain relevance even during prolonged bear markets, distinguishing it from purely speculative digital assets that lack tangible use cases.

Recent market data indicates that Chainlink has been consolidating within a specific price range, establishing both support and resistance levels that technical analysts consider crucial for forecasting future movements. The current trading pattern suggests that LINK price action has been forming a base structure that could serve as a launching pad for more significant upward momentum. Market participants have observed increasing accumulation at lower price levels, indicating that long-term holders and institutional investors view current valuations as attractive entry points.

The broader cryptocurrency market sentiment has also played a substantial role in shaping Chainlink’s immediate price outlook. As Bitcoin and Ethereum navigate their own technical patterns and fundamental developments, altcoins like LINK typically follow correlated movements while occasionally demonstrating independent strength based on protocol-specific news and adoption metrics. The interplay between macroeconomic factors, regulatory developments, and technological advancements creates a complex environment where technical analysis must be balanced with fundamental research to generate comprehensive market forecasts.

Technical Analysis Behind the $15 Retest Prediction

The projection of a $15 retest before a substantial rally stems from classical technical analysis patterns that experienced traders recognize across various financial markets. Analysts have identified key support zones that have historically attracted buying pressure, with the $15 level representing a significant psychological and technical threshold. This support area corresponds with previous consolidation ranges and represents a potential accumulation zone where smart money might increase positions before the anticipated upward movement.

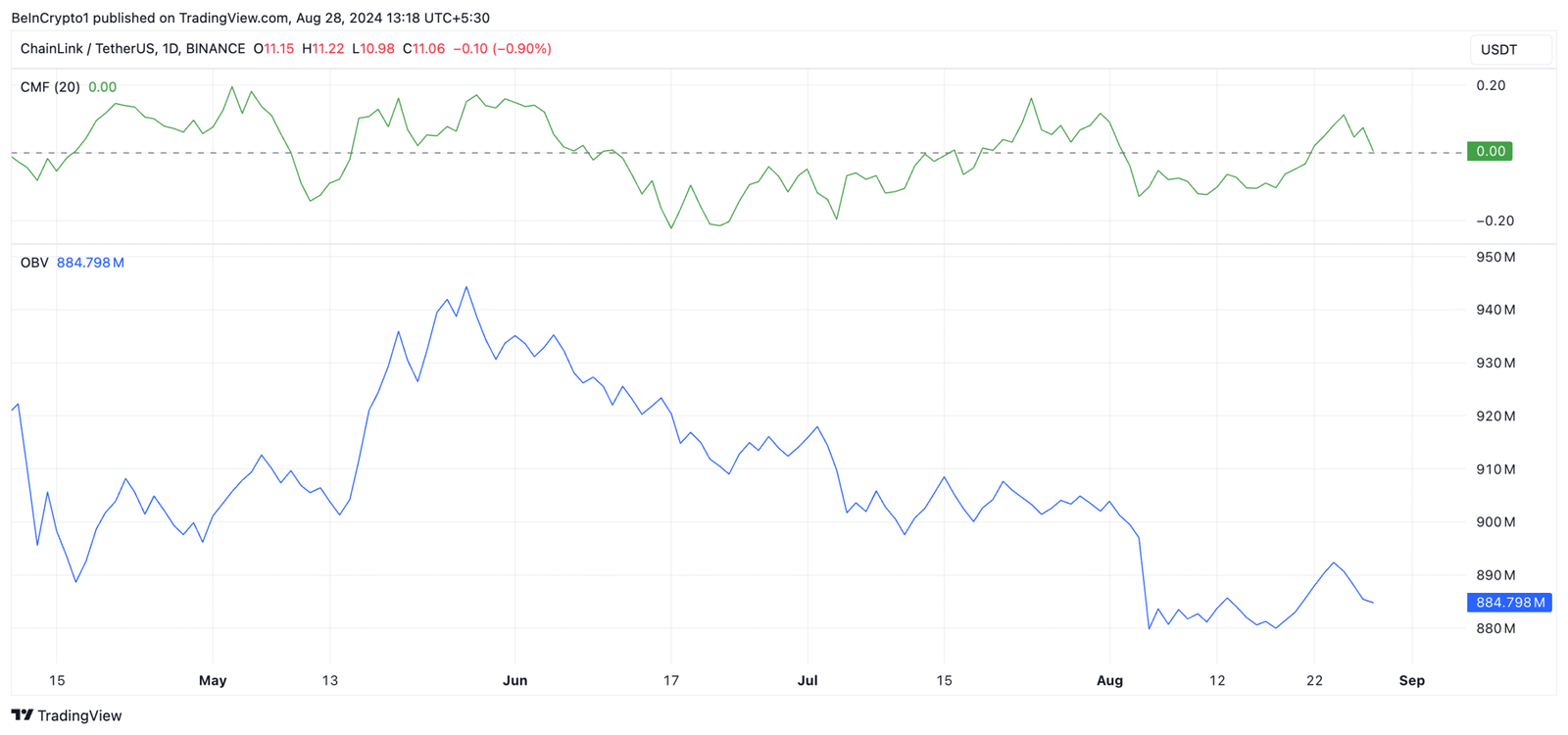

Chart patterns currently forming on Chainlink’s price graphs suggest the possibility of a healthy correction that would allow the asset to establish stronger foundations before attempting higher price targets. Technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracement levels all point toward the likelihood of this retest scenario. These tools help analysts identify overbought or oversold conditions, potential reversal points, and key areas where price action might encounter support or resistance.

The concept of retesting support before rallying aligns with traditional market behavior observed across decades of financial trading. Chainlink Price Eyes $15: When assets experience significant price appreciation, they often undergo consolidation periods or minor corrections that shake out weak hands while allowing stronger participants to accumulate positions at more favorable prices. Chainlink Price Eyes $15: This process creates healthier market structures that can sustain prolonged uptrends without the excessive volatility that characterizes purely speculative bubbles.

Volume analysis further supports the retest hypothesis, as declining volume during recent price action suggests reduced conviction at current levels. Chainlink Price Eyes $15: A return to the $15 support zone accompanied by increased buying volume would represent a classic accumulation pattern that frequently precedes major rallies. Technical traders watch these volume signatures carefully, Chainlink Price Eyes $15: as they provide insights into market participant behavior that price action alone cannot reveal.

The Case for a 200% Rally Toward $46: Chainlink Price Eyes $15

The ambitious 200% rally projection toward $46 represents more than mere optimistic speculation—it’s grounded in multiple technical and fundamental factors that analysts believe could converge to drive substantial appreciation. Historical price cycles for Chainlink have demonstrated the asset’s capacity for explosive moves following extended consolidation periods, and the current market structure bears resemblance to previous setups that preceded significant rallies.

Fundamental developments within the Chainlink ecosystem provide substantial backing for bullish price forecasts. The protocol has continued expanding its services, introducing new products like Chainlink Staking, Cross-Chain Interoperability Protocol (CCIP), and enhanced data feed solutions that increase utility and value accrual mechanisms. As more blockchain projects integrate Chainlink’s oracle services, the network effects strengthen, potentially driving increased demand for LINK tokens required to power these services.

The broader cryptocurrency adoption trends also factor prominently into the $46 price target calculation. As institutional interest in blockchain technology intensifies and regulatory frameworks become clearer, infrastructure projects like Chainlink stand to benefit disproportionately. Chainlink Price Eyes $15: Major financial institutions and enterprises exploring blockchain integration require reliable data connectivity solutions, positioning Chainlink as a critical service provider in the emerging digital economy.

Market cycle analysis suggests that altcoins typically experience their most substantial gains during the latter stages of bull markets, when Bitcoin and Ethereum have already established new highs and capital rotation begins favoring projects with strong fundamentals and clear utility. Chainlink Price Eyes $15: If cryptocurrency markets enter such a phase, Chainlink Price Eyes $15: Chainlink’s established position and proven technology could attract significant investment flows, Chainlink Price Eyes $15: potentially validating the aggressive price targets discussed by analysts.

Key Factors Influencing Chainlink’s Price Trajectory

Multiple variables beyond technical chart patterns will ultimately determine whether Chainlink achieves these projected price levels. The macroeconomic environment continues exerting considerable influence on risk assets, including cryptocurrencies. Interest rate policies, inflation dynamics, and global economic growth trajectories all impact investor appetite for speculative investments and can either accelerate or dampen cryptocurrency rallies.

Regulatory developments represent another critical factor that could significantly affect Chainlink’s price performance. As governments worldwide establish frameworks for digital asset oversight, clarity around the legal status of utility tokens like LINK could unlock institutional capital currently sidelined due to compliance concerns. Conversely, restrictive regulations could temporarily suppress prices, though Chainlink’s decentralized nature and clear utility might insulate it from the harshest regulatory actions typically targeted at securities-like tokens.

Competition within the oracle space also warrants consideration when evaluating long-term price potential. While Chainlink maintains market dominance, emerging competitors offering alternative solutions could impact market share and pricing power. However, the network effects and first-mover advantages that Chainlink has accumulated create substantial barriers to entry that protect its market position. The protocol’s commitment to continuous innovation and improvement helps maintain technological leadership within the oracle sector.

Partnership announcements and integration milestones serve as catalysts that can trigger immediate price reactions while building long-term value. When major blockchain projects or traditional enterprises announce Chainlink integrations, it validates the technology while expanding the ecosystem’s reach. These developments often generate positive sentiment that translates into increased buying pressure as investors recognize the growing utility and adoption of the protocol.

Market Sentiment and Investor Psychology

Understanding the psychological dimensions of cryptocurrency trading proves essential when evaluating price predictions like the $15 retest and subsequent rally scenario. Market sentiment oscillates between fear and greed, creating cyclical patterns that influence price movements independently of fundamental value. During periods of uncertainty, even fundamentally strong projects like Chainlink can experience temporary price weakness as investors seek safety or react to broader market trends.

The concept of a retest before a rally actually serves to strengthen market psychology by removing excessive leverage and speculative positions that could jeopardize sustained upward movements. When prices decline to test support levels, overleveraged traders face liquidations, and weak hands exit positions, leaving behind a more committed holder base capable of maintaining prices through volatility. This cleansing process, while temporarily painful for short-term traders, creates healthier conditions for subsequent appreciation.

Social media sentiment and community engagement metrics also provide valuable insights into potential price movements. Chainlink has maintained one of the most active and dedicated communities within the cryptocurrency space, with supporters consistently highlighting technological achievements and adoption milestones. This grassroots support creates organic marketing effects and can help stabilize prices during market downturns while amplifying gains during bullish periods.

The psychology surrounding specific price targets like $46 also influences market behavior. Round numbers and previous all-time highs create psychological barriers that attract profit-taking and resistance, while also serving as magnets that price action often gravitates toward. Analysts who identify these psychological levels incorporate them into technical forecasts, recognizing that human behavior patterns remain remarkably consistent across market cycles.

Risk Considerations and Alternative Scenarios

While the bullish scenario outlined by analysts presents an exciting opportunity for Chainlink investors, prudent market participants must also consider alternative outcomes and risk factors that could prevent the projected rally from materializing. Cryptocurrency markets remain inherently volatile and subject to rapid sentiment shifts that can invalidate even well-researched technical analysis.

The possibility exists that the $15 support level could fail to hold during a retest, potentially triggering deeper corrections that would delay or prevent the anticipated rally toward $46. If broader cryptocurrency markets enter prolonged bear market conditions, even fundamentally strong projects like Chainlink would likely experience sustained price weakness. Technical analysis provides probabilities rather than certainties, and traders should always implement appropriate risk management strategies regardless of their market outlook.

External black swan events—unforeseen circumstances such as major exchange hacks, regulatory crackdowns, or macroeconomic crises—could dramatically alter cryptocurrency market dynamics. These unpredictable occurrences can override technical patterns and fundamental analysis, creating scenarios that no amount of research could anticipate. Diversification and position sizing remain critical tools for managing these inherent uncertainties.

Chainlink Price Eyes $15. The timeline for achieving projected price targets also introduces uncertainty. Even if the ultimate destination of $46 proves accurate, Chainlink Price Eyes $15: the journey could take considerably longer than anticipated, testing the patience of investors and potentially exposing them to opportunity costs. Market timing remains one of the most challenging aspects of trading, Chainlink Price Eyes $15: and the difference between early positioning and premature entry can significantly impact returns.

Strategic Approaches for Potential Investors

For individuals considering positions in Chainlink based on this analytical forecast, several strategic approaches merit consideration. Dollar-cost averaging—systematically purchasing fixed amounts at regular intervals regardless of price—can help mitigate timing risks while building positions over time. Chainlink Price Eyes $15: This approach proves particularly valuable when anticipating both a retest and a subsequent rally, as it ensures participation in the eventual upward movement while averaging down if prices decline to support levels.

Another approach involves setting limit orders at the identified $15 support zone, attempting to capture advantageous entry prices during the anticipated retest. This strategy requires patience and conviction, as the retest may not occur or could briefly dip below target levels before recovering. Traders employing this method should establish clear exit parameters for both profit-taking and stop losses to protect capital if market conditions change unexpectedly.

More conservative investors might wait for confirmation of the bullish scenario before establishing positions, accepting potentially reduced upside in exchange for greater certainty. Waiting for prices to establish above key resistance levels and demonstrate sustained momentum reduces the risk of catching falling knives but also means missing the most profitable early stages of rallies. Chainlink Price Eyes $15: This trade-off between risk and reward represents a fundamental decision each investor must make based on their personal risk tolerance and investment objectives.

Regardless of chosen strategy, maintaining awareness of broader cryptocurrency market trends and Chainlink-specific developments remains essential for adjusting positions as circumstances evolve. Markets rarely move in straight lines, and flexibility in response to new information separates successful long-term investors from those who stubbornly maintain positions despite changing fundamentals or technical pictures.

Conclusion

The projection that Chainlink price could retest $15 support before embarking on a 200% rally toward $46 represents a compelling thesis supported by technical analysis, fundamental developments, and historical market patterns. While this scenario captures the imagination of investors seeking substantial returns, it’s essential to approach such forecasts with balanced perspective, recognizing both the opportunities and risks inherent in cryptocurrency markets.

Chainlink’s position as critical infrastructure within the blockchain ecosystem provides fundamental support for bullish long-term outlooks, while technical patterns suggest the possibility of near-term consolidation before more significant upward movements. The convergence of improving fundamentals, favorable market cycles, and established technical patterns creates conditions where substantial appreciation becomes plausible, though never guaranteed.

Investors interested in participating in Chainlink’s potential upside should conduct thorough research, implement appropriate risk management strategies, and maintain realistic expectations about market volatility and uncertainty. The cryptocurrency landscape continues evolving rapidly, and those who combine technical analysis with fundamental research while managing emotions and position sizes position themselves advantageously for whatever market conditions emerge. Whether the specific $15 retest and $46 target materialize exactly as predicted, Chainlink’s ongoing development and adoption suggest the protocol will remain relevant within the digital asset ecosystem for years to come.

FAQs

Q: What makes the $15 level significant for Chainlink’s price?

The $15 price level represents a crucial technical support zone for Chainlink based on historical price action and accumulation patterns. This level has previously served as both resistance and support during various market cycles, making it a psychologically important threshold for traders and investors.

Q: How realistic is a 200% price increase for Chainlink?

A 200% price increase, while ambitious, falls within the realm of possibility for Chainlink based on historical performance and market cycle analysis. Chainlink Price Eyes $15: During previous bull markets, Chainlink Price Eyes $15: LINK has demonstrated capacity for explosive moves exceeding this percentage when favorable conditions aligned.

Q: What fundamental factors support Chainlink’s bullish outlook?

Chainlink’s bullish fundamental outlook stems from its essential role as blockchain infrastructure providing oracle services to countless decentralized applications. Chainlink Price Eyes $15: The protocol has continuously expanded its product offerings, including staking mechanisms, cross-chain interoperability solutions, and enhanced data feeds that increase utility and potential value accrual.

Q: Should investors wait for the $15 retest before buying Chainlink?

The decision to wait for a $15 retest depends entirely on individual risk tolerance, investment timeline, and conviction in the analytical forecast. Chainlink Price Eyes $15: Waiting for the retest offers potential for more favorable entry prices but risks missing the rally entirely if the support level holds above $15 or if prices begin appreciating without the anticipated pullback.

Q: What could prevent Chainlink from reaching the $46 price target?

Several factors could prevent Chainlink from achieving the projected $46 target, including prolonged cryptocurrency bear market conditions that suppress prices across the entire sector regardless of individual project fundamentals. Chainlink Price Eyes $15: Negative regulatory developments, Chainlink Price Eyes $15: competition from alternative oracle solutions, technological setbacks, Chainlink Price Eyes $15: or broader macroeconomic challenges could all undermine the bullish scenario.