Top Crypto Coins Q4: BTC Price Shakes, ETH Revolution & BZIL Surge

Top crypto coins in Q4 have become crucial for both seasoned traders and newcomers seeking profitable investment opportunities. The current landscape presents a fascinating trilogy of developments: Bitcoin’s price volatility creates both uncertainty and opportunity, Ethereum’s creative revolution reshaping the DeFi ecosystem, and the BZIL presale surge captures investor attention worldwide.

Understanding which cryptocurrencies to prioritize during this critical quarter requires careful analysis of market trends, technological innovations, and emerging opportunities. The top crypto coins Q4 selection process involves evaluating multiple factors, including price performance, utility developments, community growth, and long-term potential. As traditional financial markets show signs of instability, cryptocurrency markets have demonstrated both resilience and volatility, making strategic investment decisions more critical than ever.

This comprehensive analysis will explore the three dominant narratives shaping Q4’s cryptocurrency landscape, providing insights into why Bitcoin, Ethereum, and BZIL represent the most compelling investment opportunities available to today’s crypto investors.

Bitcoin’s Price Volatility: Navigating Q4 Market Turbulence

Bitcoin’s Current Market Position

Bitcoin’s performance in Q4 2025 has been characterized by significant price fluctuations that have both concerned and excited the cryptocurrency community. The world’s largest digital asset by market capitalization has experienced dramatic swings, with prices oscillating between critical support and resistance levels. These movements have reinforced Bitcoin’s position among the top crypto coins Q4 selections, despite – or perhaps because of – its inherent volatility.

The recent price shocks are driven by multiple factors, including institutional adoption patterns, regulatory developments across major economies, and macroeconomic pressures that affect global financial markets. Major corporations continue to add Bitcoin to their treasury reserves, while governments worldwide grapple with comprehensive cryptocurrency regulation frameworks. This institutional interest, combined with retail investor enthusiasm, has created a perfect storm of market activity.

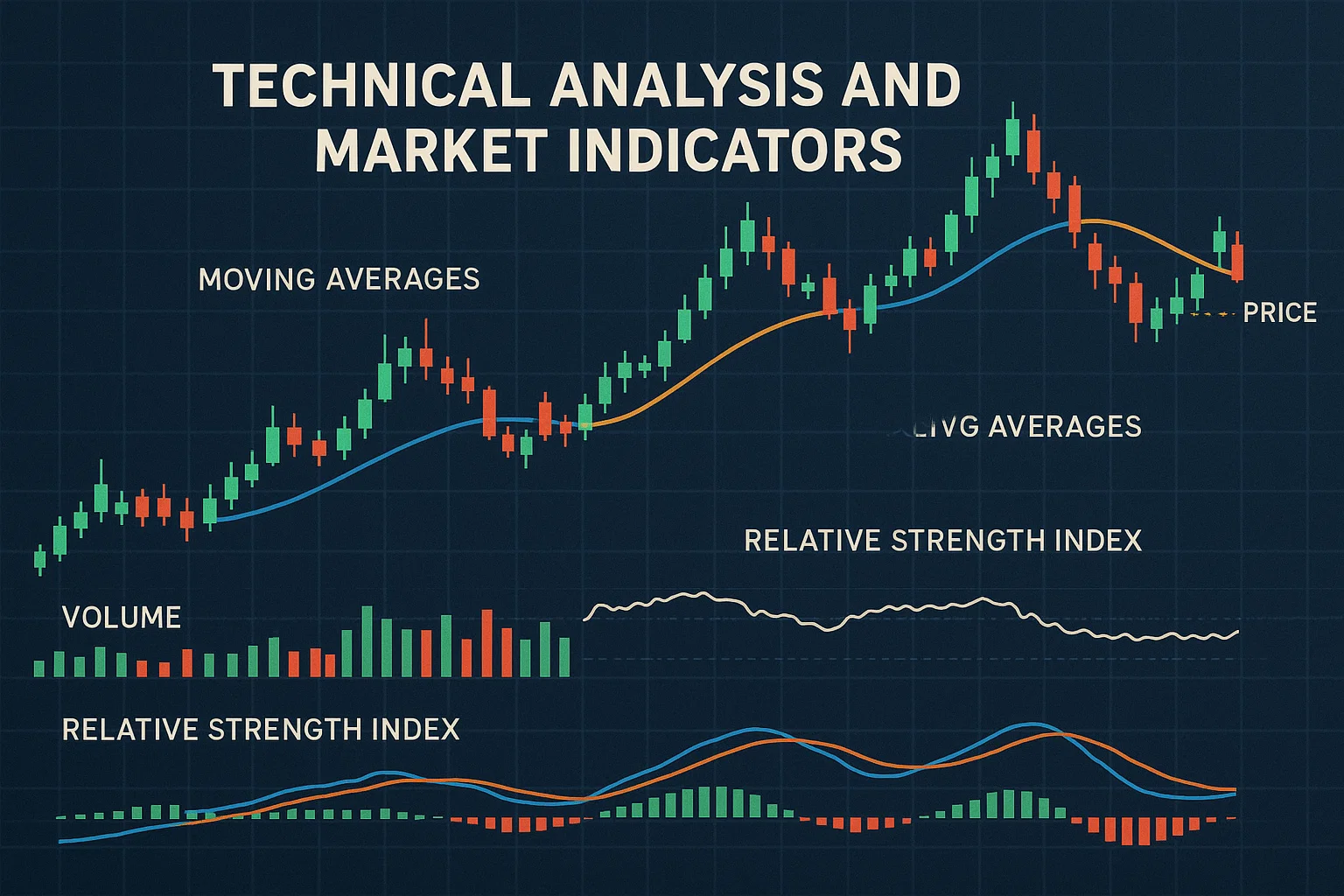

Technical Analysis and Price Predictions

From a technical perspective, Bitcoin’s price action during Q4 has followed several key patterns that experienced traders have learned to recognize. The cryptocurrency has repeatedly tested primary support levels, demonstrating remarkable resilience in the face of broader market uncertainty. Chart patterns indicate that Bitcoin is in a consolidation phase, building momentum for potentially significant price movements in the coming weeks.

Professional analysts have identified several crucial price levels that could determine Bitcoin’s trajectory through the remainder of Q4. Breaking above resistance could signal a return to bullish momentum, while failure to maintain support levels might indicate further consolidation or correction phases. These technical considerations make Bitcoin a compelling choice among cryptocurrency investment opportunities for those willing to navigate short-term volatility.

Institutional Adoption and Market Impact

The institutional narrative surrounding Bitcoin continues to evolve, with major financial institutions increasing their exposure to the cryptocurrency. Investment banks, hedge funds, and corporate treasuries have collectively allocated billions of dollars to Bitcoin positions, viewing the asset as both a hedge against inflation and a growth opportunity. This institutional involvement has added legitimacy to Bitcoin’s investment thesis while also contributing to increased price volatility.

Recent developments include the launch of additional Bitcoin exchange-traded funds (ETFs), expanded custody services from traditional financial institutions, and integration of Bitcoin payment systems by major retailers. These developments reinforce Bitcoin’s position as one of the top crypto coins Q4 investors should consider, particularly those seeking exposure to digital assets through traditional investment channels.

Ethereum’s Creative Revolution: Transforming Digital Finance

Smart Contract Innovation and DeFi Evolution

Ethereum’s role in the Q4 cryptocurrency landscape extends far beyond simple price appreciation, encompassing a comprehensive transformation of how digital finance operates. The platform’s innovative contract capabilities have enabled the creation of sophisticated financial instruments, automated trading systems, and innovative lending protocols, revolutionizing traditional banking concepts. This creative revolution positions Ethereum prominently among the top crypto coins Q4 selections for forward-thinking investors.

The decentralized finance (DeFi) ecosystem built on Ethereum has reached unprecedented levels of sophistication, with total value locked (TVL) across various protocols reaching new milestones. Yield farming opportunities, liquidity mining programs, and innovative staking mechanisms have created multiple revenue streams for Ethereum holders. These developments demonstrate why Ethereum remains a cornerstone of any comprehensive cryptocurrency investment strategy.

NFT Market Expansion and Creative Economy

Ethereum’s blockchain has become the foundation for an expanding non-fungible token (NFT) market that has redefined digital ownership and creativity. Artists, musicians, writers, and content creators have discovered new monetization methods through NFT sales, royalty structures, and community-driven platforms. This creative economy has generated substantial transaction volume on the Ethereum network, directly benefiting ETH holders through network fees and increased demand.

The NFT revolution extends beyond simple digital art collections, encompassing utility tokens, gaming assets, virtual real estate, and membership certificates. Major brands have launched NFT collections, while innovative platforms continue to develop new use cases for blockchain-based digital ownership. This expansion reinforces Ethereum’s position among digital assets with long-term growth potential.

Layer 2 Solutions and Scalability Improvements

Ethereum’s scalability challenges have been addressed through innovative Layer 2 solutions that maintain the security of the leading blockchain while dramatically reducing transaction costs and increasing throughput. Optimistic rollups, zero-knowledge proofs, and sidechains have created a more accessible Ethereum ecosystem that supports high-frequency trading, gaming applications, and micropayment systems.

These technological improvements have made Ethereum-based applications more competitive with traditional financial services, attracting developers and users who previously avoided the platform due to high gas fees. The result has been increased adoption across all sectors of the Ethereum ecosystem, supporting the cryptocurrency’s inclusion among the top crypto coins in Q4 recommendations.

BZIL Presale Phenomenon: Capturing Early Investment Opportunities

BZIL Project and Vision

The BZIL presale has emerged as one of the most talked-about crypto presale opportunities in Q4 2025, attracting investors seeking early-stage exposure to innovative blockchain projects. BZIL’s unique approach to integrating decentralized computing and artificial intelligence has captured the attention of both retail and institutional investors seeking the next breakthrough in cryptocurrency technology.

The project’s whitepaper outlines ambitious plans for creating a decentralized network that combines machine learning capabilities with blockchain infrastructure, potentially revolutionizing the development and deployment of artificial intelligence applications. This innovative approach has positioned BZIL among the top crypto coins Q4 selections for investors willing to participate in early-stage blockchain development.

Presale Structure and Investment Mechanics

BZIL’s presale has been structured to provide maximum value for early participants while ensuring fair distribution across different investor categories. The token allocation includes specific portions for community development, team incentives, and ecosystem growth, creating a sustainable foundation for long-term project success. Presale participants receive tokens at discounted rates compared to anticipated public market prices, along with additional benefits including staking rewards and governance rights.

The presale process includes multiple rounds with progressively increasing token prices, encouraging early participation while building momentum throughout the fundraising period. This structure has proven effective in generating sustained interest and investment flow, contributing to BZIL’s reputation as one of the most promising cryptocurrency investment opportunities available in the fourth quarter.

Technology Innovation and Market Potential

BZIL’s technological foundation represents a significant advancement in blockchain infrastructure, particularly in areas where artificial intelligence and decentralized computing intersect. The project’s development team includes veterans from major technology companies and blockchain projects, bringing together expertise in machine learning, distributed systems, and cryptocurrency economics.

Market analysis suggests that BZIL’s target sectors – AI-powered applications, decentralized computing, and blockchain infrastructure – represent some of the fastest-growing areas in the technology sector. The convergence of these trends creates substantial potential for BZIL token appreciation and ecosystem growth, supporting its inclusion among the top crypto coins Q4 recommendations for sophisticated investors.

Comparative Analysis: Investment Strategies for Q4

Risk Assessment and Portfolio Allocation

Investing in the top crypto coins Q4 requires careful consideration of risk tolerance, investment timeline, and portfolio diversification goals. Bitcoin represents the most established option with lower technological risk but continued price volatility. Ethereum offers exposure to innovative financial applications with moderate technological risk and strong developer community support. BZIL offers early-stage investment opportunities with higher potential returns, but also increased project execution risk.

Professional investors often recommend allocating cryptocurrency investments across multiple assets to balance risk and return potential. A typical Q4 allocation might include a substantial Bitcoin position for stability and exposure to mainstream adoption, significant Ethereum holdings for DeFi and smart contract growth, and a smaller BZIL position for early-stage upside potential.

Market Timing and Entry Strategies

Successfully investing in cryptocurrency markets requires understanding market cycles, sentiment indicators, and technical analysis principles. Q4 timing considerations include seasonal trading patterns, institutional rebalancing activities, and regulatory announcement schedules that could impact prices across all digital assets.

Dollar-cost averaging represents an effective strategy for entering cryptocurrency positions, particularly during volatile market conditions. This approach involves making regular purchases over time, rather than attempting to time market bottoms, thereby reducing the impact of short-term price fluctuations while building substantial positions in high-quality projects.

Regulatory Landscape and Future Outlook

Global Regulatory Developments

The regulatory environment surrounding cryptocurrency investment continues to evolve rapidly, with major jurisdictions implementing comprehensive frameworks for digital asset oversight. These developments generally favor established cryptocurrencies, such as Bitcoin and Ethereum, while creating additional compliance requirements for newer projects and initial coin offerings (ICOs).

Regulatory clarity has historically supported cryptocurrency adoption and price appreciation, making current development a positive factor for top crypto coins Q4 selections. Investors should monitor regulatory announcements from major financial centers, including the United States, the European Union, and Asian markets, for potential market impact.

Institutional Infrastructure Growth

The financial infrastructure supporting cryptocurrency investment has expanded dramatically throughout 2025, with major banks offering custody services, traditional brokerages adding crypto trading capabilities, and institutional-grade platforms providing sophisticated portfolio management tools. This infrastructure development supports long-term growth for established cryptocurrencies while creating pathways for newer projects to access institutional capital.

The maturation of cryptocurrency markets, driven by improved infrastructure, regulatory clarity, and institutional participation, creates a solid foundation for sustained growth across the sector. This development particularly benefits the top crypto coins selected for Q4, which combine technological innovation with strong community support and professional development teams.

Technical Analysis and Market Indicators

On-Chain Metrics and Network Health

Analyzing blockchain technology networks requires examining on-chain metrics that provide insights into user adoption, developer activity, and network security. Bitcoin’s network hash rate remains at historic highs, indicating strong miner confidence and network security. Transaction volume and active address counts provide additional confirmation of continued user engagement and adoption.

Ethereum’s network metrics show consistent growth in smart contract deployments, DeFi protocol usage, and NFT marketplace activity. These indicators support Ethereum’s position among digital assets, with strong fundamental backing that extends beyond simple price speculation. Layer 2 adoption metrics further demonstrate the platform’s evolution toward greater scalability and accessibility.

Market Sentiment and Social Indicators

Cryptocurrency markets are significantly influenced by social sentiment, community engagement, and media coverage patterns. Social media analysis tools provide insights into public perception of different projects, while developer activity on platforms like GitHub offers quantitative measures of project momentum and technical progress.

BZIL’s presale success can be attributed in part to its strong community-building efforts, active social media engagement, and favorable coverage from cryptocurrency influencers and analysts. These social indicators often precede price movements and adoption trends, making them valuable components of comprehensive investment analysis.

Risk Management and Portfolio Protection

Diversification Strategies

Effective cryptocurrency investment requires diversification across multiple assets, sectors, and risk levels to protect against project-specific failures or market-wide corrections. The top crypto coins selected for Q4 provide natural diversification across different blockchain use cases, development stages, and market capitalizations.

Professional portfolio management techniques include position sizing based on conviction levels, regular rebalancing to maintain target allocations, and stop-loss strategies to limit downside risk. These approaches help investors capture upside potential while protecting against catastrophic losses that can occur in volatile cryptocurrency markets.

Long-term vs. Short-term Investment Approaches

Cryptocurrency investment strategies should align with individual financial goals, risk tolerance, and market outlook. Long-term investors may prioritize projects with strong technological foundations and development teams, while short-term traders might focus on technical analysis and market momentum indicators.

The top crypto coins Q4 selections offer opportunities for both investment approaches, with Bitcoin providing established store-of-value characteristics, Ethereum offering exposure to growing financial applications, and BZIL presenting early-stage growth potential for patient investors willing to accept higher risk levels.

Conclusion

The fourth quarter of 2025 presents unprecedented opportunities for cryptocurrency investors who are willing to navigate market volatility and identify high-quality projects with long-term potential. The top crypto coins Q4 selections – Bitcoin, Ethereum, and BZIL – represent different aspects of the evolving digital asset landscape, from established store-of-value propositions to cutting-edge technological innovations.

Bitcoin’s price volatility creates both challenges and opportunities for investors seeking exposure to the world’s most recognized cryptocurrency. Despite short-term fluctuations, Bitcoin’s institutional adoption trajectory and macroeconomic positioning support its continued relevance in diversified portfolios. Ethereum’s revolutionary approach to decentralized finance and digital ownership has established the platform as essential infrastructure for the next generation of financial applications.

Read more: Buy Pi Coin After Main-net Launch Complete Guide to Trading Pi Network Cryptocurrency