Cardano Is Not Dead: ADA Price Targets Signal Major Breakout

Cardano ADA price targets as the blockchain network continues to evolve and adapt. Despite bearish sentiment in recent months, leading crypto analysts are now confirming that Cardano is far from dead, with new ADA price targets suggesting a potential major breakout on the horizon. This comprehensive analysis explores the technical indicators, market dynamics, and expert predictions that point toward a bullish future for Cardano ADA price targets.

Recent market data reveals that Cardano ADA price targets are being revised upward by several prominent analysts, who cite improving fundamentals and technical chart patterns as key drivers. The blockchain’s continued development, strategic partnerships, and growing ecosystem utility are contributing factors that support these optimistic ADA price targets. As we delve deeper into this analysis, we’ll examine the evidence supporting Cardano’s resilience and the specific price levels that analysts are watching.

Technical Analysis Reveals Bullish Cardano ADA Price Targets

Key Support and Resistance Levels

The technical landscape for Cardano ADA price targets has shown significant improvement in recent weeks. Chart analysis reveals that ADA has established strong support levels around $0.32, with resistance breaking at $0.42. These levels are crucial for understanding the current ADA price targets that analysts are projecting.

Multiple technical indicators are aligning to support higher Cardano ADA price targets. The Relative Strength Index (RSI) has moved out of oversold territory, while the Moving Average Convergence Divergence (MACD) is showing signs of bullish crossover. These technical signals are contributing to analysts’ confidence in their revised ADA price targets.

Volume analysis also supports the case for higher Cardano ADA price targets. Trading volume has increased significantly during recent price movements, indicating genuine market interest rather than artificial pumps. This volume confirmation strengthens the validity of the current ADA price targets being discussed by market experts.

Chart Patterns Supporting Price Breakout

Several chart patterns are emerging that support bullish Cardano ADA price targets. A potential inverse head and shoulders pattern has formed on the daily chart, with the neckline serving as a critical level for ADA price targets. If this pattern completes successfully, it could propel Cardano toward the higher end of analyst projections.

The weekly chart shows a falling wedge pattern that has been forming over several months. This pattern typically signals a bullish reversal, which aligns with the optimistic Cardano ADA price targets being discussed by technical analysts. The breakout from this wedge could catalyze reaching these ambitious ADA price targets.

Additionally, Fibonacci retracement levels provide important reference points for Cardano ADA price targets. The 0.618 retracement level at approximately $0.55 represents a key target, while the 0.786 level at $0.72 serves as a more aggressive ADA price target for the current cycle.

Fundamental Analysis Supporting ADA Price Targets

Ecosystem Development and Growth

The fundamental case for higher Cardano ADA price targets extends beyond technical analysis. The blockchain’s ecosystem has continued expanding with new decentralized applications (dApps), NFT projects, and DeFi protocols. This growth provides underlying value that supports analyst ADA price targets and suggests sustainable price appreciation.

Cardano’s approach to peer-reviewed research and systematic development has resulted in a more robust blockchain infrastructure. This methodical approach, while sometimes criticized for being slow, is now paying dividends and supporting the case for higher Cardano ADA price targets. The network’s stability and security features make it attractive for enterprise adoption, which could drive ADA price targets higher.

The recent implementation of smart contract functionality through the Alonzo upgrade has opened new possibilities for Cardano’s ecosystem. As more developers build on the platform, the utility and demand for ADA tokens increase, providing fundamental support for optimistic Cardano ADA price targets.

Institutional Interest and Partnerships

Growing institutional interest in Cardano is another factor supporting bullish ADA price targets. Several major corporations and government entities have announced partnerships or pilot programs using Cardano’s blockchain technology. These developments provide real-world utility that justifies higher Cardano ADA price targets.

The blockchain’s focus on sustainability and energy efficiency has attracted environmentally conscious investors and institutions. This trend toward ESG (Environmental, Social, and Governance) investing could drive additional demand for ADA tokens, supporting analyst ADA price targets and potentially exceeding them.

Educational initiatives and blockchain adoption in developing countries, particularly in Africa, represent another growth vector for Cardano. These partnerships not only increase the blockchain’s utility but also provide a foundation for achieving aggressive Cardano ADA price targets in the long term.

Expert Predictions and ADA Price Targets

Short-term Cardano ADA Price Targets

Leading crypto analysts have established several Cardano ADA price targets for the near term. Conservative estimates suggest ADA price targets between $0.50 and $0.65 within the next three to six months, assuming current market conditions remain stable. These projections are based on technical analysis and recent price action patterns.

More optimistic analysts are setting Cardano ADA price targets as high as $0.85 to $1.20 for the short term, contingent on broader market recovery and positive sentiment toward altcoins. These aggressive ADA price targets assume significant catalysts, such as major partnership announcements or technological breakthroughs.

The consensus among technical analysts points to Cardano ADA price targets in the $0.60 to $0.75 range as most likely for the current market cycle. This range represents a reasonable balance between bullish technical indicators and realistic market expectations for ADA price targets.

Medium-term Market Outlook

Looking ahead six to twelve months, Cardano ADA price targets become more speculative but potentially more rewarding. Analysts who maintain bullish outlooks on the cryptocurrency market overall are projecting ADA price targets between $1.50 and $2.50 for this timeframe.

These medium-term Cardano ADA price targets assume continued ecosystem growth, increased adoption of Cardano’s blockchain for real-world applications, and a general recovery in cryptocurrency markets. The realization of these ADA price targets would represent significant returns from current levels.

However, achieving these ambitious Cardano ADA price targets will require the successful execution of the blockchain’s roadmap, including continued development of scaling solutions and enhanced smart contract capabilities. Market sentiment and broader economic conditions will also play crucial roles in reaching these ADA price targets.

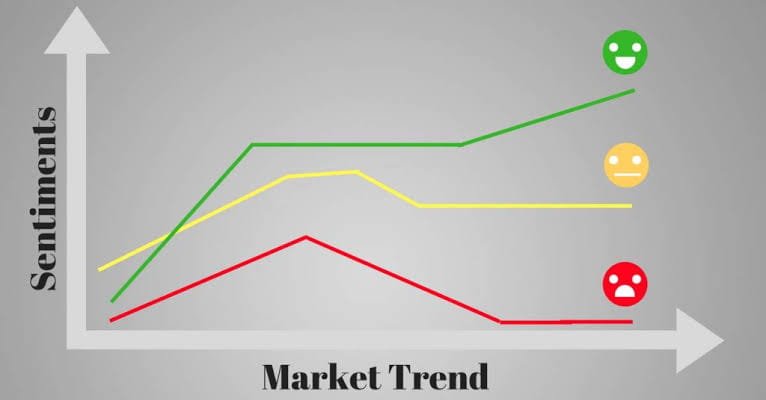

Market Sentiment and Social Indicators

Community Engagement and Development Activity

The Cardano community remains active and engaged, which provides positive momentum for ADA price targets. GitHub activity shows consistent development work, while social media engagement suggests sustained interest in the project. These social indicators often precede price movements that help achieve Cardano ADA price targets.

Developer activity on the Cardano blockchain has increased substantially, with more projects building on the platform. This increased development activity provides fundamental support for higher ADA price targets and suggests that the ecosystem is gaining traction among builders and entrepreneurs.

Community-driven initiatives, including educational programs and grassroots marketing efforts, are helping to maintain awareness of Cardano’s value proposition. This sustained community engagement creates a foundation for achieving the Cardano ADA price targets that analysts are projecting.

Whale Activity and On-chain Metrics

On-chain analysis reveals that large holders (whales) have been accumulating ADA tokens, which supports bullish Cardano ADA price targets. Whale accumulation often precedes significant price movements and suggests confidence in the project’s long-term prospects and ADA price targets.

Transaction volume and active addresses on the Cardano network have shown steady growth, indicating genuine usage rather than speculative trading. These on-chain metrics provide fundamental support for the Cardano ADA price targets being discussed by analysts and suggest sustainable demand for the token.

The distribution of ADA tokens has become more decentralized over time, with smaller holders increasing their stakes. This democratization of ownership can contribute to price stability and support the achievement of ADA price targets by reducing the impact of large sell-offs.

Risk Factors and Challenges

Market Volatility and External Factors

While the outlook for Cardano ADA price targets appears positive, several risk factors could impact their achievement. Cryptocurrency markets remain highly volatile, and external factors such as regulatory changes or macroeconomic events could affect ADA price targets significantly.

Competition from other blockchain platforms presents another challenge to reaching ambitious Cardano ADA price targets. Ethereum’s continued development, along with emerging competitors, could impact Cardano’s market share and influence the achievability of projected ADA price targets.

Regulatory uncertainty in major markets could also affect Cardano ADA price targets. While Cardano’s approach to compliance is generally positive, unexpected regulatory developments could create headwinds for achieving optimistic ADA price targets.

Technical and Development Risks

The achievement of Cardano ADA price targets depends partly on the continued successful development and deployment of planned upgrades. Any significant delays or technical issues could impact market confidence and the realization of projected ADA price targets.

Scalability remains a challenge for Cardano, as it does for most blockchain platforms. The ability to handle increased transaction volume efficiently will be crucial for supporting the fundamental value that justifies higher Cardano ADA price targets.

Security vulnerabilities, while rare given Cardano’s methodical approach, could still pose risks to achieving ADA price targets. The blockchain’s reputation for security and reliability is a key factor in maintaining investor confidence and supporting price objectives.

Investment Strategies and Considerations

Dollar-Cost Averaging Approach

For investors interested in Cardano ADA price targets, a dollar-cost averaging strategy may be appropriate. This approach involves regular purchases regardless of price, which can help smooth out volatility while positioning for potential achievement of ADA price targets.

The current market conditions may present opportunities for accumulating ADA tokens at relatively attractive prices compared to the Cardano ADA price targets being projected by analysts. However, investors should consider their risk tolerance and investment timeline when planning entry strategies.

Diversification remains important even when optimistic about specific ADA price targets. Cardano should be part of a broader cryptocurrency and investment portfolio rather than representing an outsized concentration of assets.

Risk Management Techniques

Setting stop-loss levels below key support zones can help protect against downside risk while maintaining exposure to potential upside toward Cardano ADA price targets. These risk management techniques are essential when investing based on analyst ADA price targets.

Taking partial profits as Cardano ADA price targets are achieved can help lock in gains while maintaining exposure to further upside potential. This staged approach to profit-taking aligns with the multiple ADA price targets that analysts have established.

Regular portfolio rebalancing ensures that Cardano exposure remains appropriate as prices move toward or away from targeted Cardano ADA price targets. This discipline helps maintain appropriate risk levels throughout the investment process.

Future Developments and Catalysts

Upcoming Network Upgrades

Several planned developments could serve as catalysts for achieving Cardano ADA price targets. The implementation of Hydra, Cardano’s scaling solution, could significantly improve transaction throughput and support higher valuations that align with optimistic ADA price targets.

Interoperability features that allow Cardano to connect with other blockchain networks could expand its utility and user base. These developments provide fundamental support for the Cardano ADA price targets that analysts are projecting.

The continued rollout of governance features through the Voltaire era will give ADA holders more direct influence over the network’s development. This increased utility and engagement could contribute to achieving ambitious ADA price targets.

Ecosystem Expansion Opportunities

The growing interest in NFTs and digital collectibles presents opportunities for Cardano’s ecosystem expansion. Success in this area could drive increased demand for ADA tokens and support the achievement of projected Cardano ADA price targets.

DeFi protocol development on Cardano continues to accelerate, with several major projects launching or planning launches. This DeFi growth could significantly impact token utility and support higher ADA price targets through increased demand for transaction fees and staking.

Enterprise adoption of Cardano’s blockchain technology for supply chain, identity management, and other use cases represents another potential catalyst for Cardano’s ADA price targets. Real-world utility often translates to increased token demand and higher valuations.

Conclusion

The analysis of Cardano ADA price targets reveals a compelling case for the blockchain’s continued relevance and potential growth. Despite previous bearish sentiment, technical indicators, fundamental developments, and expert analysis suggest that Cardano is far from dead and may be positioning for significant price appreciation.

The combination of improving technical charts, growing ecosystem utility, and increasing institutional interest provides multiple layers of support for optimistic ADA price targets. While risks remain, including market volatility and competitive pressures, the overall outlook for Cardano ADA price targets appears increasingly positive.

Read more: Cardano ADA Price Prediction 2025 News Expert Analysis & Latest Market Forecasts